AT&T (NYSE:T) fell 3% Tuesday on nearly 3(x) average volume after Verizon (NYSE:VZ) warned about increased churn and margin pressure in its wireless business, which saw VZ fall 4% on nearly 3.5(x) average volume.

A small position in VZ was sold on Tuesday (we’ll give it until the January ’15 earnings report to have another look at the fundamentals and guidance) but I also added some T for clients in both bond accounts and balanced accounts, given the current yield on T of 5.5%.

When I look at the current yield on (ARCA:HYG), the iShares High Yield (junk bond) ETF, which is yielding 5.75%, the trade-off between an investment-grade credit dividend at 5.5% versus high-yield current income at 5.75% with energy exposure seems compelling.

Frankly, I’d rather own Telco dividend risk, here, with T sporting an A3/A- credit rating from Moody’s and S&P (Moody’s has T on credit-watch negative) than below-investment grade credit risk, with the liquidity issues in the high-yield bond market to boot.

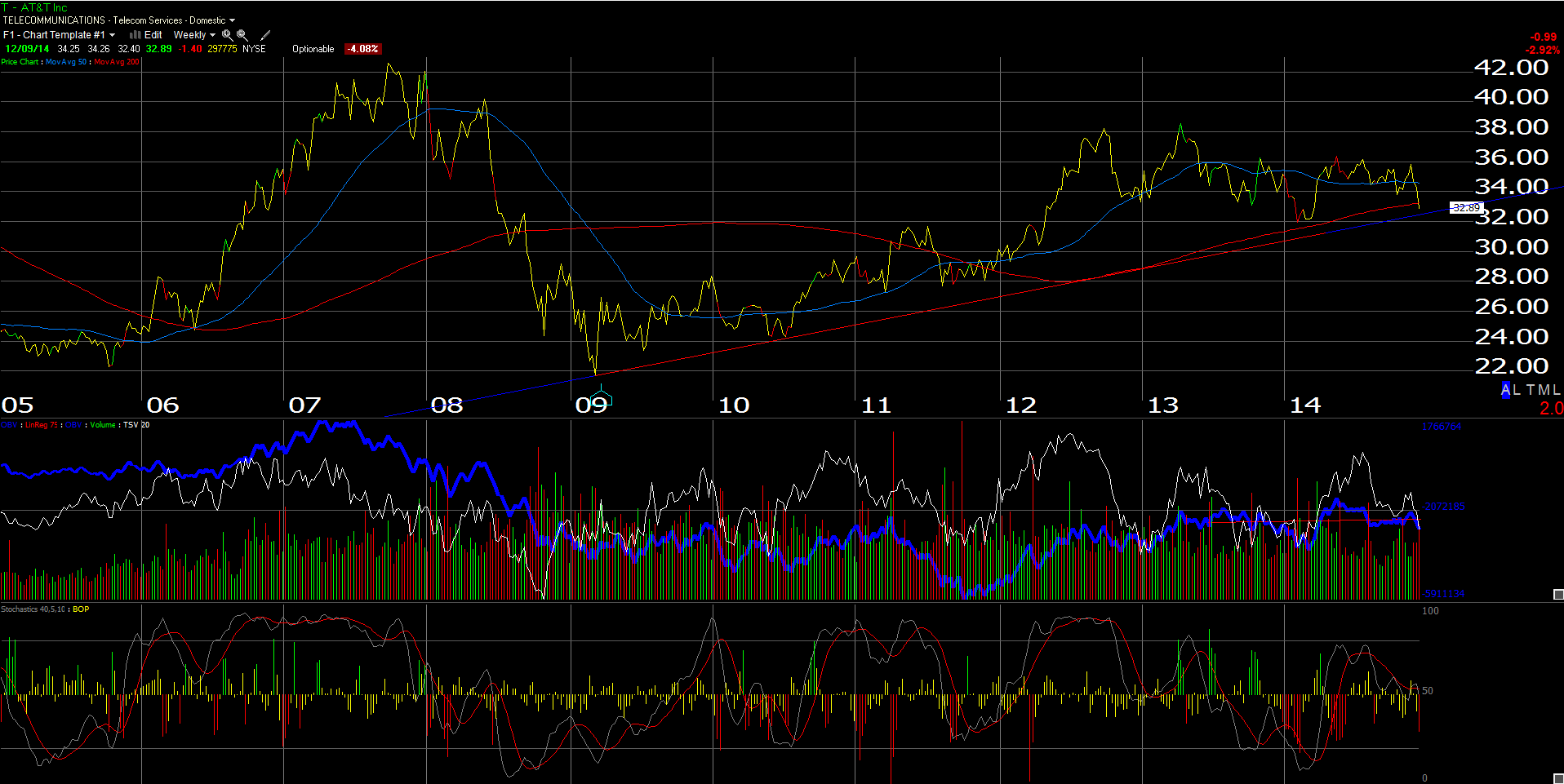

If you look at T’s chart above, the stock is testing its uptrend line off the March, 2009 lows. The early 2014 lows for T was $31.74.

We would likely be out of the stock with a trade below $30 on heavy volume, or at the very least, reconsidering the long position depending on what else is happening in the U.S. stock market.

In terms of disclosure, I have long been an AT&T client, with home and work landlines, as well as T being my cell phone carrier as well as website host. However the price war started by T-Mobile (NYSE:TMUS) and Sprint (NYSE:S) makes for a compelling value and pushes against T’s and VZ’s most profitable and growing business, i.e. the wireless biz.

Verizon took on a lot of debt with the Vodafone (LONDON:VOD) acquisition, resulting in VZ currently being rated Baa1/BBB+.

According to my internal spreadsheet(s), VZ sports $107 billion in long-term debt as of 9/30/14, while AT&T’s total long-term debt is $70 billion. T’s debt-to-capital is 28% while VZ’s is nearly 48%.

I would like for VZ to trade into the low $40’s before buying it back as a bond-proxy for clients.

This AT&T trade may be good for a week, a month or 6 months. Right now I’d prefer to collect a 5.5% Telco dividend than a 5.75% high-yield ETF dividend.