Amazon.com Inc. (NASDAQ:AMZN) is in talks to buy India’s largest grocery site BigBasket, according to a Bloomberg report.

However, the e-commerce giant refused to divulge any information on the possible sale amount or time frames.

BigBasket is India's largest online grocer and operates in about 25 cities across the country.

Amazon plans to invest $5 billion in its India operations in the coming years. If there is any truth in the hearsay, plans of buying out BigBasket will help Amazon in gaining a strong foothold in India.

India Expansion Continues

India, with a population of approximately of 1.3 billion, has encouraging demographics and the economy is also witnessing strong e-commerce growth.

Per a Morgan Stanley (NYSE:MS) research report, the Indian E-commerce market touched approximately $16 billion in 2016 and the market has potential to grow more than seven times in the long run. Apart from this, a number of other research firms have predicted that the country’s e-retail market is likely to touch the $120 billion mark by 2020. That’s 650% growth in the next four years!

Therefore, Amazon is gearing up to make the most of the ongoing e-commerce boom in India along with growing adoption of smartphones.

Further, to expand its footprint particularly in the Indian grocery market, Amazon has got government’s permission to open food-only outlets integrated with an online platform to sell locally produced food items. In order to do so, the company plans to open a wholly-owned subsidiary by investing around $522 million over a period of five years.

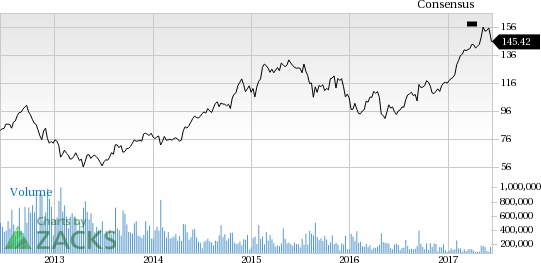

Stock Performance

Amazon is one of the largest online retailers in the world, with extensive operations in North America. Although Amazon’ primary product line was books, it has diversified into a host of other product categories and now wants to have a global presence.

The company’s share price was $980.79 as of Jun 13, 2017, up 1.65%. Shares of Amazon steadily trended up over the last two years. The stock returned 125.8% compared with the Zacks Electronic Commerce industry’s gain of just 61.7%.

The outperformance can be attributed to the company’s growing retail business, solid loyalty system in Prime, Amazon Web Services (AWS) and Internet of Things (IoT).

Bottom Line

Amazon, which carries a Zacks Rank #3 (Hold) is rapidly gaining foothold in the country through aggressive investment strategy, its execution strength and technological prowess.

We feel if Amazon successfully acquires BigBasket, it will be a big win for the online retailer. The deal will prove to be a huge competitive advantage over locals as well as bigwigs like and Alibaba (NYSE:BABA) .

Stocks to Consider

Other better-ranked stocks in the industry are Autobytel Inc. (NASDAQ:ABTL) and Mercadolibre, Inc. (NASDAQ:MELI) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Autobytel Inc. delivered a positive earnings surprise of 41.98%, on average, in the trailing four quarters.

Mercadolibre, Inc. delivered a positive earnings surprise of 26.74%, on average, in the trailing four quarters.

Zacks' 2017 IPO Watch List

Before looking into the stocks mentioned above, you may want to get a head start on potential tech IPOs that are popping up on Zacks' radar. Imagine being in the first wave of investors to jump on a company with almost unlimited growth potential? This Special Report gives you the current scoop on 5 that may go public at any time.

One has driven from 0 to a $68 billion valuation in 8 years. Four others are a little less obvious but already show jaw-dropping growth. Download this IPO Watch List today for free >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

MercadoLibre, Inc. (MELI): Free Stock Analysis Report

Autobytel Inc. (ABTL): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Original post

Zacks Investment Research