Accenture Plc (NYSE:ACN) is set to report third-quarter fiscal 2017 results on Jun 22. Last quarter, the company posted a positive earnings surprise of 2.31%. Let’s see how things are shaping up for this announcement.

Factors to Consider

The latest forecast for worldwide IT spending by Gartner raises concerns about Accenture’s fiscal third-quarter performance. The research firm lowered its forecast on IT spending for 2017. The recent forecast of 1.4% year-over-year growth in IT spending is 1.3% lower than its previous projection of 2.7% growth. Moreover, as Accenture is the world’s leading IT services provider, a decline in IT spending will surely have a negative impact on the company’s to-be-reported quarterly results.

Furthermore, Gartner cited rising U.S. dollar exchange rate as the main reason behind lowering its estimate. Notably, Accenture derives approximately 54% of total revenue from outside the U.S. in the form of key currencies such as pound, Euro, Australian Dollar and Yen. Thus, a rise in U.S. dollar exchange rate will also adversely affect the company’s overall performance, which we may see in the upcoming quarterly results.

Additionally, increasing competition from peers such as Cognizant Technology Solutions (NASDAQ:CTSH) and International Business Machines (NYSE:IBM) Corporation, as well as an uncertain macroeconomic environment may deter its growth to some extent.

Nonetheless, we are positive about Accenture’s latest product additions in the analytics application space, given the increasing demand for digital solutions. Moreover, the company’s strategy of growing through acquisitions is encouraging. These acquisitions have enabled Accenture to foray into new markets, diversify and broaden its product portfolio, and maintain a leading position. We believe all this have a positive impact on the company’s upcoming quarterly results.

Earnings Whispers

Our proven model does not conclusively show that Accenture will beat on earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

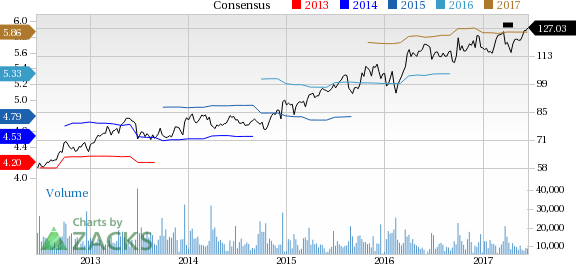

Zacks ESP: Accenture has an Earnings ESP of -0.66% as the Most Accurate estimate of $1.50 is a penny lower than the Zacks Consensus Estimate of $1.51. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Accenture carries a Zacks Rank #4 (Sell). It should be noted that we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are a couple of stocks that you may consider, as our model shows that they have the right combination of elements to post an earnings beat:

Visa Inc. (NYSE:V) , with an Earnings ESP of +1.25% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Advanced Micro Devices, Inc. (NASDAQ:AMD) , with an Earnings ESP of +33.33%, and a Zacks Rank #3.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

Cognizant Technology Solutions Corporation (CTSH): Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Accenture PLC (ACN): Free Stock Analysis Report

Visa Inc. (V): Free Stock Analysis Report

Original post

Zacks Investment Research