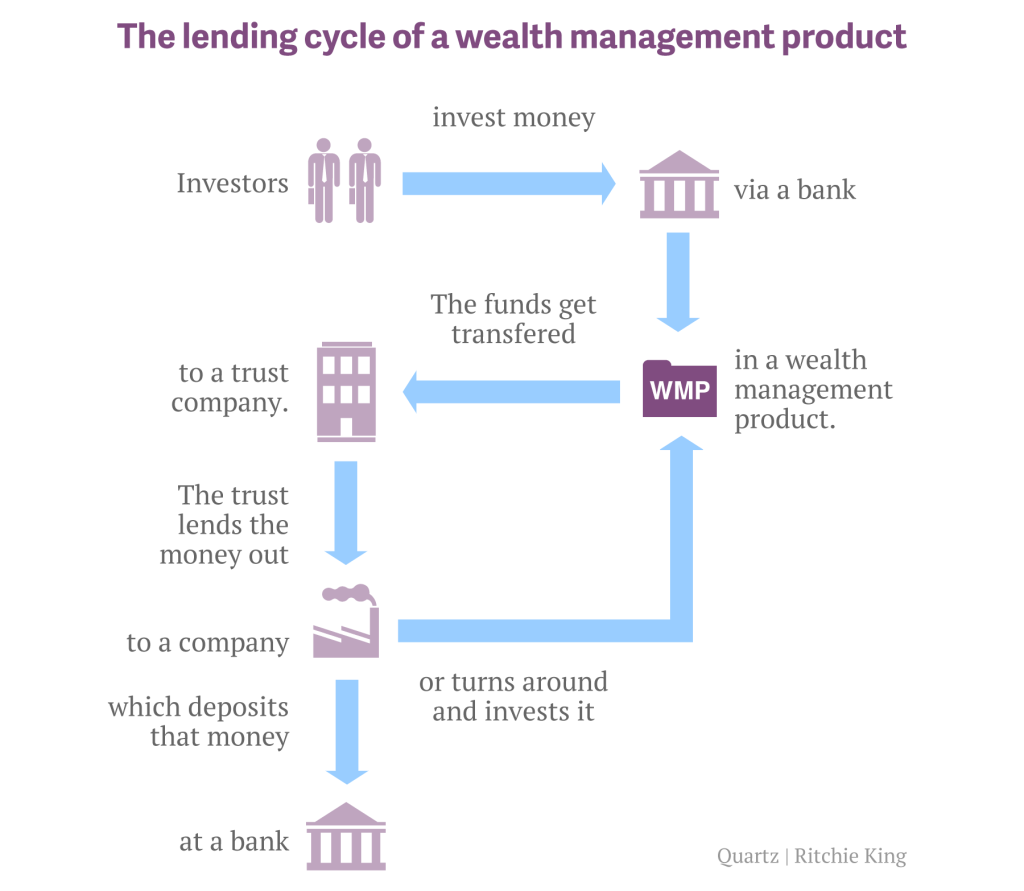

I have been writing about the risks in China for quite some time (see previous discussions here) along with many other analysts. For newbies, Quartz has an excellent graphical primer on the risks building up in the shadow banking system:

(1) Bank loans. When China joined the World Trade Organization during December 2001, the country’s banks had $1.4 trillion in loans outstanding, which was equivalent to 35% of US commercial bank loans. At the start of this year, Chinese bank loans rose to a record $12 trillion, now equivalent to 162% of their US counterparts! Those numbers don’t include the lending of the shadow banking system.

(2) Deflation. Coal companies seem to be at the epicenter of the current rising default risks in China’s shadow banking system. That’s because coal prices are falling. So are other industrial prices, according to China’s PPI, which is down 1.6% y/y through January. It has been deflating since March 2012. China’s CPI is still inflating at a moderate pace, with an increase of 2.5% y/y through January.

The combination of lots of debt and mounting deflationary pressures increases the risks of a credit crisis in China.

China's Xi Jinping has cast the die. After weighing up the unappetising choice before him for a year, he has picked the lesser of two poisons.

The balance of evidence is that most powerful Chinese leader since Mao Zedong aims to prick China's $24 trillion credit bubble early in his 10-year term, rather than putting off the day of reckoning for yet another cycle.

He went on to highlight the Apocalyptic scenario should Beijing fail to properly navigate its reforms:

Societe Generale has defined its hard landing as a fall in Chinese growth to a trough of 2pc, with two quarters of contraction. This would cause a 30pc slide in Chinese equities, a 50pc crash in copper prices, and a drop in Brent crude to $75. "Investors are still underestimating the risk. Chinese credit and, to a lesser extent, equity markets would be very vulnerable," said the bank.

Such an outcome -- not their base case -- would send a deflationary impulse through the global system. This would come on top of the delayed fall-out from China's $5 trillion investment in plant and fixed capital last year, matching the US and Europe together, and far too much for the world economy to absorb.

Evans-Pritchard went on to highlight the concerns of various China analysts:

[JP Morgan analysts] Haibin Zhu says there is mounting risk of "systemic spillover". Two thirds of the $2 trillion of wealth products must be rolled over every three months. A third of trust funds mature this year. "The liquidity stress could evolve into a full-blown credit crisis," he said.

Officials from the International Monetary Fund say privately that total credit in China has grown by almost 100pc of GDP to 230pc, once you include exotic instruments and off-shore dollar lending. The comparable jump in Japan over the five years before the Nikkei bubble burst was less than 50pc of GDP.

You get the idea.

An American Renaissance?

While the world focuses on China, it's also important to think about the second order effects of all these changes that are happening.

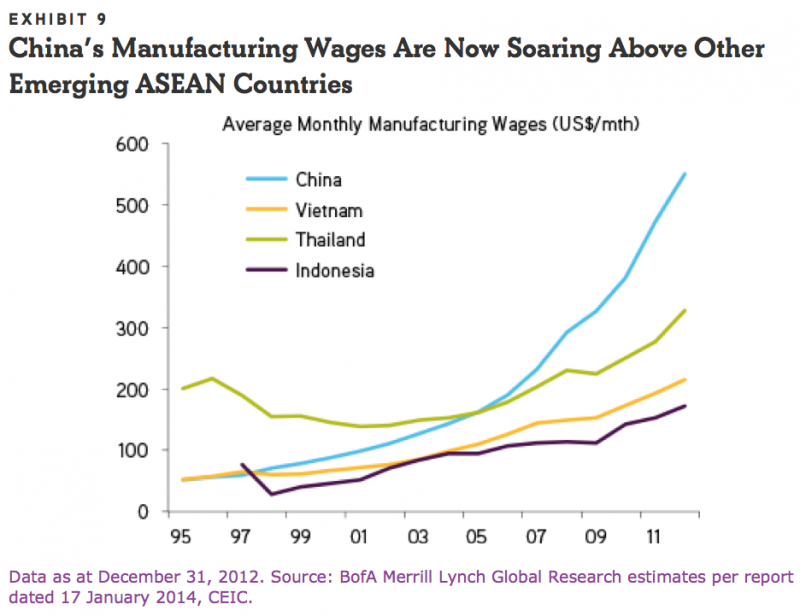

Think about this for a minute. Let's assume that China successfully rebalances its engine of growth. Consumer spending rises while exports based on cheap labor falls; and infrastructure spending declines. Such a shift would have two significant effects. First of all, the price of labor elsewhere becomes more competitive. BoAML recently produced analysis showing how Chinese labor rates have risen in the last few years (via Business Insider):

The worst of all worlds

As I write these words, it appears that China may not experience neither a hard nor soft landing, but a long and bumpy landing. Every time the Chinese leadership signals its intent to reform the economy, stresses start to appear and Beijing blinks (see Will Beijing blink yet one more time?).

BCA Research took a sanguine view. They studied China's growth slowdown experience in the 1990's and concluded that, despite all of the fears, tail-risk is unlikely to substantially materialize [emphasis added]:

[C]redit tightening was clearly a headwind for growth in the 1990s. However, the sharp credit growth slowdown between 1998 and 2000 did not lead to major growth problems in the broader business activity. In fact, amid the credit crunch, the economy was able to withstand major global shocks such as the Asian financial crisis and the global tech bubble bust, and stayed largely stable without major financial stress. If history is any guide, we expect the economy and financial system to remain resilient in the ongoing tightening cycle, especially as policymakers are in no rush to hasten the “deleveraging” process, and the global business cycle is gradually on the mend.

If the Chinese leadership continues on this path of talking tough on reform but finds its initiatives watered down because they run up against entrenched interests, then China faces the worst of all worlds. While a hard landing could be avoided for a considerable amount of time, China faces a lost decade of ever slowing growth without the targeted rebalancing of growth from infrastructure spending to consumer spending as the primary engine.

At the same time, the American Renaissance would continue as rising Chinese labor costs erode competitiveness and falling commodity prices enhance the operating margin of companies based in the developed markets.

American Renaissance: Winners and losers

Before you get overly excited about the prospect of an American Renaissance, consider who the American winners and losers of such a shift might be. Despite the bright prospect of onshoring, manufacturing jobs aren't going to pay the same kinds of wages that they used to. Steven Rattner wrote a New York Times Op-Ed precisely on precisely this topic [emphasis added]:

But we need to get real about the so-called renaissance, which has in reality been a trickle of jobs, often dependent on huge public subsidies. Most important, in order to compete with China and other low-wage countries, these new jobs offer less in health care, pension and benefits than industrial workers historically received.

In an article in The Atlantic in 2012 about General Electric’s decision to open its first new assembly line in 55 years in Louisville, Ky., it was not until deep in the story that readers learned that the jobs were starting at just over $13.50 an hour. That’s less than $30,000 a year, hardly the middle-class life usually ascribed to manufacturing employment.

This disturbing trend is particularly pronounced in the automobile industry. When Volkswagen opened a plant in Chattanooga, Tenn., in 2011, the company was hailed for bringing around 2,000 fresh auto jobs to America. Little attention was paid to the fact that the beginning wage for assembly line workers was $14.50 per hour, about half of what traditional, unionized workers employed by General Motors or Ford received.

Even though jobs may return because of onshoring, globalization hasn't gone away. Shane Ferro of Reuters recently highlighted a paper by Michael Boehm of the University of Bonn:

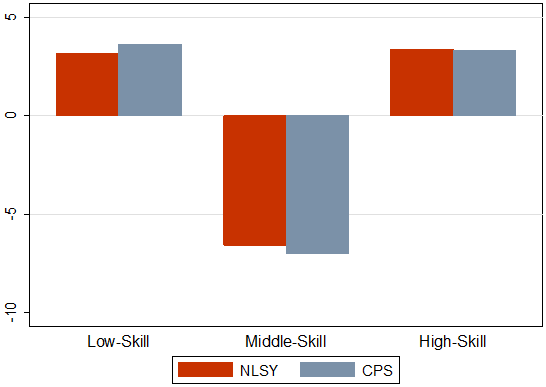

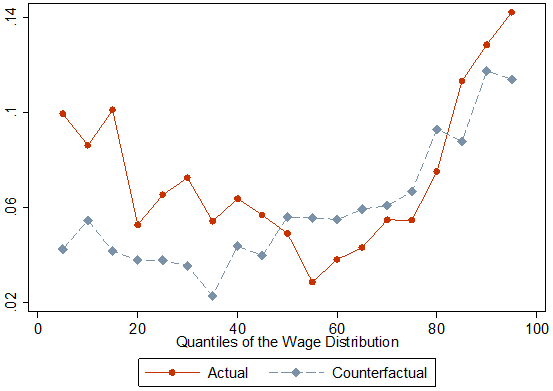

This chart shows the changes in US employment shares by type of occupation since the end of the 1980s. The paper used two different measures, the National Longitudinal Survey of Youth (NLSY) and the comparable years and age group in the more standard Current Population Survey (CPS):

For this chart, the high-skill occupations comprise managerial, professional services, and technical occupations; middle-skill occupations are things like sales, office/administrative, and production occupations; and low-skill occupations include food, cleaning, and personal service occupations.

What Boehm found is that this erosion of middle-skill jobs is correlated with a similar erosion of middle-skill pay. This chart shows how wages were expected to grow back in 1980 (blue line), and how wages actually grew (red line):

Barry Ritholz highlighted analysis of long-term trends in a post with the following conclusion:

Manufacturing will become increasingly global, with estimates as high as 80% of manufacturers having a multi-country operation.

The technology used on assembly lines continues to growth more and more sophisticated, making automation far easier to implement.

For the suppliers of labor, these shifts present a good news-bad news story. The good news is that there will be more jobs; the bad news is that the jobs won't pay as well as manufacturing jobs used to. American workers may welcome the return of jobs that were previously offshored, but they will largely be working either directly for a multi-national or for a company in the supply chain of a multi-national. If you are competing with Third World countries for work, don't expect First World compensation.

For the suppliers of capital, these shifts represent unabashedly good news. Operating margins are likely to get boosted upwards because of lower input costs from falling commodity prices and more responsive manufacturing because of a more educated labor force and lower transportation costs from being closer to end consumer markets. As well, the returns to capital are likely to improve as cheaper automation drive down the price of capital expenditures, which raises overall returns on assets employed.

Longer term, these changes are incredibly bullish for US equities and moderately bullish for the US economy.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. (“Qwest”). The opinions and any recommendations expressed in the blog are those of the author and do not reflect the opinions and recommendations of Qwest. Qwest reviews Mr. Hui’s blog to ensure it is connected with Mr. Hui’s obligation to deal fairly, honestly and in good faith with the blog’s readers.”

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this blog constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or I may hold or control long or short positions in the securities or instruments mentioned.