Public Storage (NYSE:PSA) is expected to beat expectations when it reports second-quarter 2017 results on Jul 26, after the market closes.

Last quarter, this self-storage real estate investment trust (“REIT”) delivered lower-than-expected performance, posting a negative surprise of 3.7%.

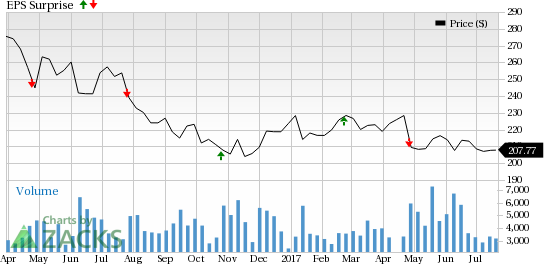

The company has a mixed surprise history. In fact, the company exceeded estimates in one occasion, met in another and missed in the rest two, over the trailing four quarters, resulting in an average negative surprise of 1.16%. This is depicted in the graph below:

Let’s see how things are shaping up for this announcement.

Why a Likely Positive Surprise?

Our proven model shows that Public Storage is likely to beat estimates because it has the right combination of two key ingredients. A stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold) to beat estimates, and Public Storage has the right mix.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks ESP: The Earnings ESP, which represents the percentage difference between the Most Accurate estimate of $2.59 and the Zacks Consensus Estimate of $2.56, is +1.17%. This is a meaningful and leading indicator of a likely positive surprise.

Zacks Rank: Public Storage’s Zacks Rank #3, when combined with a positive ESP, makes us reasonably confident of a positive surprise this season.

Conversely, we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

What's Driving the Better-than-Expected Earnings?

Public Storage has a sturdy brand image and is a recognized name in the self-storage industry in the U.S. The company’s solid presence in key cities serves as a major growth driver. Acquisition and expansion initiatives are likely to stoke growth. Further, the company managed to create a significant presence in the European markets through the Shurgard Storage Centers buyout.

In addition, the self-storage industry is anticipated to experience solid demand backed by favorable demographic changes and events like marriages, shifting, death and even divorce.

As such, in the to-be-reported quarter, the company remains well poised to experience growth in same-store revenues, stemmed by a rise in realized annual rent per occupied square foot.

Stocks That Warrant a Look

Here are a few stocks in the REIT sector that you may want to consider, as our model shows that these have the right combination of elements to report a positive surprise this quarter:

Liberty Property Trust (NYSE:LPT) , slated to release second-quarter results on Jul 25, has an Earnings ESP of +1.61% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

CyrusOne Inc. (NASDAQ:CONE) , scheduled to release earnings on Aug 2, has a Zacks Rank #2 and an Earnings ESP of +2.70%.

Piedmont Office Realty Trust, Inc. (NYSE:PDM) , slated to release earnings on Aug 2, has an Earnings ESP of +2.27% and a Zacks Rank #3.

Note: All EPS numbers presented in this write up represent funds from operations (“FFO”) per share. FFO, a widely used metric to gauge the performance of REITs, is obtained after adding depreciation and amortization and other non-cash expenses to net income.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Public Storage (PSA): Free Stock Analysis Report

Piedmont Office Realty Trust, Inc. (PDM): Free Stock Analysis Report

CyrusOne Inc (CONE): Free Stock Analysis Report

Liberty Property Trust (LPT): Free Stock Analysis Report

Original post

Zacks Investment Research