In recent days, we’ve seen the beginnings of an inversion in the yield curve.

While the 2-year and 5-year yield curves have inverted, that has yet to happen with the the 2- and 10-year yields, which is the most-watched curve. However as bond traders would say, the “2s and 10s” look like they're headed for an inversion very soon.

We know that an inversion of the yield curve precedes a recession and bear market – that's good for gold. But timing is important and the key word is "precedes."

In order to analyze the consequences for gold, let's consult history.

Historically Speaking

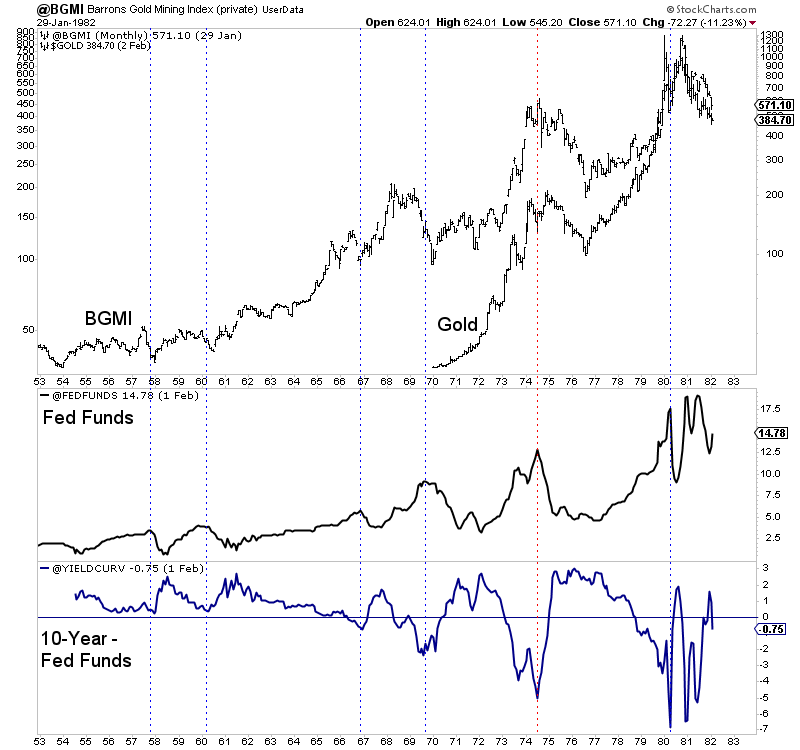

First, we'll take a look at the 1950-1980 period.

In the chart below, we plot the Barron’s Gold Mining Index (BGMI), gold, the Fed funds rate (FFR) and the difference between the 10-year yield and the FFR (as a proxy for the yield curve).

The six vertical lines highlight peaks in the FFR and troughs in the yield curve (YC), which begins to steepen when the market discounts the start of rate cuts. A steepening YC is and has been bullish for gold, except when it’s preceded by inflation or a big run in the metal.

Note that five of the six lines also mark a recession, except in 1966-1967.

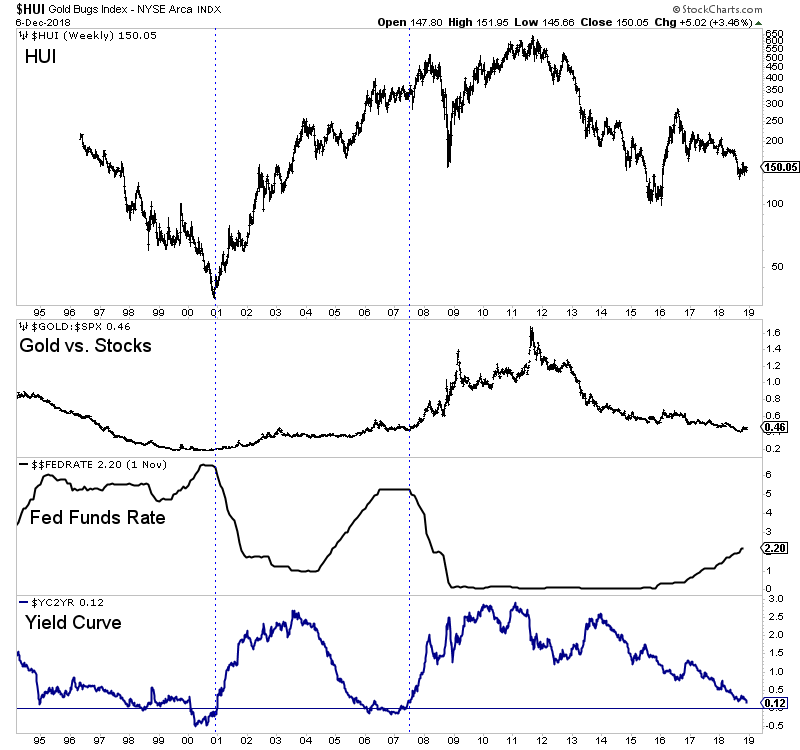

Right now, the yield curve is on the cusp of inverting for just the third time since 1990.

The previous two inversions in 2000 and 2007 were soon followed by a steepening curve as the market sensed a shift in Fed policy.

The initial rate cut in 2000 marked an epic low in gold stocks and the start of gold strongly outperforming the stock market. In the summer of 2007, rate cuts began and precious metals embarked on another impulsive advance.

Past Inversions

The historical inversions carry a different context but the takeaways are not so different.

Aside from the mid 1970s through the early 1980s, we find that a steepening of the curve, which accelerates from the start of Fed rate cuts, is bullish for precious metals. This also includes a steepening in late 1984 that preceded the bull market in the mid 1980s.

With that said, the inversion itself is not bullish for precious metals because there can be a lag between the initial inversion, the first rate cut and steepening of the curve.

I took a careful look at four of the previous inversions and calculated the time between the inversions and the next significant low in gold stocks. The average and median time of those four was 10 months.

That appears to be inline with my thinking that the Federal Reserve’s final rate hike will be sometime in 2019.

In the meantime, precious metals are rallying but the inversion of the yield curve and Fed policy argue it would not be wise to chase this strength. There will be plenty of time to get into cheap juniors, which can triple and quadruple once things really get going.