Key Points:

- Double bottom formation nearing completion.

- Parabolic SAR and EMA bias indicative of a imminent breakout.

- Neckline will need to be broken before any rally can eventuate.

For those watching the exotic crosses out there, the EUR/CAD is flirting with some fairly sizable upside potential which could be realised moving forward. Specifically, we might see the pair reach back towards November’s highs if the currently forecasted chart pattern comes to pass.

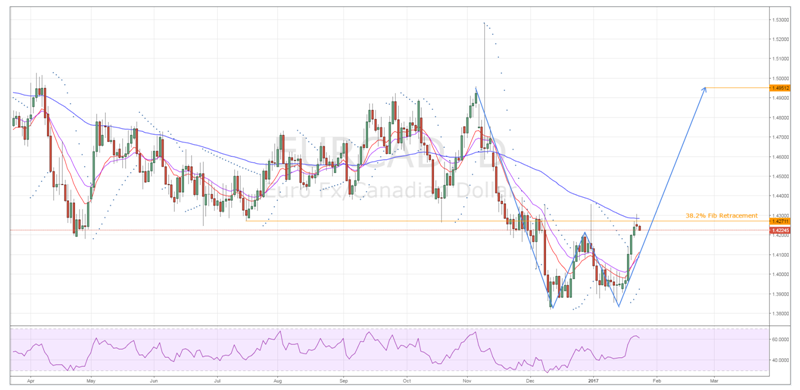

As shown on the below daily chart, the past few months of price action is tracing out a relatively faithful double bottom structure. Moreover, the pair now rests firmly at the neckline of this pattern which means a breakout could be only a handful of sessions away. However, there are certain technical factors which are currently proving to be somewhat of an impediment and are worth taking into account.

Most notably, the 100 day moving average is clearly exerting some downward pressure on the EUR/CAD which resulted in a shooting star candle during Monday’s session. Ordinarily, such a candle combined with the dynamic resistance provided by the 100 day EMA would be a fairly patent bellwether of a change in momentum for the pair. Fortunately for the bulls however, there is some evidence that the forecasted breakout should still be on the cards.

Indeed, the recent shift in the Parabolic SAR bias coupled with an equally bullish 12 and 20 day EMA configuration would tend to suggest that the 38.2% Fibonacci level can be breached. Furthermore, the relative neutrality of the RSI oscillator leaves considerable room for the EUR/CAD to climb prior to becoming overbought.

If the pair does manage to gather the requisite momentum to push above the 1.4271 handle, the resulting rally could be as high as the 1.4951 mark. Its remains worth noting however, this rally will likely be more sedate than the rather precipitous plunge to the recent bottoms, as the driving force behind the slip was largely a symptom of the post-Brexit uptick in market uncertainty. In the absence of similarly buoyant fundamental forces, we could be waiting well into late March for the full upside potential to be realised.

Ultimately, EU centric news is likely to be more important in helping this forecast eventuate, but don’t neglect he Canadian side of things. What’s more, news relating to the Brexit negotiations will be pivotal in allowing the EUR to appreciate so significantly against the CAD and it should be monitored religiously as a result. This being said, there is still a strong technical argument for some extended gains which will leave the pair predisposed to move higher over the coming weeks, even in the absence of a fundamental upset.