The US stock market had a long run higher off of the bottom in February. That ended in April and it has been moving sideways since. That consolidation has been in an upward drift. A series of higher highs and higher lows has started an uptrend, but will it continue? As always at points of consolidation there are no lack of opinions either way.

The preponderance of evidence suggests that it should continue higher. But the market has failed to do so for 13 months. Many will talk about the reasons that have held it back. When will the FOMC raise rates again? When will inflation rise so that it makes sense to raise rates? What about the strong dollar? What about the weak European markets? What about the Brexit vote?

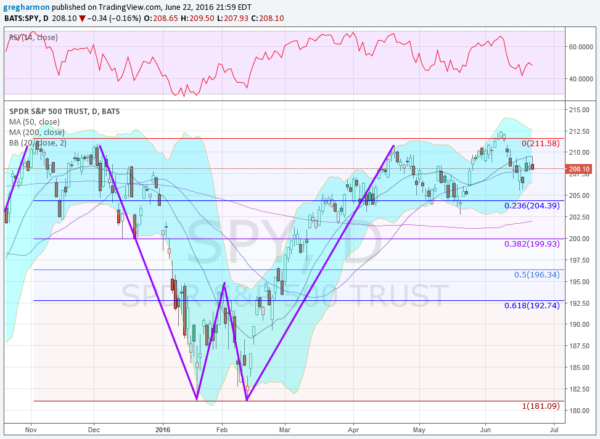

SPDR S&P 500 (NYSE:SPY) Daily Chart:

Let me be the first to tell you that Brexit may or may not be the catalyst to a major move in the markets. Can you pinpoint a market move to one event? Sometimes. The Gulf War. Soros breaking the pound. But those are rare. But that is very rare.

Most times it is the removal of layers of worry that compound. In this way Brexit may be that catalyst. Or it may not be. The market can always shift focus to a July rate hike. Or falling growth in employment. Or whatever. But for now the risk is to the upside in the market. Brexit or not.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.