By now everyone is familiar with the wild ride Tesla (NASDAQ:TSLA) took investors on and without a doubt, that story is far from over, but I will save that analysis for another day. Today I want to write about Amazon (NASDAQ:AMZN) and the hints of similarity its recent price action has with TSLA’s explosive move.

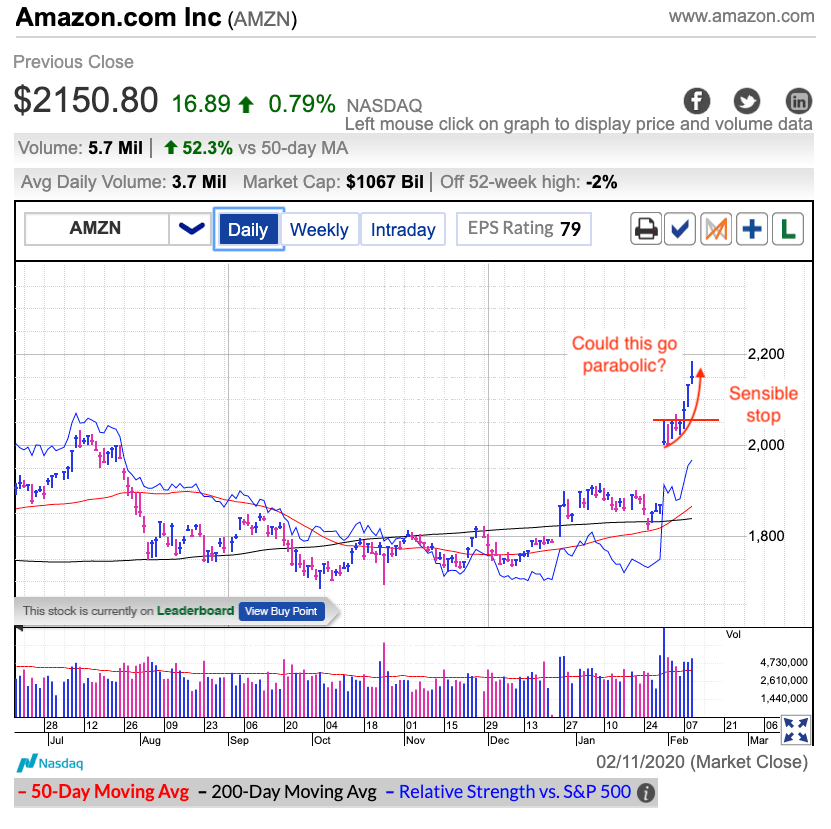

AMZN reported better than expected earnings two weeks ago and the stock popped 10% the next morning. That opening surge put the stock back near all-time highs and it spent a few days consolidating those gains. The initial risk was a conventional retreat that closes the gap, as is typical following big moves.

But AMZN bulls are a stubborn bunch and resisted the temptation to take profits. Instead, after a few days, the stock started climbing again. And more than just climb, the last three sessions it started racing higher.

While AMZN has been on my radar for a long time and I told subscribers before earnings that a strong result would push the stock into record territory, this sharp acceleration the last few days really stands out. While I would be suspicious of something like this during more normal times, that buying frenzy in TSLA shows just how extreme buyers are willing to take things.

Now, I need to preface this by saying this is still a remote possibility and I am not predicting this is what will happen. I am simply saying this could happen. And if it does happen, we need to remember AMZN is 10x the size of TSLA and there is no way AMZN can climb 50% in two days.

That said, AMZN stock owners are nearly as “cultish” as TSLA owners and this type of fanatical ownership group can lead to some extreme moves. Could we be on the verge of one of these extreme moves? This is really starting to feel like it.

First, there is no way I would want to be short AMZN at these levels. Without a doubt, a lot of TSLA’s lift came at the expense of short-sellers getting squeezed out at steep losses. And we could see a similar phenomenon in AMZN. If you are short AMZN, do something to protect yourself. If you are contemplating shorting AMZN don’t!

Second, if someone wants to get on this ride, remember, this is an extremely risky and low probability trade so adjust your position size accordingly. Start small and only add after it starts working. And not only that, keep a hard stop-loss. Probably starting with something near $2050 and then move your stop up as the stock climbs.

And third, this is a quick trade. If this takes off, please don’t fall in love with it. Take profits quickly and don’t feel bad if you sell too early. People who ride these moves all the way to the top inevitably ride them all the way back down. Don’t be that guy.

How high could this go? I have no idea. But if a person has a huge appetite for risk, this could be an entertaining ride. Just be sure to keep your head screwed on tight and don’t fall for the hype if it works out.