Markets and many stocks continued to consolidate and correct but we did see a decent sign that a low may be in Thursday and Friday.

I never really expected this correction to be very deep and so far it hasn’t been.

I also expected this correction to run until around this time or until mid-October, which is fast approaching.

I’ve got some great stocks on my shopping list for subscribers!

One secret to finding great stocks is to see which ones hold up or are even strong while most stocks and markets are not doing anything, or are showing weakness.

As for the metals, gold and silver are now nearly at their major support levels at $1,180 and $15 respectively.

I’ve had a lot of emails this past week admitting to me that they were very skeptical that gold and silver could fall this hard and this fast, as I’ve been calling for.

Basically, they’ve been giving me props for being so right on target for so long.

That has me nervous.

Once people begin to acknowledge the truth of the situation, it is far too late, or near a turning point often times.

Could we be nearing a major low for gold and silver?

I have no idea yet.

We need to see how they behave and paint the chart at the major support levels so let’s take a look.

Gold lost 2.37% for the week and is very near critical support near most recent lows at $1,180.

For the past couple weeks gold just built a bear flag pattern that is just breaking now.

I still do think $1,000 is a very real possibility but I have to see how gold acts at this support area first.

As I said though, the reduction in emails calling me a idiot, and increase in those more thoughtful emails has me weary.

Time will tell but for now, gold remains very weak, and looking to head lower.

Silver lost a large 4.56% this past week and is still leading gold lower.

$15 is not far off now.

I’m hearing of increases in demand for silver, and gold as well to some degree.

I talk about the blood in the streets moment a lot.

We really need to see a major, major capitulation of physical gold and silver come to market and a major change on the charts before I can begin to think a low is in.

I am not seeing investors throw in the towel yet, even the many who are now underwater are adding, and not yet capitulating.

It will come, and it will be painful for the many, but very lucrative for those who know what to do when the time is right.

No sign of a low for silver yet.

Platinum continued to get hammered and lost 5.78% this past week alone.

I took last weekend off, but two weeks ago when we were trading at the $1,340 area, I said if we couldn’t hold there then $1,200 would be the next major support level.

I did not expect this move to happen quite so fast but it has.

We are very near $1,200 now and we have to hold that level.

Expect at least a few weeks or even a couple months of consolidation at the $1,200 area before we see the next major move begin and if that is to be up or down, is yet to be determined.,

The swiss steps are a rare pattern, and one we usually see on the upside but platinum has shown it perfectly to the downside.

It really is a thing of beauty this swiss steps pattern, but one we rarely see, and one that is not so much predictive as better viewed in hindsight.

I find the Elliot Wave also to be great, in hindsight.

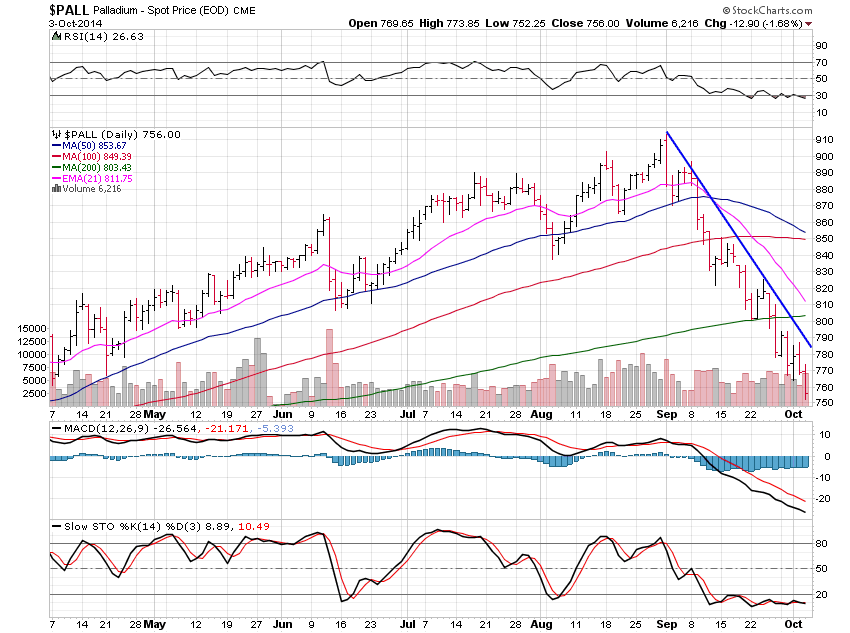

Palladium lost 3.23% for the week and is now nearing the $745 major support level I talked about here 2 weekends ago.

Expect some support and a much needed rest, or consolidation period around $845.