Key Points:

- Final leg of an Elliot wave could be about to begin.

- Current support is reinforced by 100 day EMA.

- Stochastics should encourage bulls to re-enter as the week closes.

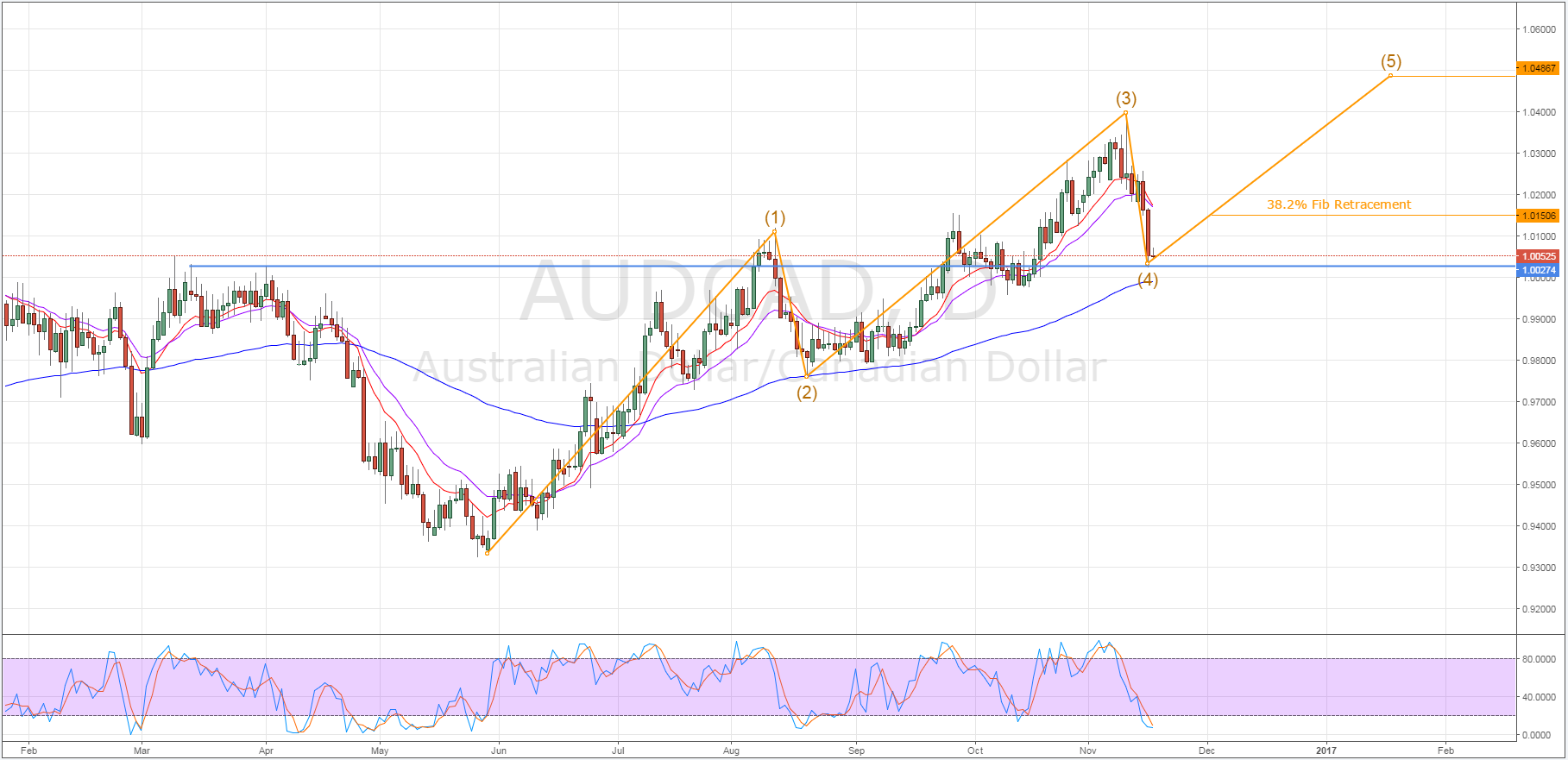

In the wake of a rather sharp slip during the prior session, the AUD/CAD has approached a robust zone of support which could mark the beginning of the final bullish impulse in its long-term Elliot wave. As a result, we could see the pair push as high the 1.0486 level in the coming weeks if it can break back through the 38.2% Fibonacci retracement level.

As shown below, the AUD/CAD has been forming a fairly convincing Elliot wave over the past number of weeks and last session’s tumble has ostensibly confirmed the end of leg number four. Furthermore, due do the presence of a rather strong and historical zone of resistance around the 1.0027 mark, one can be fairly certain that the pair has little in the way of downside potential in the absence of a strong fundamental upset.

However, whilst the presence of a strong zone of support should cap downside risks, it by no means ensures that we will experience the rather strong surge in buying pressure needed to see the wave complete convincingly. Fortunately, a highly oversold reading on the stochastic oscillator will be encouraging the bulls to wade back into the fray which could provide the initial momentum needed to spark a rally.

In addition to stochastics, daily EMA activity is hinting that the long-term bullish bias may not have been entirely eroded just yet. Whilst awfully close to doing so, the 12 and 20 day averages are yet to experience a bearish crossover and the 100 day moving average remains bullish. What’s more, the 100 day EMA is acting as a source of dynamic support which will further limit downside risks as the week comes to a close.

Once a reversal has occurred, it will likely require the 38.2% Fibonacci retracement to be broken before we can be relatively certain that the final leg is fully underway. As a result, keep a watch out for any bearish signals as the pair approaches this level as they could mean that a ranging phase is set to occur, much as it did at the start of the previous impulse.

Ultimately, the technical evidence remains suggestive of a reversal and subsequent rally for the AUD/CAD but fundamentals could come into play as the week winds down. Namely, the Canadian CPI data and the BoC Review are due out which could either assist or hinder the above forecast. However, the recent Australian Unemployment rate did come in on target which could provide a modicum of buoyancy for the pair in the lead up to the Canadian results.