Macy's, Inc. (NYSE:M) is slated to report second-quarter fiscal 2017 results on Aug 10, before the opening bell.

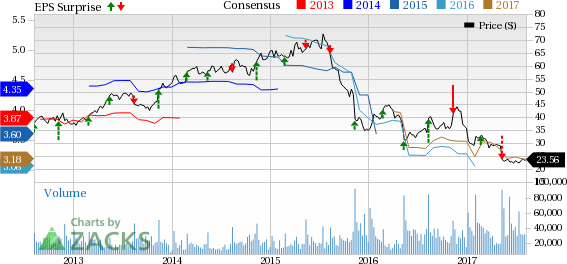

In the previous quarter, this department store retailer reported negative earnings surprise of 31.4%. Also, the company’s bottom line lagged the Zacks Consensus Estimate in the trailing four quarters by an average of 12.9%. Let’s see how things are shaping up prior to this announcement.

What to Expect?

The question lingering in investors’ minds now is, whether Macy's will be able to deliver positive earnings surprise in the to-be-reported quarter.

Meanwhile, the Zacks Consensus Estimate for the fiscal second quarter has declined by a penny to 44 cents in the last 30 days. This reflects a year-over-year decline of 18%. Further, analysts polled by Zacks expect revenues of $5,490 million, down 6.4% from the year-ago quarter.

Coming to Macy's share price performance, we note that the stock plunged over 19% in the last three months, wider than its industry’s decline of 4.8%. On the contrary, the broader Retail-Wholesale sector, of which they are part of, gained 3%. Currently, the sector is placed at bottom 13% of the Zacks classified sectors (14 out of 16).

Zacks Model Shows Unlikely Earnings Beat

Our proven model does not conclusively show earnings beat for Macy's this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Macy's has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate are currently pegged at 44 cents. Moreover, it currently carries a Zacks Rank #4 (Sell).

As it is we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Factors at Play

Challenging retail landscape, aggressive pricing strategy, waning mall traffic and increased online competition have remained the major deterrents for Macy’s. In addition, the company warned investors that its margins may continue to feel the pinch and expects gross margin to shrivel by 100 basis points in the second quarter.

Furthermore, Macy’s dwindling top-line and bottom-line results remain the primary threat for investors. In fact, a look at the company’s performance in fiscal 2016 unveils that net sales decreased 7.4%, 3.9%, 4.2% and 4% in the first, second, third and fourth quarters, while earnings per share declined 28.6%, 15.6%, 69.6% and 3.3% during the respective quarters.

Notably, during the first quarter of fiscal 2017, the scenario was no different, as net sales and earnings per share declined 7.5% and 40%, respectively.

Nevertheless, Macy’s has announced slew of measures revolving around stores closures, cost containment, real estate strategy and investment in omnichannel capabilities to improve its performance. Also, in an attempt to improve sales, profitability and cash flows, the company has been taking steps such as integration of operations as well as developing eCommerce business and online order fulfillment centers.

Stocks with Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Dollar General Corporation (NYSE:DG) has an Earnings ESP of +0.93% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Gap, Inc. (NYSE:GPS) has an Earnings ESP of + 3.85% and a Zacks Rank #2.

Nordstrom, Inc. (NYSE:JWN) has an Earnings ESP of +3.28% and a Zacks Rank #3.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Gap, Inc. (The) (GPS): Free Stock Analysis Report

Nordstrom, Inc. (JWN): Free Stock Analysis Report

Dollar General Corporation (DG): Free Stock Analysis Report

Macy's Inc (M): Free Stock Analysis Report

Original post

Zacks Investment Research