On Nov. 2, the price of nearby NYMEX crude oil futures looked like another journey into a bearish abyss was on the horizon. On April 20, the price of nearby May NYMEX futures plunged to below negative $40 per barrel. The move below zero came holders of landlocked West Texas Intermediate petroleum had nowhere to store the energy commodity.

The wide contango or forward premium caused many dominant market participants to enter into cash and carry trades. They took delivery of physical crude oil and put it into storage. Simultaneously, they sold deferred contracts or entered into forward or swap transactions on the short side to take advantage of the wide price spread between crude oil for nearby and deferred delivery.

As storage capacity disappeared, those holding long positions in the May NYMEX futures contract had nowhere to store the oil with the contract’s expiration only days away. The May contract fell to a negative price, but the current active month December contract only made it to a low of $25.31 per barrel in late April. The crude oil price then recovered and traded around the $40 pivot point from early June through late October.

As the number of coronavirus cases in Europe and the U.S. was surging and the U.S. election was the next day, the crude oil market fell to a low of $33.64 on Nov. 2, which turned out to be a bottom for the energy commodity.

As of the end of last week, the price was back at the $40 pivot point that has been in place for five months. As bearish as crude oil looked on Nov. 2 when it was below $34, it looked bullish last week. The United States Oil Fund (NYSE:USO) tracks the price of a portfolio of NYMEX futures.

False Technical Break And Bullish Reversal Going Into The 2020 Election With Energy On The Ballot

Crude oil futures appeared to be falling off the edge of a bearish cliff from Oct. 28 through Nov. 2.

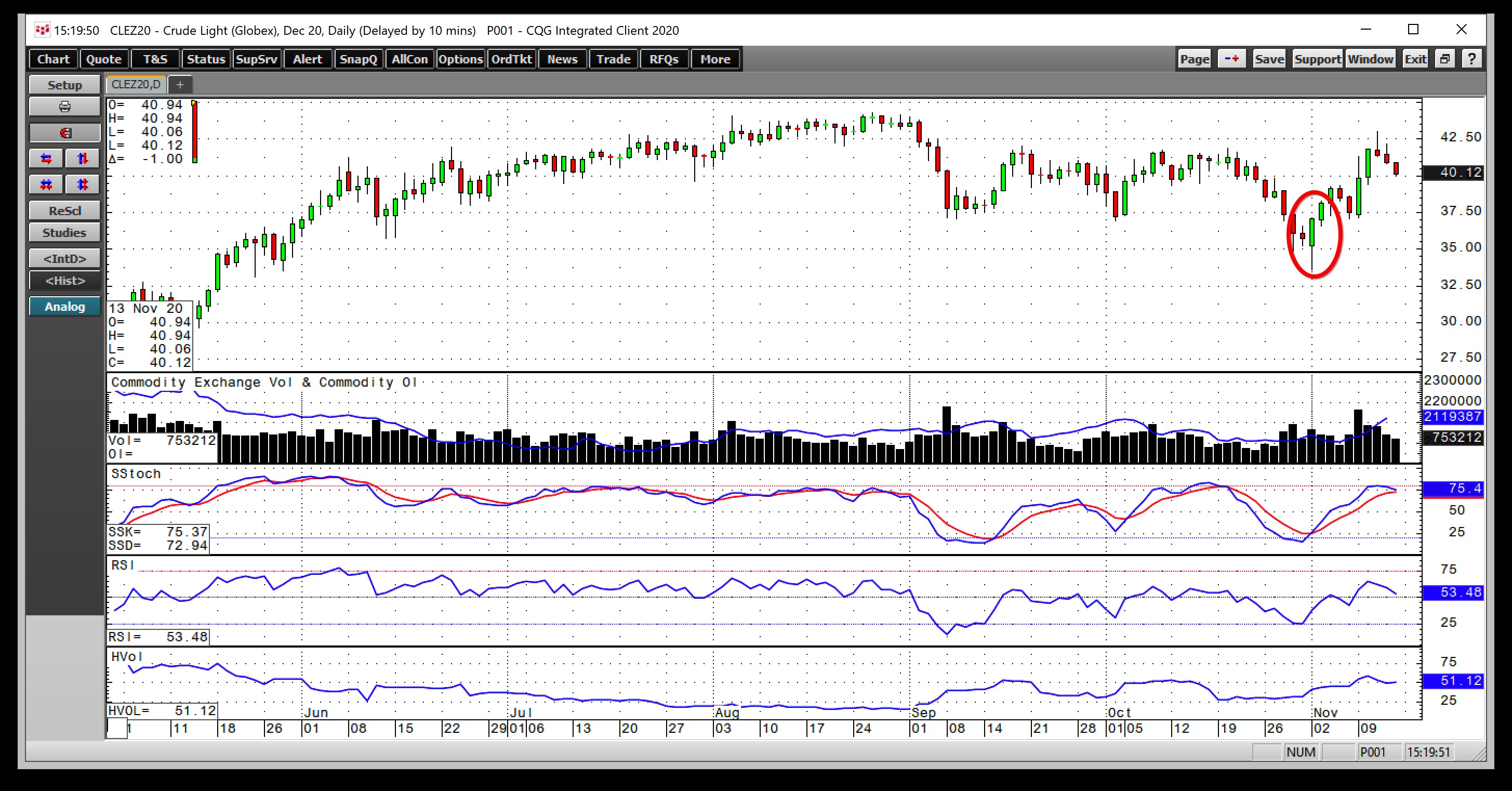

Source: CQG

As the daily chart of December NYMEX futures highlights, the price fell to a low of $33.64 on Nov. 2, where it found a bottom. On that day, the crude oil futures put in a bullish reversal and continued moving on the upside through the election. At the end of last week, the price was just above $40 per barrel. The total number of open long and short positions had been flatlining at just over the two million contract level, but it began to rise with the price.

Increasing price and open interest tends to be a bullish technical sign in a futures market. Price momentum and relative strength indicators turned higher and were rising above neutral readings on Nov. 13. At over 51% daily historical volatility was at an elevated level as the daily trading ranges expanded.

U.S. energy policy was on the ballot on Nov. 3 as Democrats favor a move away from fossil fuels, and Republicans advocate for energy independence from the Middle East and Russia.

News From Pfizer Sends Crude Oil Back To Pivot Point

One of the primary issues facing the crude oil market has been weak demand because of the ongoing global pandemic. While the U.S. election and the future of U.S. energy production was an issue going into the Nov. 3 contest, the rising number of COVID-19 cases in Europe and the U.S. trumped the election concerns in the oil market.

The Saudis and Russians had already stated that they expect to extend the 7.7-million-barrel-per-day production cut when they meet in the coming weeks. U.S. output has declined from 13.1 to 10.5 mbpd from March through Nov. 6 in sluggish demand for crude oil.

Meanwhile, Pfizer's (NYSE:PFE) Nov. 9 announcement that its vaccine was 90% effective pushed the price of the energy commodity back over the $40 per barrel pivot point for the first time since Oct. 23.

New High Could Follow New Low For Three Reasons

The level of critical technical resistance on the NYMEX December futures contract stands at $44.33 per barrel, the Aug. 26 peak. Crude oil fell through technical support at $35.72, the June low. However, it stopped its retreat 52 cents short of the next level of support at the May 22 low of $33.12 per barrel. After failing to reach the technical downside target, the price now looks like it could head for a test of the upside at $44.33, the late August high in crude oil.

Two factors are likely to determine the path of least resistance of crude oil over the coming weeks and months. COVID-19 is the primary issue for the energy commodity as the futures market faces the virus during seasonal weakness during the winter months. When it comes to the longer term, the Georgia runoff elections will determine the majority of the Senate and the direction of US energy policy.

Another victory by Democrats that makes Chuck Schumer the majority leader would likely cause U.S. oil and gas production to decline, handing more influence over to OPEC and Russia over the coming years. Crude oil prices could rise if increased regulation cause U.S. production to fall.

Meanwhile, at the end of last week, the path of least resistance for the oil market was back in consolidation mode at the $40 pivot point. Crude oil put in a false downside break in early November only to spring back to what has been an equilibrium price for months. After trying the downside and failing, the energy commodity could be in a position to challenge the upside at over the $44 per barrel level on the December futures contract.