What decision could OPEC and its allies potentially make as we witness an economic slowdown in China, the world’s top importer of crude oil?

Energy Market Updates

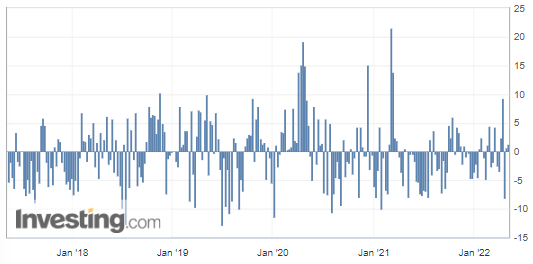

Commercial crude oil reserves in the United States unexpectedly rose in the week ended April 29, according to figures released Wednesday by the US Energy Information Administration (EIA).

US crude inventories have increased by more than 1.3 million barrels, which implies lower demand and could potentially count as a bearish factor for crude oil prices. This comes in addition to the US Federal Reserve’s rate hike.

In normal times, theoretically, it tends to push commodities to the lower side, unless the markets have already priced more aggressive monetary policy adjustments by the Fed and thus were somehow disappointed that Powell ruled out a further 75bps in June.

Source: Investing.com

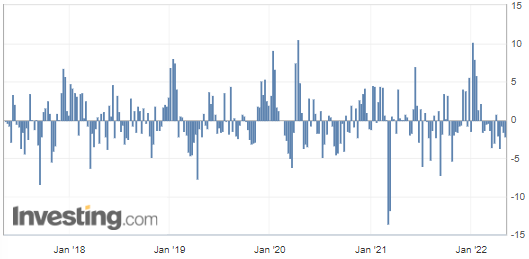

On the other hand, some additional figures, extracted from the same EIA report, were released and surprised the markets.

These are US Gasoline Reserves, which plunged by about 2.23 million barrels over a week, while the market was forecasting just a little more than half a million decline.

Source: Investing.com

The OPEC+ countries, which meet on Thursday, should once again agree on a marginal increase in their production of black gold, comforted by the risks that weigh on demand against the backdrop of anti-COVID restrictions in China.

As explained in my last analysis, the market does not expect much more from this meeting, as the current targets of 400k barrels per day – or just a little more eventually – should be sustained, even though the cartel has been struggling to pump such volumes.

Notably, given the current political crisis in Libya – the producing country endowed with the most abundant reserves in Africa – which has seen its oil infrastructure blocked, oil operations have been stopped since mid-April. With the likelihood of a “double-standardized” embargo on Russian oil and gas, it will certainly not help.

In the end, some more dependent countries (such as Hungary and Slovakia) will still be allowed to buy Russian fossil fuels, and others might simply buy Russian hydrocarbons through a parallel market since the opacity of some pipelines may sometimes turn some buyers blind when it comes to tracking oil and gas origins. However, everything is just a matter of communicating nowadays.

So, how do you think black gold will progress from now? Do you think it will break out of the triangle and accelerate further by following the recent market development for gasoline?

Or perhaps you believe this attempt is a ruse designed to mislead buyers, causing crude to fall lower.