The British pound closed Friday down to a 2 1/2 year low against the US dollar, as Brexit fears continued and data released on Friday showed that the UK’s economy contracted for the first time since 2012.

Second-quarter data released from the Office for National Statistics revealed that year-on-year economic growth in the world’s 5th largest economy declined to 1.2% from the 1.8% recorded in the first quarter of the year. Output declined 0.2% in the 2nd quarter, below market expectations of a flat reading.

Weak UK Housing Data

The disappointing economic data followed a week of poor housing data. The Royal Institution of Chartered Surveyors revealed its headline price indicator declined to -9 in July from the 10-month high of -1 recorded in June. The fall was far steeper than analysts’ had predicted. The weak house price data follows Wednesday’s disappointing numbers from mortgage lender Halifax, which showed house prices declined last month for a second successive month.

The UK housing market has slowed since the Brexit referendum result from June 2016. However, the impact has mostly been concentrated in London and the surrounding areas. Prices there were already considered inflated having experienced the most growth prior to the referendum.

Cable at 31-Month Low

GBP/USD plummeted to a fresh 31-month low on Friday, closing down 0.82% with cable valued at 1.2031. The U.S. dollar also suffered on Friday, down 0.20% against the EUR, as trade war talk between the U.S. and China; the world’s two largest economies, intensified. Elsewhere, the British pound plunged 1% against the euro and 1.17% against a strong JPY. The Japanese yen is considered a safe haven amongst investors in this volatile period and has enjoyed healthy investment. Against the Canadian dollar, the GBP closed 0.81%, whilst sterling closed 0.59% down against the Aussie.

The Brexit Factor

With new Prime Minister Boris Johnson committed to exiting the European Union on October 31st, with or without a deal with the EU in place, the economic outlook for the remainder of the year and beyond continues to be uncertain.

The Brexit-related stockpiling of the last few months appears to have abated as the blame game between the UK and an unflinching EU continues. The outlook for the GBP and the UK economy remains extremely fragile, on a knife-edge, despite dovish statements from the Bank of England for the rest of the year.

Having seen poor industrial production and manufacturing figures add to the weak housing and economic growth data, and with less than three months to go before the Brexit deadline, there is still time for further contraction and weak data.

Planned car factory shutdowns for the original March 29th Brexit day deadline were behind much of the Q2 decline. Manufacturing, which declined by 2.3 per cent, was the worst-performing sector of the UK economy.

Is it All Doom and Gloom?

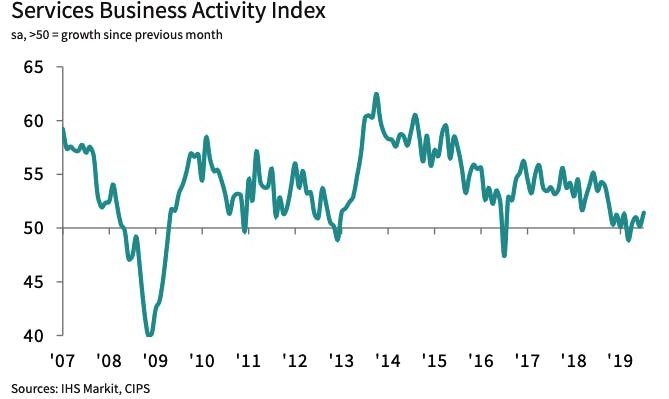

Is it all as bad as it seems? The dominant and important services sector expanded, albeit at just 0.1 per cent. UK unemployment was forecast to rise by nearly 1 million people in 2016. In fact, unemployment in the UK has fallen to a 45-year low.

The trade war between the U.S. and China is not just affecting the UK, it is affecting almost every country. A trade war is bad for the global economy and the global outlook. Should there be some positive movement there, we could well see the UK economic conditions improve along with other economies.

Growth throughout Europe and the European Union has slumped too. Germany, the economic powerhouse fueling the EU project is in trouble. The EU’s engine room posted their steepest annual decline in exports for three years in June. The world’s 4th largest economy is forecast to expand by just 0.5% this year as industrial production posted its largest annual decline in nearly a decade. German giants including BASF (DE:BASFN), Continental (DE:CONG), Daimler (DE:DAIGn) and Lufthansa (DE:LHAG) have all cut their outlooks as the trade war takes its toll.

It’s not just Germany that is suffering. French industrial output plunged 2.3% in June, the largest decline since the start of 2018. Meanwhile, Italy has already experienced a recession in the latter half of last year. Within the eurozone as a whole, manufacturing activity in July contracted at its steepest rate since late 2012. The point being: Britain is not alone in its economic woes.

So, Is Britain in a Recession?

At this point in time, it is too early to say for sure. The PMI for services data, a strong indicator for future growth or contraction, was 50.2 in June and 51.4 in July, which shows a pick-up in the all-important services.

This could keep Britain out of a recession in the next quarter, but only JUST. By Oct. 31st, the scaremongering and the project fear centered around Brexit could well just be a memory. Boris Johnson could lead the UK successfully out of the EU. Who knows?We could even see an easing in the U.S.-China trade war.

Statistically, the global economy is due a recession. It’s been a full decade since the financial crash of 2008. However, with record highs in US stock markets and so much global geopolitical uncertainty, it would be a brave person to bet against a global recession in the near future. At this point, it is fair to say that Britain is NOT in a recession, more like on the cusp of a recession. The next quarter, with BREXIT approaching, is vital.