Earnings volatility has certainly been big. Tesla (NASDAQ:TSLA) pushed the markets much higher early this week and the U.S. stock markets have continued the upward momentum after the State Of The Union address and the acquittal of President Trump on Wednesday. Still, we continue to believe this rally may be a “fake” with respect to the fallout from the Wuhan virus. Certainly, foreign investors are continuing to pour capital into the U.S. stock market as the strength of the U.S. dollar and the strong economy is drawing investment from all over the globe.

We think the scope of this parabolic rally in the U.S. stock market should actually concern skilled traders. Markets just don't go straight up for very long. The last time this happened was in the 1970s and 1980s. Very minor volatility during that time prompted a big move higher in the U.S. stock market that set up the eventual Dot-Com collapse.

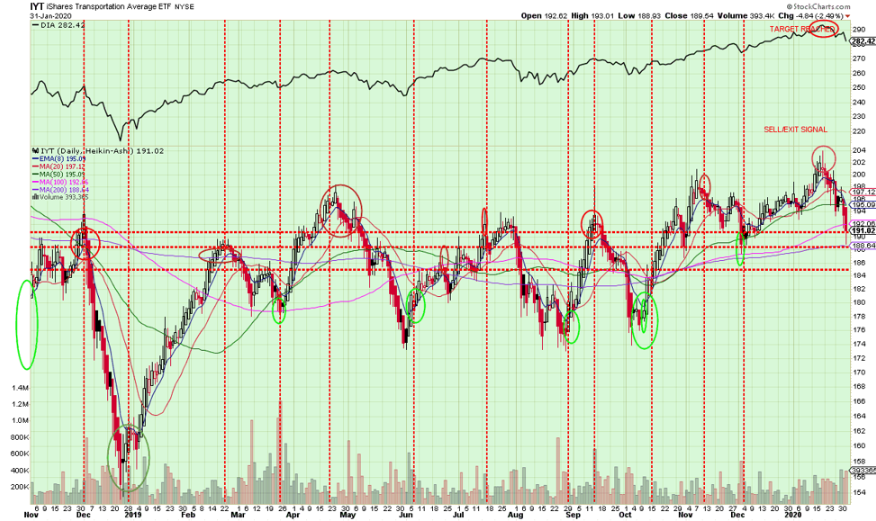

Oil, Shipping, Transportation, Consumer, Manufacturing and Retail will all take a hit because of the Wuhan virus. We've personally received notices from certain suppliers that factory closures in China will greatly delay the fulfillment of orders. Our opinion is that nations may have to close all or a majority of their cities, ports and activities in Asia for at least 90+ days in order to allow this virus event to peak and subside. We don't see any other way to contain this other than to shut down entire cities.

The U.S. Fed and Central Banks are doing everything possible to continue the economic growth and stability of global economics. Yet the reality may suddenly set in that without risking a global contagion, nations may be forced to actually shut down all non-essential activities for well over 90+ days (possibly even longer). Stop and consider what it would be like for half of the world, and many of the major manufacturing and supply hubs, to shut down for more than 3 to 6 months while a deadly virus spreads.

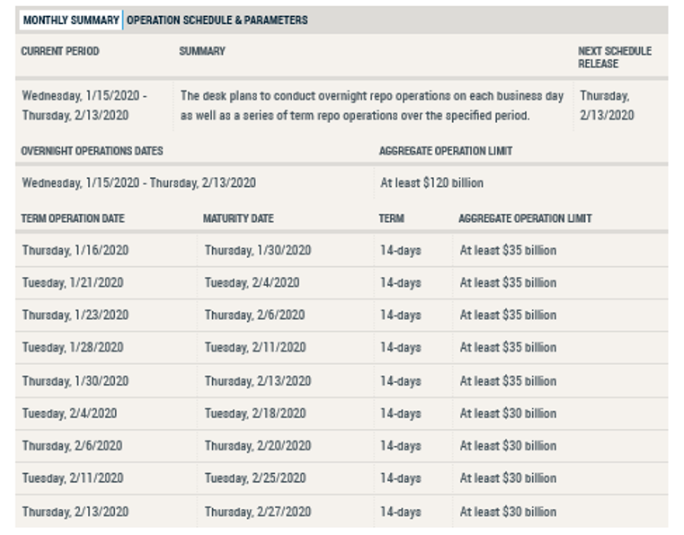

Repo lending continues to show that liquidity is a problem. We believe this problem could get much worse. Skilled traders need to be prepared for a sudden and potentially violent change in the direction of global stock markets.

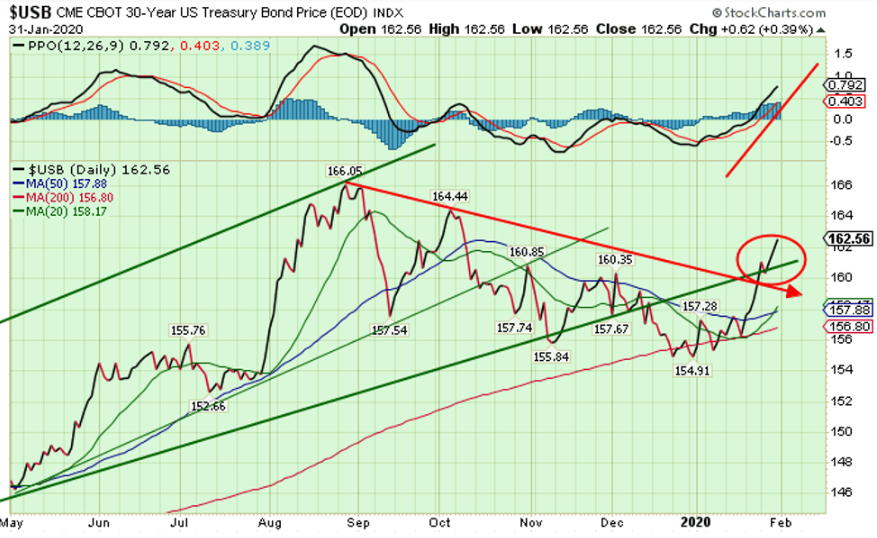

There is now a solid wall of inversions in all the treasury notes and bills. The 10-year yield is inverted with 6-month and shorter durations. The 30-year long bond dipped below 2.0% for the third time and is just 6 basis points from a record low.

Prepare to capitalize on this “crowd behavior” in the near future. Right now, the U.S. stock market is pushing higher as Q4 earnings drive future expectations. Yet be ready for the reality of the situation going forward.

This Wuhan virus may present a very real “black swan” event. At the moment, the U.S. stock market appears to want to rally as earnings and economic data continue to impress investors. Overall, the real risk to the markets is a broader global economic contagion related to the virus and the impact it may have on foreign and regional economies.

Next week is going to be critical for many things. Virus contagion growth, factory closures, Oil breakdown follow through, equities breakout follow through and the precious metals pending move.