According to the book, Business Cycles and Depressions:

The Kitchin cycle is a cycle in the level of economic activity with a period of about 50 months or 3.5 years. It is named after Joseph Kitchin, a British statistician who identified both minor cycles of 40 months and major cycles of 7 to 10 years. [….] Kitchin examined monthly statistics on bank clearings, commodity prices, and short-term interest rates in the United States and Great Britain from 1890 to 1922. All three series apparently moved together through 40-month cycles.

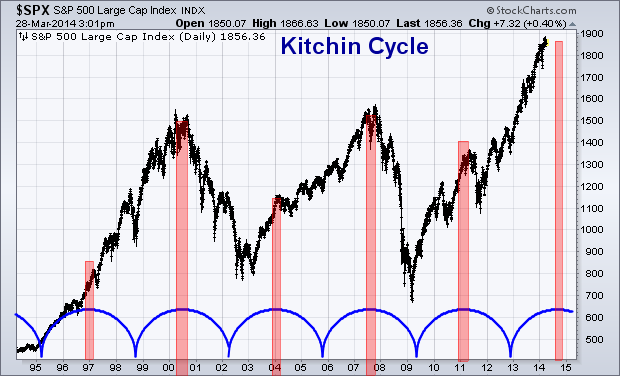

I’ve re-created the Kitchin cycle on the chart below. As you can see, the past four cycle peaks have lead to bearish periods of trading. We have the 2000 tech bubble top, the flat/down year in 2004, the 2007 peak, and the mini-bear market in 2011. If history continues to repeat itself, then the next Kitchin cycle peak will be later this year around July to September.

I’m by no means calling for a market top later this year. I’m simply presenting one piece of data and you’re free to make you’re own conclusions. I continue to let price dictate my bias and will watch the market internals for clues to potential weakness in the current equity up trend.

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the blog. Please see my Disclosure page for full disclaimer. Connect with Andrew on Google+, Twitter, and StockTwits.