- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Is AUD Topping In The Hourly?

Aussie dollar pairs are showing some temporary weakness in the 15 minutes to the hourly timeframe, which may result in a short-term reversal. In this post, I analyzed the market’s supply and demand on the 3 of the most traded AUD pairs: AUD/USD, EUR/AUD and GBP/AUD.

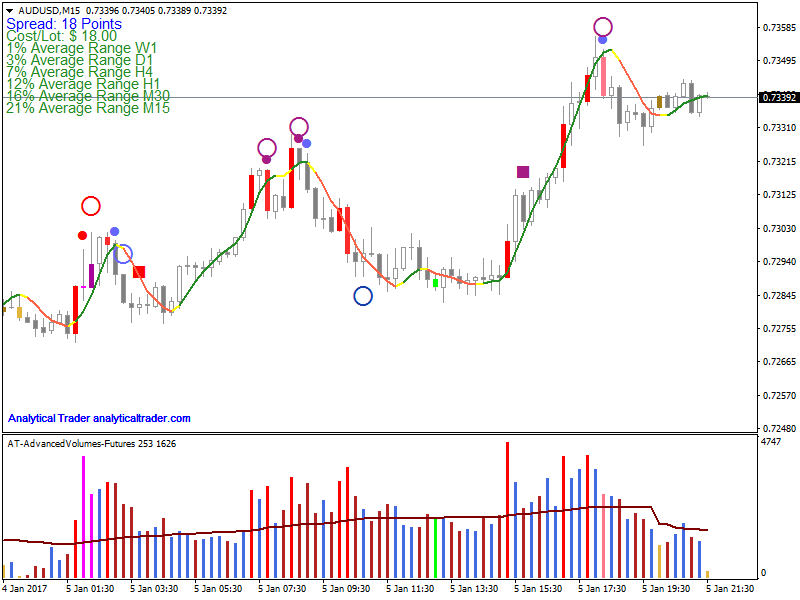

AUD/USD

In this pair there was supply at new highs, which often pinpoints the beginning of a downtrend – in new (relative) market highs, there just isn’t trading due to old resistances, and so any supply sign tends to carry more weight. Before looking for a short I would like to see another descending top (lower than the last 2) on low volume, a downtrend confirmation.

Note: Nonfarm employment change and unemployment rate numbers are coming out tomorrow for USD at 1:30 PM GMT

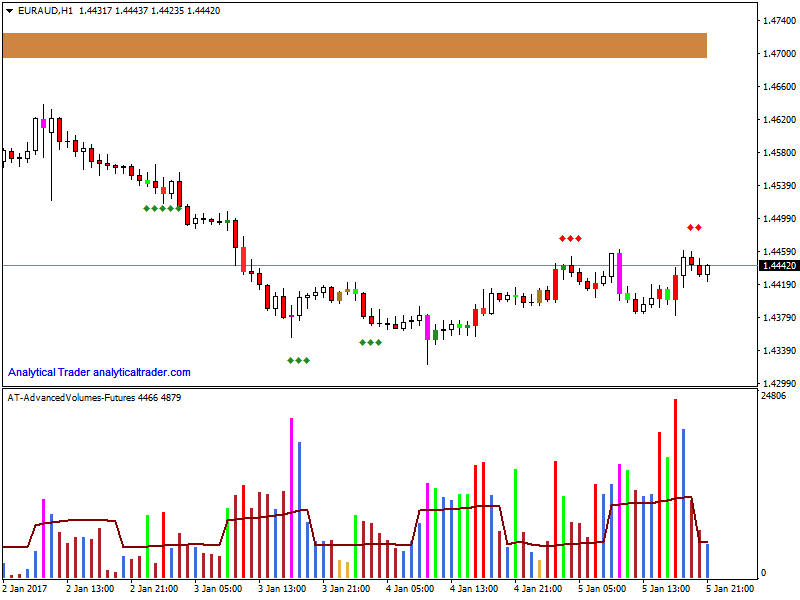

EUR/AUD

In EUR/AUD Hourly chart, the price is still moving in sideways, but the volumes are telling another story. They spiked on the market lows, which means there was mostly demand in the last 2 days. A low volume rally to 1.44 would be the trigger for a high probability long trade.

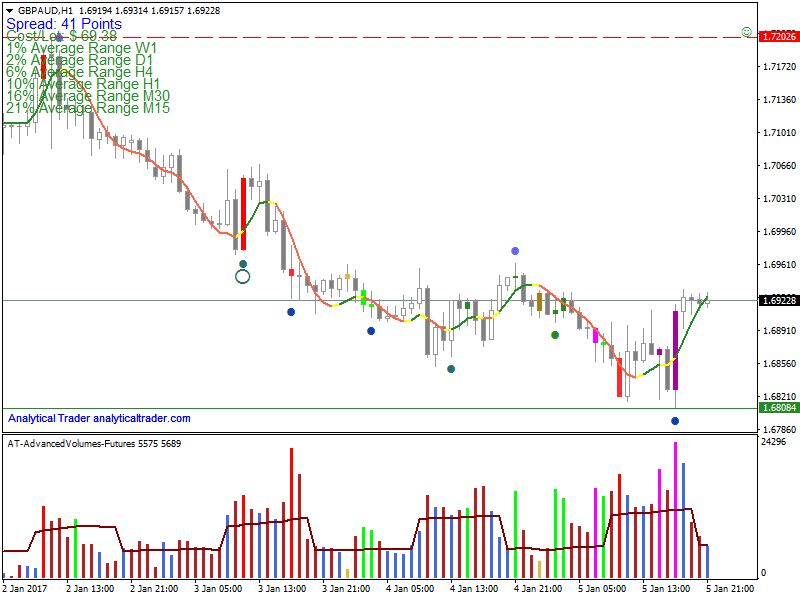

GBP/AUD

This pair is near a long-term support at 1.68, and just showed a major shake-out (blue dot). It’s probable that it may form an inverse head-and-shoulders, that given the accumulation, would show strength. Even if that doesn’t happen, though, a dip to around 1.687 (previous low) on low volume would still give a long opportunity with a favorable risk:reward.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Japanese yen is slightly lower on Wednesday. In the North American session, USD/JPY is trading at 148.92, down 0.07% on the day. What is the best performing G-10 currency...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.