- Interest in AI and ChatGPT has increased over the past few months.

- But, after a tumultuous 2022 and the retreat in February, investors remain cautious.

- In this article, we will look at the 5 stages of a financial bubble, suggesting AI may already be entering phase 2.

Since ChatGPT came about, a new topic has dominated the conversations of techies and investors: artificial intelligence.

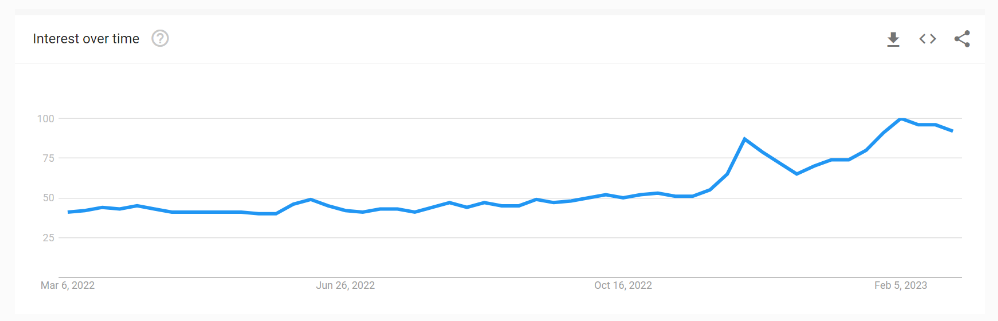

Searches on Google worldwide for the term "AI" (artificial intelligence) are up about 30 percent since the beginning of the year.

Source: Google

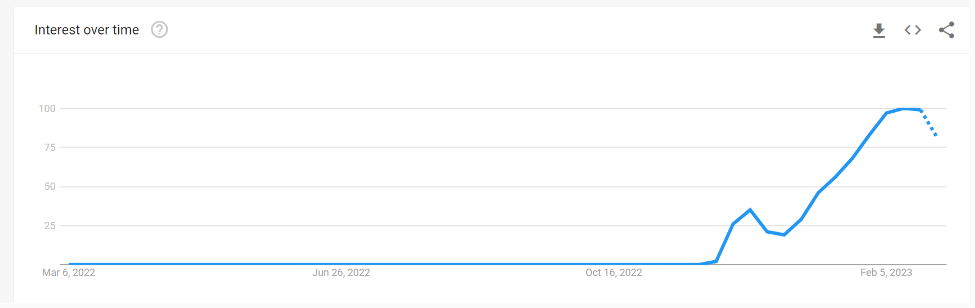

There has also been an exponential increase in searches for the term ChatGPT over the last couple of months.

Source: Google

We have all, in one way or another, tried out a tool to see what this technology can do.

On the investment side, though, we have not yet seen any special excitement. Investors are still cautious after the sharp drop in 2022, and the retracement in February (after an excellent January) has taken away the little optimism we had.

The chart above shows a big spike in the Global X Robotics & Artificial Intelligence ETF (NASDAQ:BOTZ) this year. However, it is important to note that the trend follows the broader stock market, with a significant drop in price in February.

But as always, the moment the broader market starts to rise again (not a question of if, but when), the narrative will change, so I prefer to talk about it today with a clear and relaxed mind, away from the hangover of the rallies.

5 Stages of a Financial Bubble

The following outlines the main characteristics of the creation and bursting of speculative bubbles so that you can recognize them if and when they occur in the future.

1. Key Event

The key event is usually technology or a novelty in the market. For example, the Internet in the dot-com bubble, subprime mortgages that were packaged and sold with high returns and minimal risk in CDOs in 2008, and railway shares or the carry-over mechanism in the crisis of '29.

This novelty, which may also be relevant on a technological level, nevertheless initiates the next step, the self-reinforcing narrative.

2. Self-Reinforcing Narrative

When the media starts to jump on the bandwagon, as they always do, exaggerating (positively in these situations) the new technology, the devastating impact it will have on society, and all the effects and benefits it will bring to the world. The early managers begin to structure and create products around the topic, influencers, and celebrities increase interest by reaching the masses. The market players make sure that the message of new technology = new opportunities = money gets through.

3. FOMO

This is where the third phase begins, known as FOMO (fear of missing out), which simply means the fear of being left out, of being the last to join the party. Seeing your neighbor, colleague, or best friend investing and making so much money, you convince yourself that you must get in on this new business, lest you miss out on the next wave of profits.

4. Loss of Rationality

The fourth stage is the worst. All logical patterns break down. Losing stocks that continue to grow at double-digit rates, companies with no earnings that excite new investors every day (see meme stocks), conversations that are now solely focused on a well-defined group of stocks referred to as the next Microsoft, the next Meta, the next Google.

There is no looking at fundamentals, no looking at the market as a whole, no looking at growth prospects, and no looking at how many years of earnings it will take to cover valuations. You don't worry about money management; worst of all, you don't think that values will eventually collapse and return to normal.

5. Collapse

The fifth phase always comes, and it is the cruelest. It is the return to normality, which usually coincides with a dizzying collapse in valuations. The self-reinforcing mechanism works in reverse, and everyone becomes convinced that, given the levels reached, the whole circus did not make much sense after all. Unfortunately, this is also when investors come to terms with their losses; some learn their lessons, while others do not.

I don't know if artificial intelligence will be the next bubble, but phase 1 may be coming to an end, and phase 2 has just begun, so we'll have to watch over the next few months to see if there are any developments in that regard. We shall see, but at least now we know how the process unfolds.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or recommendation to invest. As such, it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset is evaluated from multiple points of view and is highly risky and, therefore, any investment decision and the associated risk remain with the investor.