The latest January trade data of China showed the broadest measure of China's global trade surplus fell to a several-year low to around 2.7% of GDP. Export also collapsed to a negative 0.5% year-over-year in January, down from +13.4% in December. Imports looked even more dire with a 15.3% year-over-year decline.

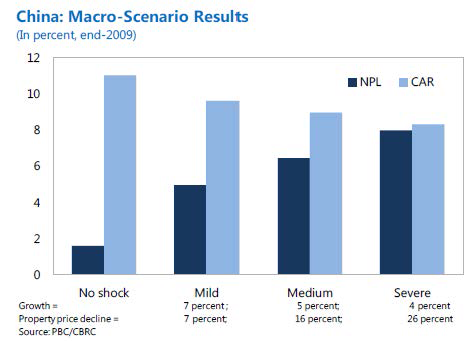

Earlier this month, the IMF already issued a report on China stating that real estate remains the greatest domestic risk to China, and in the most sever scenario, China's growth could drop to 4%, less than half of the trend for the past decade. According to the IMF, in this scenario, a downturn of the property market causes a sizable portion of credit to local government financial platforms, the real estate sector, and small and medium enterprises to become impaired.

With major trade partners battered by recession, the new trade data seem to give credence to a China hard-landing crash scenario by some forecasters. However, it remains difficult to conclude a definitive pattern yet as the Chinese Lunar New Year fell in January this year (vs. February in 2011) distorting the prior year and month-on-month comparison.

Furthermore, a look at the commodity imports volume also revealed a more upbeat picture. FT.com reported that based on preliminary customs data, China’s copper imports were 413,964 tonnes, an increase of 13.6% from January 2011. Crude oil imports also rose to 23.4m tonnes, equivalent to 5.5m barrels a day, compared to an average of 5.1m barrels a day last year. In the next couple of years, many expect China may well overtake the U.S. as the world's biggest importer of oil.

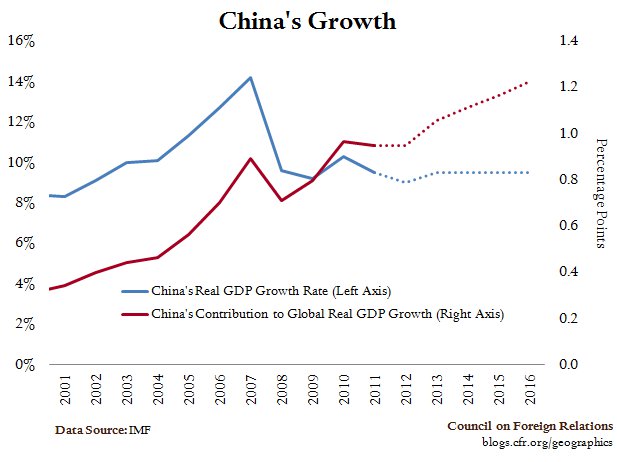

Despite the mixed bag of data points and opinions, one thing we could say for certain is that the era of consecutive annual double-digit Chinese GDP growth has most likely come and gone.

China is starting to shift from the construction infrastructure growth stimulus model like the one implemented in post-2008 financial crisis, to soft infrastructure—welfare, education, and alternative energy, etc.—to encourage domestic consumption, which is much harder to execute and much slower to see the results showing in the GDP.

Furthermore, China is in the year of leadership transition which means less drastic and slow policy change by the incumbents as well as the new leaders, which would also translate into slower growth, at least in 2012 and into the first half of next year. Meanwhile, the new leadership lineup, with a diverse and prestigious educational and professional background, is quite positive for China's future.

For now, the IMF expects the growth of China to still stay above 8% in 2012-13 under its base scenario, noting that "China has room for a countervailing fiscal response, and should use that space."

As the chart above from the Center for Geoeconomic Studies points out, with its huge population, production and consumption, the Chinese economy is now so large that it will continue to make a significantly rising contribution to global growth even if its own growth rate continues to fall off moderately.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Is China Losing Its Steam?

Published 02/12/2012, 11:56 PM

Updated 05/14/2017, 06:45 AM

Is China Losing Its Steam?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.