When I drove from Cleveland to Lima last weekend I went past 100 miles of corn fields. Nothing but stumps of cornstalks cut off 1 foot from the ground. So this may seem like a silly question months after the harvest. But farmers and speculators trade corn all year round. And with farmers now preparing their financial books for the coming planting season what better time for the corn to start popping. Will it?

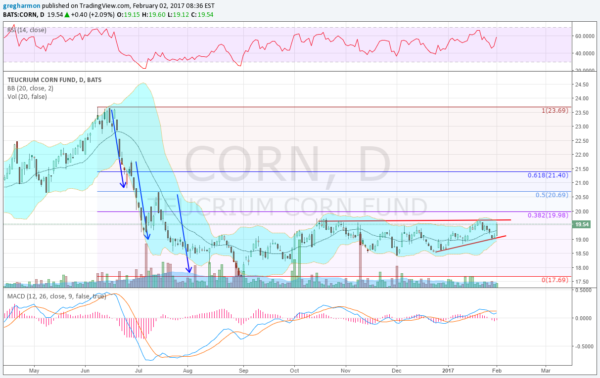

The chart below tells the story. After a peak early in the growing season last year, corn started to move lower. It took 3 steps down, a 3 Drives pattern, with the third leg getting a bit messy. At the end of August the price had dropped over 25%. A 3 Drives pattern would look for a reversal there. And it did, sort of. Over the next 6 weeks corn recovered nearly 38.2% of the move lower. But since mid-October it has stalled.

The price has moved sideways under resistance at 19.65 since then in a $1 range. But something interesting has been happening since the middle of December. That is when the last push higher started. And since then it has made a series of higher highs, and higher lows. The start of an uptrend. Thursday saw a strong push higher to near the resistance level. A break through would be a buy signal. Momentum is picking up with the RSI moving up in the bullish zone and the MACD turning back up towards a bullish cross. Keep an eye on Corn as it may start to grow early this year.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.