Gold is down 24% for the year, whilst Bitcoin has been up by as much as 4,600% since the beginning of the year.

In a relatively short period of time people are declaring that Bitcoin is gold 2.0. These declarations originate from Bitcoin’s climb whilst gold drops, despite ongoing central bank easing and a distinct lack of global recovery. These are conditions in which traditionally gold is expected to outperform currencies.

Is Bitcoin an alternative to gold? Or is it in a bubble?

Perhaps it can be used alongside it. I took a quick look at the key issues surrounding the virtual currency and wondered if the gold school is now too old school.

Are investors buying Bitcoin rather than gold?

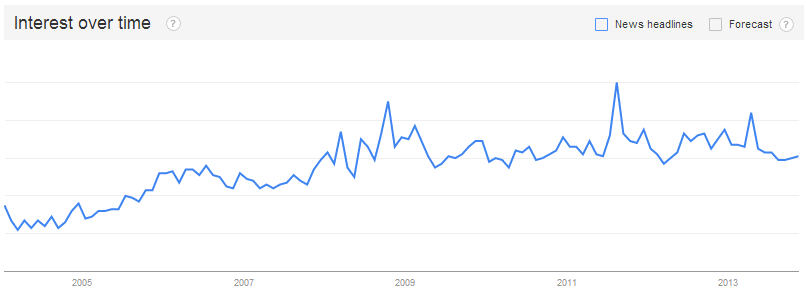

There is no evidence that suggests this is the case, however the interest in the virtual currency certainly continues to peak. In contrast, the interest to ‘buy gold’ is comparatively more constant. Unlike Bitcoin, this cannot be aligned with the price movements of the asset in question.

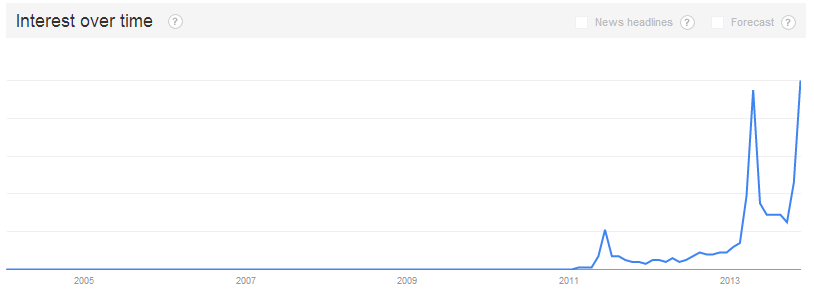

However, as we can see from the Google Trends graph below, the searches for ‘buy Bitcoin’ continue to spike.

How does it look for ‘buy gold?’ Well, it’s slightly more erratic.

Like all assets, gold and Bitcoin have their moments of peak news coverage. Again, unlike gold, the interest in Bitcoin is generally matched to when it is introduced to the public psyche. In contrast, gold is rarely mentioned in the mainstream media and often in a negative fashion. Yet interest in the yellow metal remains constant.

The authorities

Given the media storm around Bitcoin at present, both regarding its price and its role on the Silk Road it is unsurprising that the authorities are being forced to sit up and pay attention.

Publicly they are playing it exceptionally cool. Behind closed doors we suspect they are suffering from Death Valleyesque temperatures.

This week saw the first ever Congressional hearing on virtual currencies. Both the Department of Justice and the SEC told the US Senate Committee that Bitcoin is a ‘legitimate financial instrument.’

Even Ben Bernanke sees the potential for Bitcoin as a medium of exchange. He said in a letter presented at the hearing Tuesday, that virtual currencies, “may hold long-term promise, particularly if the innovations promote a faster, more secure, and more efficient payment system.” But, he crucially stated that the potential is within the realms of regulation.

Bernanke’s comments regarding virtual currencies were vastly different to his previous comments on gold when he admitted that he didn’t understand the precious metals. His successor, Janet Yellen, updated this jaw-droppingly daft comment when she stated that there was no economic model that could explain the price of gold.

Tuesday was day two of the US Senate getting its head around Bitcoin. Senator Mark Warner stressed the need for participants to have an open mind. As Bitcoin magazine reported:

‘He specifically stressed the need for open minds to hear about the potential and also the important ramifications around monetary policy and taxation related to Bitcoins and other crypto-currencies. He stated that Bitcoin can radically transform central banks, monetary policy and also pose threats.’

One of the many warnings from those crying foul over Bitcoin was that US regulators would shut it down as fast as you could say ‘Bitcoin at $1,000’. It seems, so far, this is not the case.

But it may not be too long. During Tuesday’s committee session, Jennifer Shasky Calvery of FinCen warned Bitcoin operators to act within regulatory laws and drew parallels with Liberty Reserve. Apparently FinCen is yet to decide whether or not Bitcoin is a virtual currency.

Unsurprisingly, this offer of peace from the authorities prompted the price of Bitcoin to soar.

For Jim Rickards, author of Currency Wars, it is not a surprise that the officials-on-high have pre-emptively given their approval to currencies. It makes it ‘easier to keep tabs on everything you do.’

But this warm reception so far from the US government does not mean that this is a guaranteed safe haven. As Patrick Murk, General Counsel to the Bitcoin Foundation, told the US Senate’s Committee on Homeland Security and Governmental Affairs, “It’s very much an experimental currency and it should be considered a high risk environment for consumers and investors at the moment.”

Is there any point in comparing the two assets?

There are, of course, many parallels to be drawn between gold and Bitcoin.

Both are finite. For gold, this is guaranteed (unless you know an alchemist out there). For Bitcoin it is certainly the case for now, but according to coders it seems nothing is entirely ‘unhackable’.

Both are produced outside of the central banking system. But this does not mean both cannot be manipulated. For gold, this is an issue we have covered several times before – central banks partake in gold leasing and there are queries over their involvement in the futures market. Tuesday it was reported that the US government is the world’s largest single address holder of Bitcoin. Is this bad or good?

One advantage Bitcoin may have over gold is that it is reportedly anonymous. Depending on how and where you buy gold, this can also be the case. However, the channels for buying gold in the West are well established and records are often kept.

For Bitcoin, anonymity is unlikely to remain the case for much longer. As Bitcoin companies begin to be viewed as legitimate businesses and look for banks to facilitate transactions, they will be required to carry out various anti-money laundering checks.

The one thing gold has over Bitcoin is history.

Investors do not choose to invest in gold just because it cannot be devalued by governments. They also choose to invest in it because it is an asset which has a long and proven history as both a hedge and safe haven. For thousands of years it has been tested, each time showing itself to perform during both political and financial turmoil.

Bitcoin does not yet have a legacy. Whilst the price has caused many surprise so far this year, it has not yet been tested during times of strong economic turmoil.

Does Bitcoin have value? Precious metals fans and our own non-exec, Ned Naylor-Leyland certainly don’t think so. ‘It will get interesting when people think about Bitcoin’s true meaning rather than just observing price action. Profound consequences for gold,’ Ned tweeted the other day.

But, other big sound money fans see huge potential for the virtual currency. Bill Bonner opines that Bitcoin ‘could also make gold obsolete. This new money is easier to use and costs nothing to store.’

At present, many believe Bitcoin is in a bubble. Unlike gold, which happens to sell off from time to time, the virtual currency is currently experiencing frenzied speculation.

Bubble or no bubble in Bitcoin or gold, if it bursts what do you have left at the end?

How easy is it to own Bitcoin?

Whilst we discuss gold in terms of central banks, it also represents a huge part of the wealth in many Asian and Middle Eastern countries. Owning the yellow metal is something that has been ingrained in people since the day they were born.

But once again, gold is not used in these place as a form of exchange, rather it is a store of wealth.

In countries where cash transactions and the transfer of money is difficult to facilitate, mobile money platforms have been embraced. Now, the same platforms are embracing Bitcoin. M-Pesa, a successful mobile money platform in sub-Saharan Africa is integrating Kipochi, the Bitcoin wallet service into its services.

More than one third of Kenyans have already signed up for Kipochi, as well as five million Tanzanians. And, in East India 8,300 ‘brand agents’ are also currently canvassing, targeting ‘unbanked’ people.

The cost of transferring Bitcoins from user to user, across continents, is miniscule compared to traditional money transfer services such as Western Union.

Last month, Charlie Shrem of Bitinstant asked at a conference, “Who are the first types of people to use any kind of new technology? The ones that need to use it the most, right?”

At present this is where gold falls down. Yes, it is a store of wealth. Yes, it is money. But it is not money that can be easily transacted.

However, in China – a country we regularly report on in terms of staggering gold demand, Bitcoin has been fully embraced. There are even reports that national television has been promoting ownership of the virtual currency. Just as they did with gold.

Rather than asking which is best, or if Bitcoin is gold 2.0, the wealthiest nation and anti-US dollar government are encouraging ownership of both.

Do you take Bitcoin?

Bitcoin is quickly establishing itself as a medium of exchange. As it continues to gain acceptance in this medium, it will no doubt become increasingly attractive as an alternative currency. Like any sovereign currency it has proven itself in a variety of transactions, both legal and illegal. From house sales to drug sales, you name it. you can probably pay for it in Bitcoin.

So far any efforts to facilitate gold as a payment mechanism via a digital payments system have been thwarted. As Will Bancroft showed in his Digital Money infographic, the moves made by both eGold and GoldMoney to enable payments to be made in physical gold have been barred at every turn by regulators from the Netherlands to the United States.

We believe that Bitcoin will be good for gold. As it gains acceptance by national governments, the road will be paved for allowing digital payments, outside of a banking system, to become commonplace. This is where gold’s role as money can enter the mainstream of everyday life.