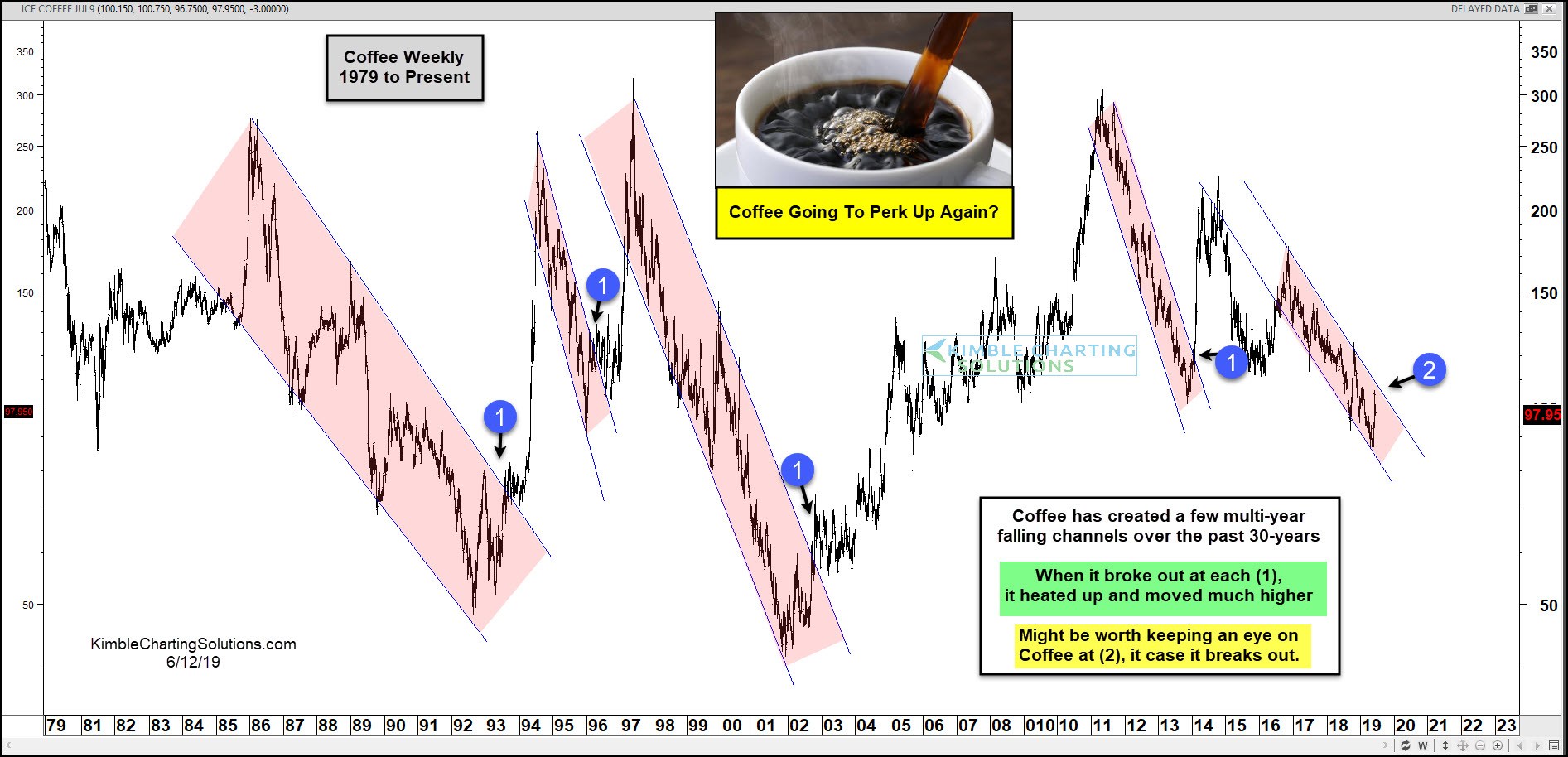

Coffee could be about to perk up and rally. An important breakout test in a downtrend is near.

This chart looks at coffee on a weekly basis over the past 40 years. Four different times over the past few decades, the commodity has created multi-year falling channels.

When coffee succeeded in breaking out at each (1), strong rallies took place.

Coffee has cooled off over the past 5 years, as it lost nearly 60% of its value since peaking in 2014.

A small counter-trend rally over the past few weeks has it nearing the top of a 3-year falling channel, where strong resistance comes into play at (2).

Someday coffee will breakout from this falling channel as it did in the past at each (1). When it does, look for a tradeable rally to follow.

$107 looks to be the key resistance level/breakout line in the sand, which is still 10% above current prices.