Chipotle Mexican Grill Inc (NYSE:CMG) Consumer Discretionary - Hotels, Restaurants, and Leisure | Reports April 26, After Market Closes

Key Takeaways:

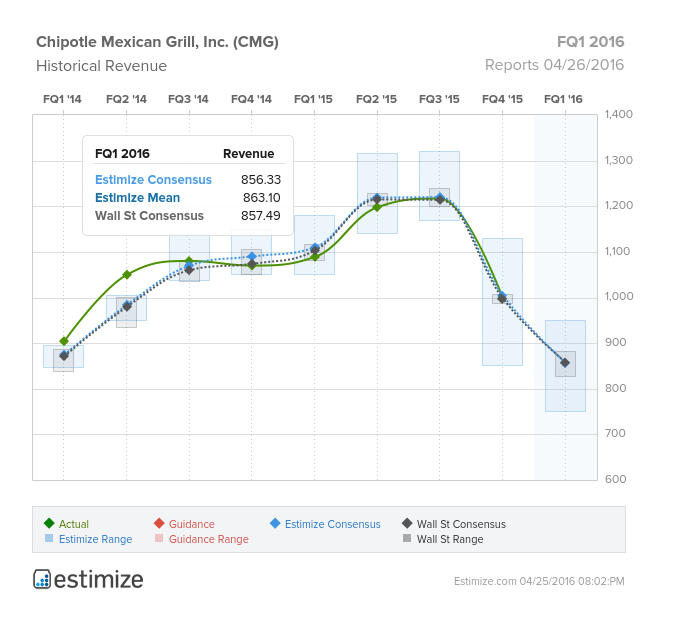

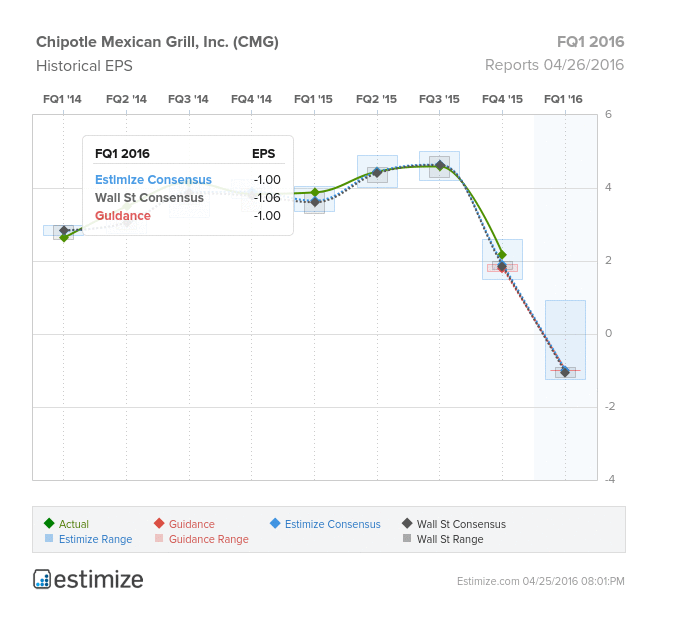

- The Estimize consensus is calling for a loss of $1.00 and revenue of $856.33 million, 6 cents higher than Wall Street and $1 million below on the top

- At the end of 2015, Chipotle locations in the United States were found carrying the E.coli virus

- Since the outbreak, shares have plunged 36%, earnings have declined and key metrics like same store sales have plummeted.

- What are you expecting for CMG?

Chipotle Mexican Grill (CMG), the poster child for fast-casual, is experiencing a nightmare that terrifies any restaurant operator. The chain is scheduled to report first quarter earnings Tuesday afternoon with expectations that don’t look promising. The Estimize consensus is calling for a loss of $1.00 and revenue of $856.33 million, 6 cents higher than Wall Street and $1 million below on the top. These figures would represent year over year declines for the same quarter a year ago of 125% and 21% respectively.

At the end of 2015, Chipotle locations in the United States were found carrying the E.coli virus. As a result, store traffic drastically declined and confidence in the restaurant that once prided itself on fresh and quality ingredients has wavered. Since the first outbreak, shares have plummeted 36%.

At the same time, comparable sales were weakened by the health scares and thereby hurt Chipotle’s bottom line. This past January and February, the restaurant saw comps slide 36% and 26%, respectively. Furthermore, rising beef prices, increasing labor costs and heavy marketing investments are expected to take a toll on profits.

Regardless, Chipotle is taking the appropriate measures to revitalize its customer base and eradicate any health concerns. This past February, Chipotle closed all its restaurants for a food safety event and offered company wide coupons to drive store traffic. There is the hope that these coupons will bring back its most loyal customers.

Chipotle, without question, is one of the most recognizable brands in the USA. Sooner or later, they will be able to turn their losses into profits, but for the near term, the stock has a mountain to climb to reach its highs of $750 per share.