AUD/USD

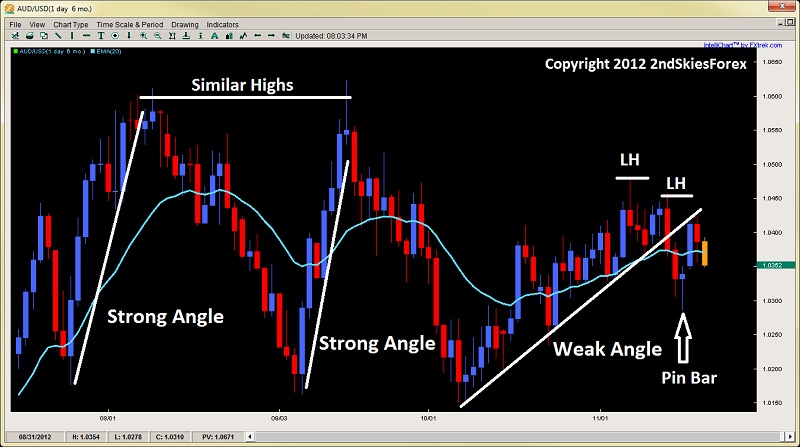

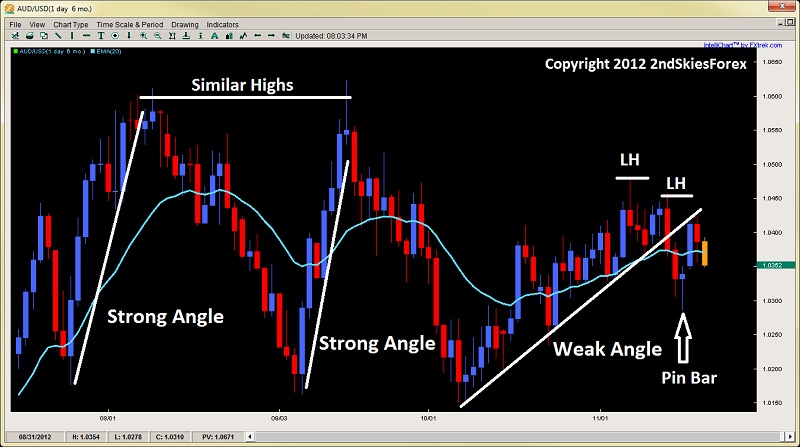

As I wrote in my weekly market commentary, I talked about how the price action angles on the aussie were weakening, suggesting a likely breakdown. The main thing needed was a lower high, and at that point, we had started the week off of a pin bar rejection, suggesting short-term higher prices. Price did climb, for a day, but has since started to show signs of weakening with a bear close Monday, and aggressive selling to begin today.

If the pair takes out Monday’s lows (about 1.0345), then it should challenge the pin bars lows at 1.0287. Below here, it could make a run towards 1.0150 which could offer some nice profits for bears. Bulls will likely want to wait till 1.0150 before adding longs, or aggressive short-term players can watch the pin bar lows for a possible short-term play.

AUD/USD" title="AUD/USD" width="800" height="599">

AUD/USD" title="AUD/USD" width="800" height="599">

NOTE: I am also short on this pair in a live trade as we speak, having shorted at 1.0393, taken 1/2 profit off the board and holding for my target or an exit signal. See chart below.

Original post

As I wrote in my weekly market commentary, I talked about how the price action angles on the aussie were weakening, suggesting a likely breakdown. The main thing needed was a lower high, and at that point, we had started the week off of a pin bar rejection, suggesting short-term higher prices. Price did climb, for a day, but has since started to show signs of weakening with a bear close Monday, and aggressive selling to begin today.

If the pair takes out Monday’s lows (about 1.0345), then it should challenge the pin bars lows at 1.0287. Below here, it could make a run towards 1.0150 which could offer some nice profits for bears. Bulls will likely want to wait till 1.0150 before adding longs, or aggressive short-term players can watch the pin bar lows for a possible short-term play.

AUD/USD" title="AUD/USD" width="800" height="599">

AUD/USD" title="AUD/USD" width="800" height="599">

NOTE: I am also short on this pair in a live trade as we speak, having shorted at 1.0393, taken 1/2 profit off the board and holding for my target or an exit signal. See chart below.

Original post