Last week I posed the question whether the consumer was returning. It seems to be a common perception that consumer credit is driving the retail economic expansion. Below is a set of graphs that may surprise.

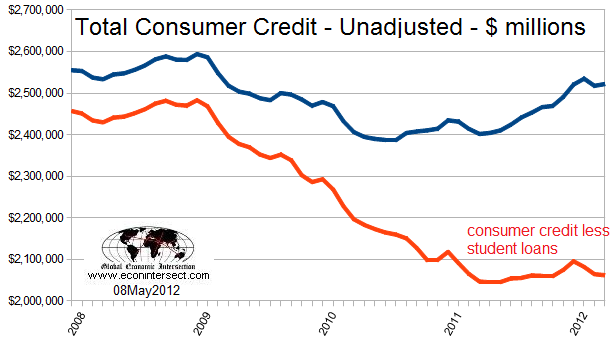

Consumer credit is expanding at an annual rate of 7.75% according the G.19 consumer credit report released last week by the Fed. If one digs a little into the data, and if student loans are backed out, consumer credit grew 0.1% year-over-year, and declined marginally month-over-month.

Yes, one could argue there is a gradual increase in the trend line in consumer credit if student loans were removed – but the year-over-year increase is only 0.1%. On the surface, this is hardly fuel for a credit based consumer resurgence.

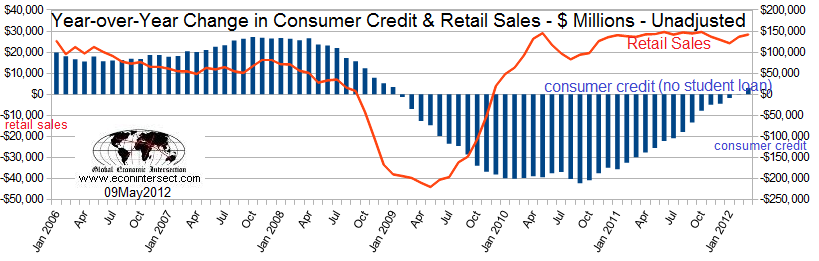

It has not been until the March 2010 data, that total outstanding consumer credit (excluding student loans) actually began expanding year-over-year. With the current trends, it should be expected consumer credit will begin to add fuel to the retail fire instead of acting like a tailwind. To date expanding consumer credit has been a soft push only – roughly consumer credit expanded in March half as fast as retail sales. And before the first of this year contracting consumer credit had been a headwind for sales for nearly three years.

These graphs only tell part of the story. What is missing is the write-offs in consumer credit. It is reported that in March that there were $20 billion in consumer credit write-offs according to CUNA. Write-offs distorted the point where new credit began fueling a retail resurgence. This $20 billion would have accounted for all the retail growth year-over-year in March.

Going forward – it would not be a big surprise if credit expansion was a big driver for a strengthening retail sector – depending, of course, that another recession is not about to start.

Other Economic News this Week:

The Econintersect economic forecast for May 2012 shows moderate growth. There was some improvement in the government pulse point, but degradation in some of our transport related pulse points. Overall, the pluses and minuses balanced out.

ECRI has called a recession. Their data looks ahead at least 6 months and the bottom line for them is that a recession is a certainty. The size and depth is unknown but the recession start has been revised to hit around mid-year 2012.

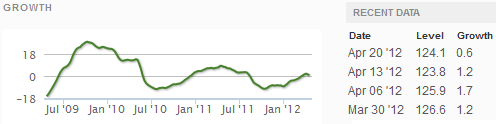

This week ECRI’s WLI index value declined for the third week in a row to -0.1, after the previous twelve weeks of index improvement. This index is now showing the economy six months from today will be as bad as it is today.

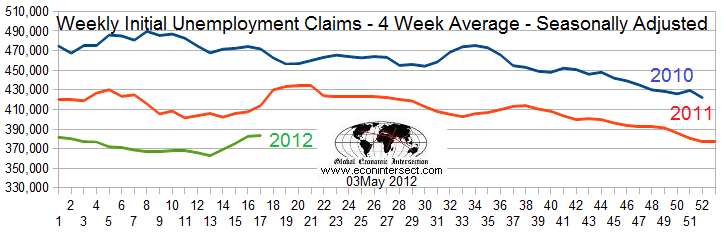

Initial unemployment claims essentially decreased from 388,000 (reported last week) to 365,000 this week. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate (background here and here). The real gauge – the 4 week moving average – rose from 381,750 (reported last week) to 383,500. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Data released this week which contained economically intuitive components (forward looking) were rail movements and the import portion of the trade balance. Rail movements data this week is still indicating a moderate expansion if one ignores coal. Imports returned to the lower end of the growth range that imports have remained in since mid-2011.

Weekly Economic Release Scorecard:

Click here to view the scorecard table below with active hyperlinks.

Bankruptcies this Week: Corporate Management Solutions

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Is Consumer Credit Fueling Retail Sales Growth?

Published 05/13/2012, 01:36 AM

Is Consumer Credit Fueling Retail Sales Growth?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.