The past few weeks have been relatively positive for crude oil prices despite a range of external pressures, including continuing inventory builds as reported by the EIA and a pending Doha meeting. However, despite the looming meeting, the downside pressures are building for the commodity and the $40 handle is likely to be back in focus shortly.

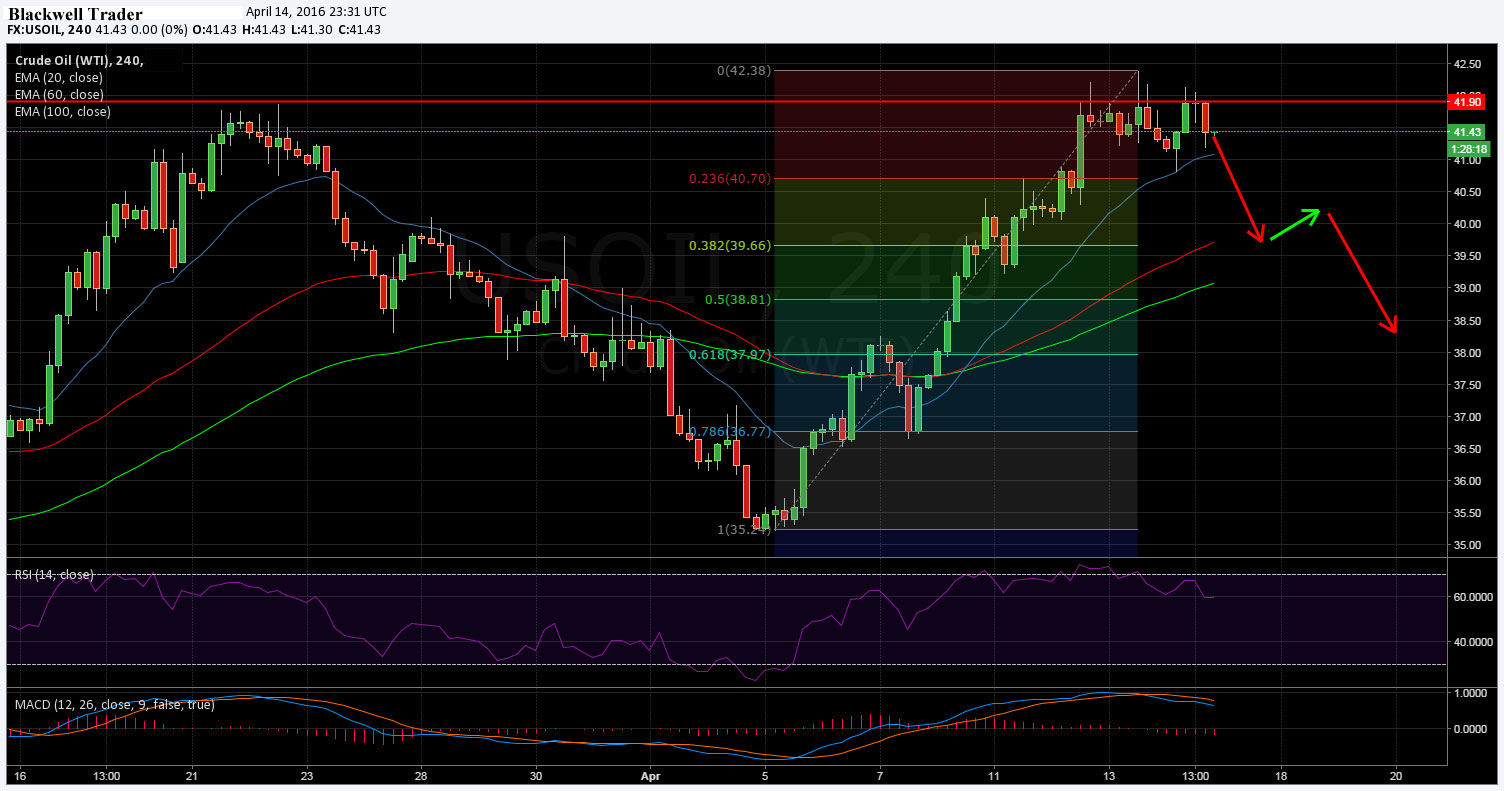

A technical review of the commodity over the past few weeks shows the strongly linear bullish trend which has developed. Subsequently, the buoyant trend has seen price action claw its way back from the low at $35.25 to its current range, just above the $40.00 handle. However, the strong rally recently touched upon a key zone of resistance around the $42.22 mark which has caused it to largely start to form a corrective structure.

In addition, the RSI Oscillator has been moving steadily lower, out of oversold territory, whilst price action has remained largely sideways. In confluence with RSI, Stochastics are also turning bearish with the signal line crossing to the downside. Also, price action is now flirting with a downside cross of the 12EMA which would add further weight to the bearish contention.

Moving forward, there are some key price levels which are likely to come into play in the coming days. Initially, the pair will need to cement a move below the 20EMA, which is acting as dynamic support around the $41.08 level, as well as the 23.6% fib level at $40.71. Such a setup would predicate the pair to strongly challenge the downside with a target of $38.32.

Moving forward, the commodity will likely remain fairly inactive until the Doha OPEC meeting, scheduled for the 17th of April. Although there are plenty of pundits predicting the meeting’s outcome as leaning towards production cuts the reality is that we are likely to remain in the current status quo. For production cuts to be effective, all OPEC members would need to be on-board and in agreement and that is looking highly unlikely given the current fractious nature of the cartel. Subsequently, expect to see little substance from the Doha event, and then the recommencement of the bearish trend.