Five months into 2016 and crude oil has a steak of 4 positive months in a row. So much for the $20 or $10 per barrel predictions. From a spike down under $30 per barrel in January crude oil is now flirting with $50 per barrel at the end of May, an 80% increase. Relative to the highs in 2008 it is still really cheap. In fact relative to the prices of 2014 it is cheap too. Will this continue or is crude oil about to gush higher?

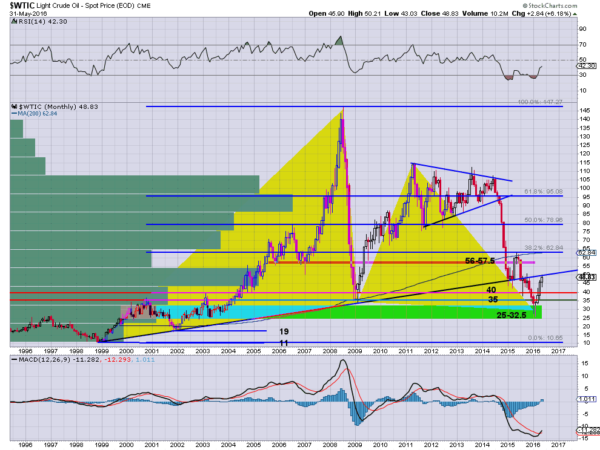

The monthly chart above gives some clues. The first thing to note is the bullish Bat harmonic. The two yellow triangles show the Bat and dip under $30 triggered the reversal. The first target is a 38.2% reversal or to over $62. The second target on continuation would be a 61.8% retracement or to $95.

Note also that the momentum indicators are continuing to improve and close to turning bullish. The RSI is rising and closing in on the mid line. The MACD has just crossed up. The current path and the momentum suggest a continuation higher.

On the other side of the coin is the rising 17 year trend line. It acted as support 4 times until the price broke down below it in 2015. Now it is testing this trendline from below as resistance. How it reacts in June may be key to the future. Often a retest of a key level or trend is where the counter trend move reverses again.

Also notice the volume at price bar that started at about $43 and goes to $55. Volume where crude oil exchanges hands is much larger in this range than the area that the price just moved through. It could take a while to work through the supply there.

So crude oil is trending higher and sets up well to continue. There may be some trouble getting above $55 from the previous trading volume. And that trendline might also give it some trouble. But if neither halts the rise in crude oil prices it has a lot of room to the upside.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.