Copper is known as the "smart metal" because it is supposed to indicate changes in the global economy. Copper has historically been used primarily for industrial purposes so it has been a good indicator of economic strength or weakness.

In 2009, two months before stocks bottomed, copper prices bottomed and started rising, indicating that the worst of the global recession has bottomed.

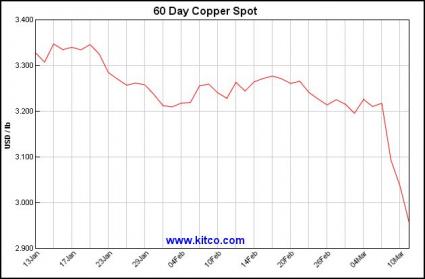

Copper is back in the news this week but not for good reasons. Copper has fallen to 44-month lows and in New York, prices have breached the key $3.00 per pound level. Yesterday, copper for the May contract closed at $2.95. Today, it traded as low as $2.91 before bouncing back to around the $2.95 level.

Copper has fallen over 14% this year and about 9% in just the last week.

China consumes about 40% of the world's copper demand a year so the theory has been that copper is an indicator of the strength or weakness of the Chinese economy.

But there is another worry now. Commodities analysts believe that up to 60% of China's copper demand is used for collateral in the shadow banking system.

With copper prices falling, collateral on those loans is also falling. Some will have to come up with more collateral when the Chinese Central Bank is trying to tighten credit.

Copper is also involved in the currency carry trade. Analysts believe large copper positions are being unwound as traders get out of the carry trade, causing even more pressure on copper prices.

Is a copper panic brewing?

And if so, can it be contained without damage spreading to the rest of the Chinese economy?