With so much interesting stuff happening here in the States, it’s easy to forget that there’s a whole world of foreign markets out there.

Many investors don’t pay them much attention. And that’s a shame. For one thing, Chief Investment Strategist Alexander Green urges investors to put a chunk of their portfolios in international equities.

What’s more, big economic events overseas can have ripple effects back home. And after the recent downgrade of China’s sovereign debt, let’s look at what a Far East financial crisis could do to your portfolio.

The China Debt Downgrade: How Bad Is It?

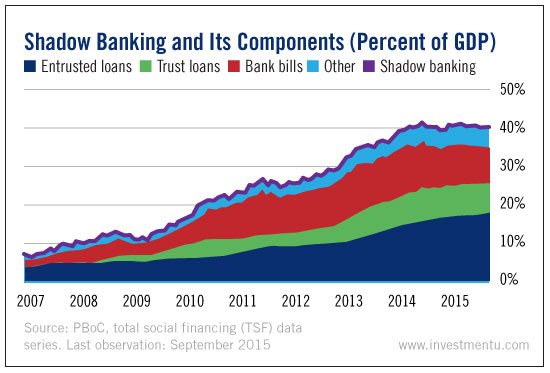

I could go on for pages and pages trying to explain why Moody’s downgraded the credit rating of the world’s largest nation last week. Or I could just show you this graph...

That’s a whole lot of debt buildup in a few short years.

You see, China has gotten used to being one of the world’s fastest-growing economies. And for the moment, it still is. But over the last 10 years, China’s natural growth rate has dwindled. And to maintain appearances, it has supplemented it with aggressive corporate borrowing.

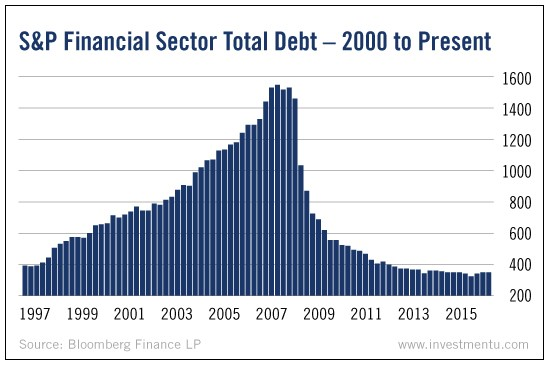

It’s never a good sign when an economy props itself up with debt. Especially when that debt is of dubious quality. Does the graph above remind you of anything?

I spoke to Oxford Club Director of Research Ryan Fitzwater about China’s debt problem last week. Here are his thoughts on the potential consequences:

Today’s downgrade tells us what many smart economists and investors have known since chapter one - that China’s growth story is financed with outrageous amounts of debt. It’s a land of shadow banking, ghost cities, phony factories and unreliable statistics.This downgrade is the tip of the iceberg - a clear warning sign for investors.

There are some legit Chinese businesses to invest in, of course. But avoiding the potential land mines takes immense skill, an iron stomach and one hell of a b.s. detector.

The takeaway here is pretty clear. International equity exposure is important, China downgrade notwithstanding. But if you’ve been thinking of loading up on mainland Chinese equities... then you might want to hold off for a little while.

Big Earnings Reports: Bank of Nova Scotia and Michael Kors

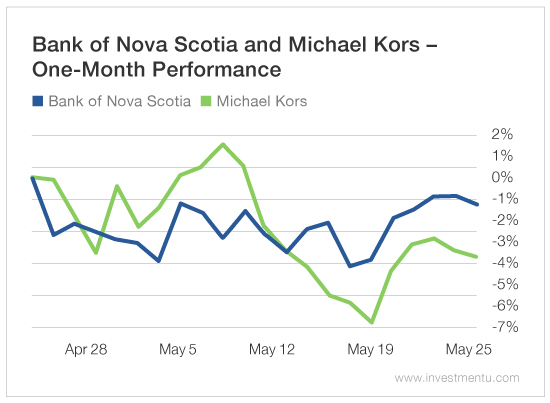

Bank of Nova Scotia (NYSE:BNS) will report earnings on Tuesday morning. The consensus EPS forecast for the large cap bank is $1.14 - $0.03 above the same quarter’s earnings last year.

Fashion retailer Michael Kors Holdings (NYSE:KORS) will post its earnings the next morning. Analysts are looking for EPS of $0.70. That’s almost $0.30 below this quarter’s EPS last year.

Both stocks have been trading down in the weeks leading up to the report. That implies that Wall Street thinks their chances of beating expectations are slim.