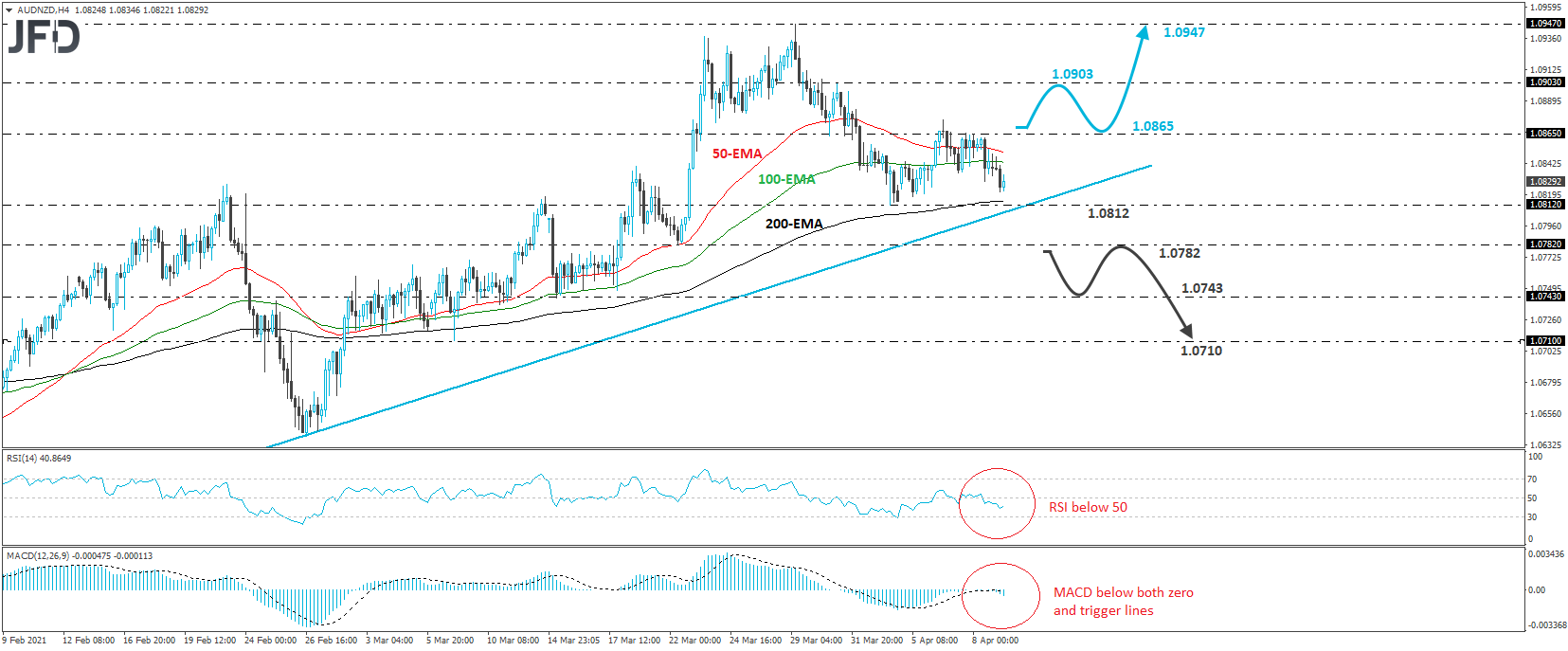

AUD/NZD traded lower and today during the European session, after it hit resistance at 1.0865. Overall though, the pair continues to balance above the upside support line drawn from the low of Feb. 3, and thus, we would consider the latest retreat as a corrective move. We see decent chances for the bulls to take charge from near that line and thus, we would see a cautiously-positive picture.

If, indeed, buyers are strong enough to take the reins back from near the crossroads of the aforementioned upside line and the 1.0812 support zone, we may see a rebound back near the 1.0865 area. However, in our view, a break above that zone may be needed to signal the continuation of the prevailing uptrend. Such a move may pave the way towards the high of Mar. 31, at 1.0903, the break of which could carry extensions towards the peak of Mar. 29, at 1.0947.

Taking a look at our short-term oscillators, we see that the RSI lies below 50, while the MACD runs below both its zero and trigger lines. Both indicators detect negative speed and support the view for some further retreat before the next leg north, perhaps for the rate to test pre-discussed upside support line.

On the downside, we would like to see a dip below 1.0782 before we start examining a bearish reversal. The rate would already be below the upside support line and the bears may get encouraged to push the action towards the low of Mar. 15, at 1.0743. Another break, below 1.0743, could set the stage for the 1.0710 area, defined as a support by the low of Mar. 8.