It may still be too early to gauge Wall Street's attitude towards bitcoin but so far the sentiment we're seeing is extreme caution.

Yesterday, the CBOE's new contracts saw just 411 coins traded, which comes out to about $7.3 Million, or about 0.062% of the total amount traded on the world's largest exchange sites.

The SEC financial regulator in the United States has now issued a warning on cryptotrading and especially on ICOs saying what most of us in the industry already know. If something looks like a scam and smells like a scam, it probably is one.

Furthermore, by calling something an ICO it does not change the underlying nature of the asset itself. If a company is offering a token that acts as an investment in the success of that company, it still falls under the jurisdiction of the same regulations as any other financial asset.

We can expect them to continue to crack down on specific companies who have intentionally tricked investors in this space as they probably should have been doing right from the start.

In today's update, I'd like to explore with you the relationship between the world's newest financial asset and it's oldest most established store of value. Please keep an open mind as I'd love to hear your opinion after you read it.

Today's Highlights

Oil and Ice in London

Some Data and a Question

Please note: All data, figures & graphs are valid as of December 12th. All trading carries risk. Only risk capital you can afford to lose.

Market Overview

Stocks in the United States climbed further yesterday nearing all-time record highs powered by advances in tech stocks and the energy sector.

The UK's main North Sea pipeline has been shut down for repairs due to a hairline crack and will likely be out of commission for a couple weeks. There's a yellow weather warning out in London telling residents to prepare for ice.

The combination of greater demand and less supply has sent the price of oil up in the UK but even the Oil that is traded at eToro is seeing a significant surge toward the highs.

The price of oil has been rising steadily thanks to efforts from OPEC to reduce the global glut. Still uncertain, how US oil producers are going to react to all this.

Stock markets in Asia did not continue New York's sentiment and the China A50 index fell 1.8% today. The European markets are opening just now but looking rather flat.

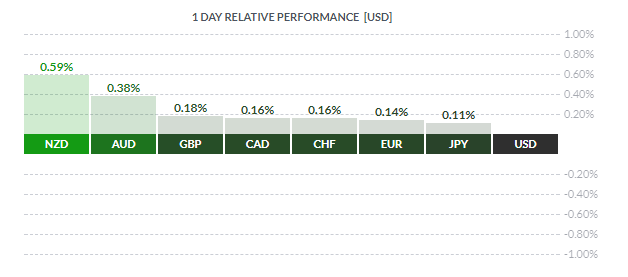

In addition, we're seeing a notable risk-on sentiment in the currency markets, with the safe haven's (USD, JPY), and Euro) down and the risky currencies gaining in comparison.

What about Gold?

Normally, we would look to gold to understand investor attitude towards risk on any given day. After thousands of years of acting as a store of value and a solid place to keep your money in times of crisis, it has forged a sturdy relationship with other assets and served as the main barometer for risk sentiment.

Indeed, with the markets showing risk on today, we do in fact see gold taking a dive. However, what's more interesting to investors at the moment is gold's relationship with bitcoin.

An analyst on from ACG on CNBC yesterday made the claim the bitcoin was stealing some of gold's market share, saying the the crypto-market is now standing at about 23% of the liquid "tradeable" gold in the market.

Seemingly in response, an analyst from Goldman Sachs (NYSE:GS) was quoted in the Financial Times as saying that this is not happening and that the markets remain unconnected.

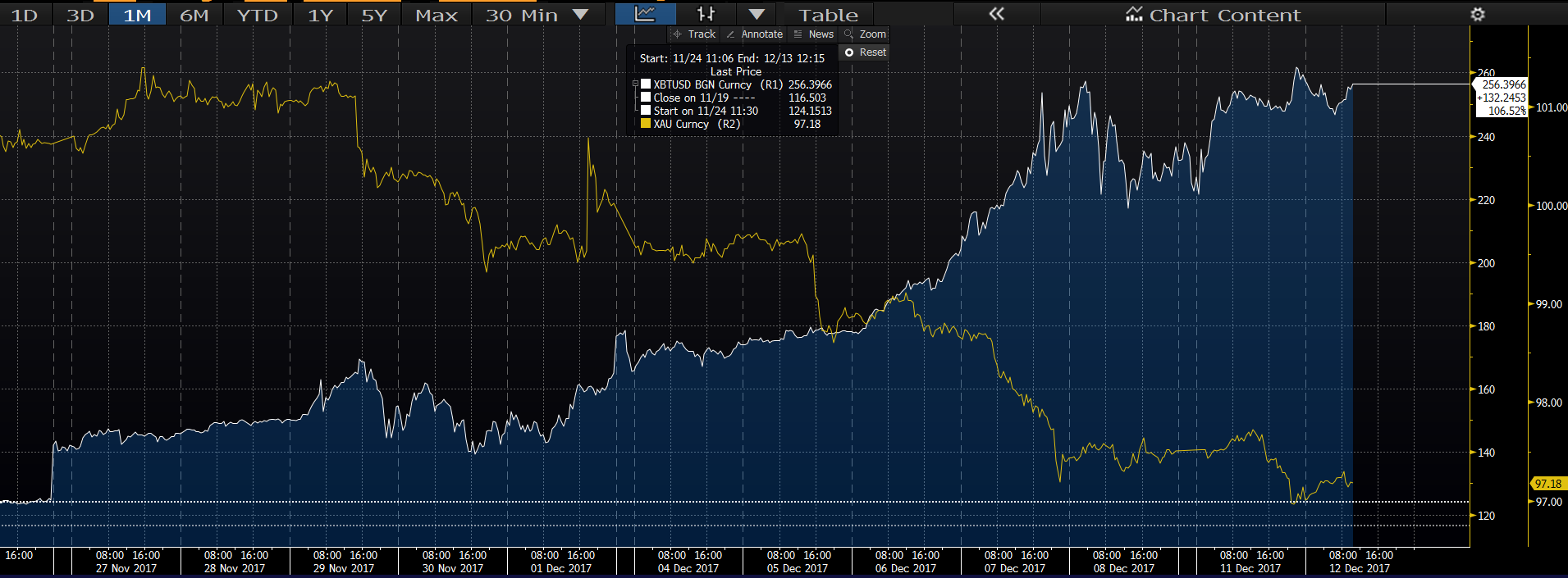

Let's take a look at some charts

Over the last few weeks, we can spot a rather clear reverse-correlation between the two assets with the chart creating a rather large X as bitcoin surges and gold declined over the same period.

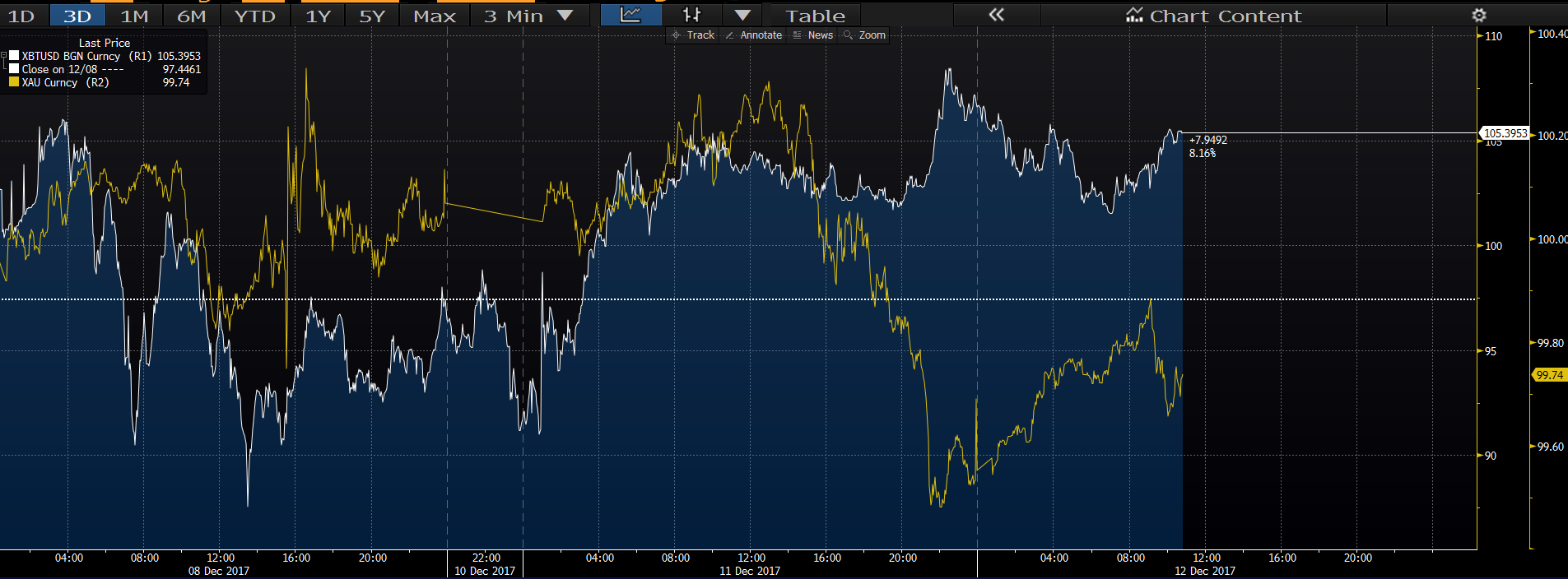

but the most interesting thing that I'm seeing is actually what's happened in the last 20 hours or so. Here, take a look at this snapshot.

Of course, it's a very small amount of data, but at least from 16:00 yesterday afternoon bitcoin and gold are trading in a lockstep mirror image.

Deeper in the data

In eToro, it's no secret that we're seeing a lot of new customers mainly thanks to the rise in populist finance surrounding the cryptocurrencies. I'd like to take this opportunity to welcome everybody, I hope you're enjoying the platform so far. :)

After an extensive conversation on the above question with one of our senior officers in the trading department. It seems that what we're seeing in eToro is actually a trickle-down effect.

Meaning, yes. We're seeing volumes on bitcoin going through the roof but the volumes on gold are rising as well. Of course, this is only an initial finding and we'll need to pour into the data a bit further later on, but it seems that the volumes that we're seeing on gold so far this year have more than doubled what we saw last year.

In comparison, we are also seeing increases in the volumes of Oil and the Euro Vs the US Dollar but the increase on these assets is not as much as the increase that we saw in gold.

This indeed could be a remarkable find in behavioral economics. Similar to when a new Pizza Shop opens up just down the street from an established one. It would seem initially that they would now need to fight over market share but in fact, as the awareness grows so does the hunger for investments and in fact, both end up benefiting as a result.

As this is only my personal view from where I sit. I do believe that this question is more of an emotional one that should be put to the general public and not one to be answered by financial analysts such as myself who may be already stuck in a certain way of thinking.

If you have a moment, please reply on this post either by Email, or with a comment below (depending where you see it), or just tag me on social media with your thoughts and opinions.

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.