It’s been a historic few weeks with this viral pandemic sweeping across the globe and grinding the world’s economy to a halt. While those headlines dominate the financial press, it’s easy to forget about the other things going on in the market. It seems like forever ago, but Tesla (NASDAQ:TSLA) was the hottest trade less than two months ago. While the world has largely moved on to bigger things, this trade matters for the people still holding it, so let’s take a look.

Along with everything else, TSLA’s stock plunged in late February. But as is often the case, the higher they go, the harder they fall. At one point, TSLA was down nearly 65% from those heady highs. While it seemed inevitable this stock would tumble from those unsustainable levels near $1,000, no one could have predicted the tsunami that was coming. This was an unprecedented global catastrophe that pummeled all stocks, not just the highfliers. But that still doesn’t justify someone holding this thing as it shed nearly 2/3 of its value.

While I was skeptical of the frenzied buying that propelled this stock up nearly 100% in just a few weeks, it was obvious to most this was too good to last. If it wasn’t a global pandemic, it would have been something else. That’s why it was critical to protect our profits by following this up with a trailing stop. Not long after the stock bumped up against $1k, it tumbled back under $800. That would have been a good place to lock in some profits. The stock did a good job clawing back above $800 over the next few weeks, but that second violation of $800 was definitely our signal to get out.

Rather than “hold and pray”, we should have locked-in profits and waited to see what comes next. As individual investors, our greatest strength is the nimbleness of our size. We can jump in and out of full positions with a few mouse clicks. If we don’t take advantage of this agility, we give up one of the few advantages we have over the larger institutions.

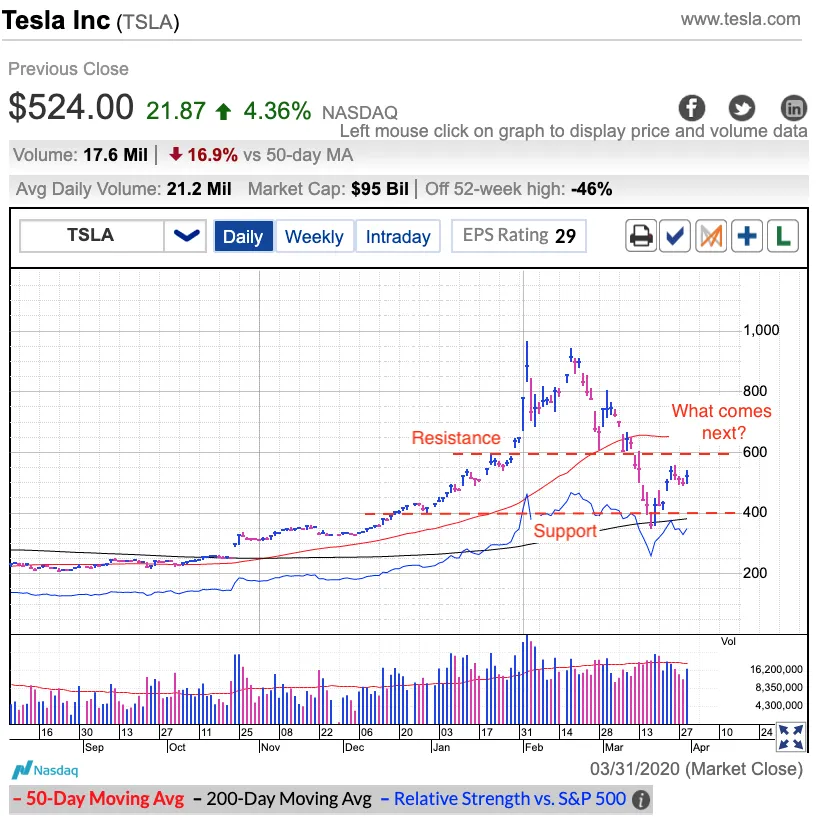

That said, hindsight is 20/20 and the horse is long gone. What owners really want to know is what comes next. While I like these big discounts on the other high-flying FAANG stocks, it is hard to feel the same way about TSLA’s future prospects. Without a doubt, this was a momentum story and the momentum has clearly been broken. The giddy buyers are long gone and won’t be back anytime soon. While I could see the FAANG stocks returning to their all-time highs over the next several months, it is hard to see TSLA getting back near its highs for a long, long time.

Now don’t get me wrong. This is still a great company with a great story. The stock will do well, but well is a relative term. While we will most likely return to the pre-bubble highs near $600 over the next few weeks, I wouldn’t count on anything above that for a good long while. There are a lot of people who have lost a lot of money in this stock and it will take them a while to admit defeat and get out. Until then, expect this to remain rangebound between $400 support and $600 resistance. Once these retakes and holds $600, we can revisit it as a buying opportunity.