Barrick Gold's hostile takeover offer for Newmont Mining (NYSE:NEM) likely signals “peak gold.” Barrick claims the shareholders would benefit from over US$7 billion in NPV of “real synergies.” These “synergies” would primarily be derived from proposed cost-savings by combing the Nevada operations of both companies. As it turns out, footnoted in Barrick’s presentation is the disclosure that the proposed $7 billion NPV represents the projected cash flow benefit of the merger over a 20-year period discounted at 5%.

If I were a NEM shareholder, my answer would be “no thanks.” First, it would be more appropriate to use a 15-20% discount rate to better represent the probability that Barrick’s projections over 20 years are even remotely accurate. Second, given the poor track record over the last 20 years of Barrick’s management, I would be skeptical of any representations and projections made by the Company. Barrick’s stock has substantially underperformed the HUI index over the last 20 years. This is significant because Barrick carries a 13.8% weighting in the HUI. While some type of joint venture or merger of the two companies’ Nevada operations makes sense, I do not believe that Barrick will achieve the synergies as presented.

I believe Barrick’s move to buy Randgold (LON:RRS) and its attempt to acquire Newmont is a desperate attempt to accumulate as much gold reserves as possible to replace the depletion rate of Barrick’s reserves. The most cost effective way with the gold price at its current level to build a large gold resource base is to buy it. Acquiring Newmont would double Barrick’s proven/probable reserve base and double its annual production.

In my opinion, Barrick’s acquisition of Randgold and its attempt to acquire Newmont signals both “peak gold” and an outlook for a much higher gold price. There has not been a major gold deposit discovered in several years. A five million oz discovery used to be considered “major.” While I don’t know if this is still the case, a former Newmont geologist who now runs a junior mining company told me 10 years ago that NEM wouldn’t even consider a project unless the geologists thought it had a least 5 million ozs of gold.

Those days are probably over. It’s likely that Barrick’s management does not believe the Company has a major discovery to be made in its future. However, the strategy of buying large gold reserves does not make sense unless the Company believes that the depletion rate of gold in the ground is going to exceed the amount of gold found in new deposits going forward. It also suggests that Barrick believes in the eventuality of a much higher gold price.

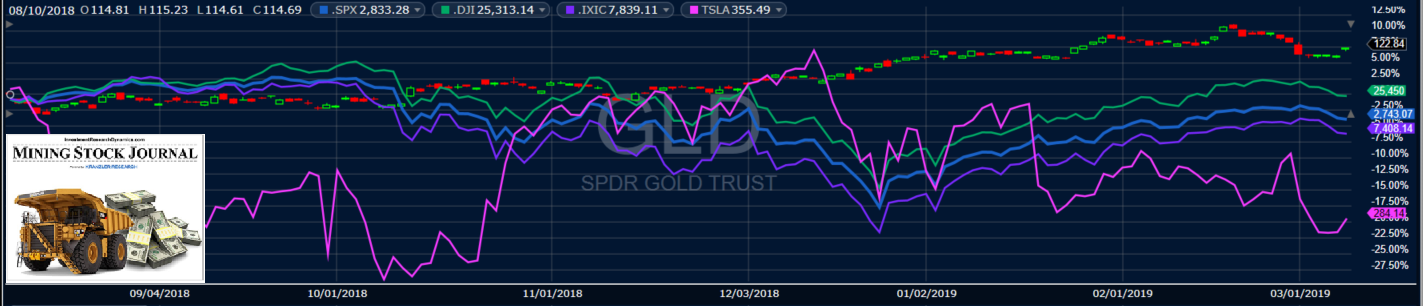

On another note, since August 12th, the price of gold has outperformed all of the major stock indices plus Tesla stock (NASDAQ:TSLA):