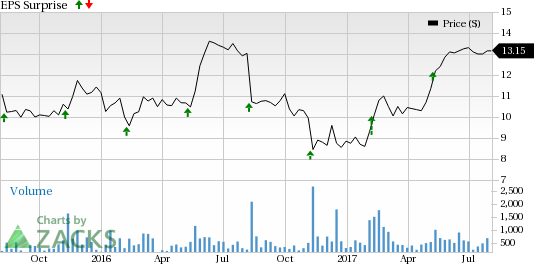

Model N Inc. (NYSE:MODN) is scheduled to report fiscal third-quarter 2017 results on Aug 8. Notably, the stock has beaten the Zacks Consensus Estimate in three of the preceding four quarters with an average positive earnings surprise of 9.23%.

Last quarter, the company delivered a positive surprise of 2.86%. Including stock-based compensation, loss of 34 cents per share was narrower than the Zacks Consensus Estimate of a loss of 35 cents. Revenues of $33.3 million increased 27.6% year over year but missed the Zacks Consensus Estimate of $34 million.

Model N forecasts revenues between $33.5 and $33.8 million for the third quarter. Non-GAAP loss from operations is expected to be in the range of $3.0 million to $3.5 million. Further, non-GAAP net loss is expected to be in the range of 17 cents to 19 cents per share.

We note that the company’s positive earnings surprise trend and encouraging guidance boosted its share price. Model N has rallied 48.6% year to date, substantially outperforming the 17.3% gain of the industry it belongs to.

Factors to Consider

Model N is on track to shift its business to a 100% SaaS and Maintenance revenue model. Its revenue management platform continues to attract big players from the life sciences and high tech field.

During the quarter, Ampleon, a radio frequency (RF) power provider, selected Model N revenue cloud services. The services under consideration are Model N Deal and Channel Management Solutions, which are anticipated to optimize deal conversion rates and financial controls for Ampleon.

Notably, the Revitas acquisition continues to be a positive for the company. Per the third quarter guidance cost savings synergies from the Revitas acquisition are now expected to be toward the top end of the range of $11-13 million. However, stiff competition from SAP, I-Many Inc. and Symphony Teleca Corp. may affect profitability.

Earnings Whispers

Our proven model does not conclusively show that Model N is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Zacks ESP: The Earnings ESP for Model N is 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate stand at a loss of 27 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Model N currently carries a Zacks Rank #3, which when combined with a 0.00% ESP, makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 or 5 (Sell-rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks That Warrant a Look

Here are a few companies that you may want to consider as our model shows that these have the right combination of elements to deliver an earnings beat in their upcoming release:

Luxoft Holding, Inc. (NYSE:LXFT) with an Earnings ESP of +5.17% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

CACI International (NYSE:CACI) with an Earnings ESP of +1.83% and a Zacks Rank #2.

Broadcom (NASDAQ:AVGO) with an Earnings ESP of +2.57% and a Zacks Rank #2.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Model N, Inc. (MODN): Free Stock Analysis Report

Luxoft Holding, Inc. (LXFT): Free Stock Analysis Report

CACI International, Inc. (CACI): Free Stock Analysis Report

Broadcom Limited (AVGO): Free Stock Analysis Report

Original post

Zacks Investment Research