Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) is scheduled to report second-quarter 2017 results on Jul 27, before the opening bell.

In the last reported quarter, Alexion’s earnings surpassed Zacks Consensus Estimate. Alexion’s track record is excellent as the company has consistently beaten expectations in the last four quarters with an average positive earnings surprise of 7.49% over the trailing four quarters.

Let’s see how things are shaping up for this announcement.

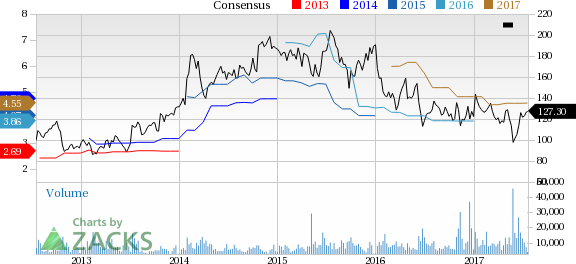

A look at Alexion’s share price movement year to date shows that the stock has underperformed the Zacks classified Medical - Biomedical and Genetics industry. While the company’s shares have gained 4.1%, the industry witnessed an addition of 10.6% in the same period.

Factors Likely to Impact Q2 Results

Alexion continues to identify and treat a consistently high number of new patients with paroxysmal nocturnal hemoglobinuria (PNH) and atypical hemolytic uremic syndrome (aHUS) with Soliris, across its 50-country operating platform. In order to further increase the commercial potential of the drug, Alexion is working on expanding Soliris’ label into additional indications. Label expansion into additional indications would give Soliris access to a higher patient population and increase the commercial potential of the drug significantly. Additionally, the company is working on the launches of both Strensiq and Kanuma.

Strensiq continues to perform well with revenues benefiting from a growing number of patients (both children as well as adults with pediatric onset disease) owing to HPP disease awareness and diagnostic initiatives. These initiatives are leading to steady identification of new patients with hypophosphatasia (HPP). In fact, the company expects Strensiq to be an additional growth driver in 2017, and beyond.

Alexion is also looking to achieve annual cost synergies, which are expected to touch at least $150 million in 2017.

Meanwhile, Alexion continues to progress with in-country funding processes for both the products in additional countries in the EU this year.

Notably, the company’s efforts to develop its pipeline are impressive, particularly in case of ALXN1210. Currently, it is evaluating ALXN1210 (a longer-acting anti-C5 antibody that inhibits terminal complement) in phase III studies for both PNH and aHUS. Additionally, the company is conducting a phase I study on a new formulation of ALXN1210, when administered subcutaneously in healthy volunteers.

Alexion plans to initiate a phase III PNH switch study of ALXN1210 administered intravenously every eight weeks compared to patients currently treated with Soliris. in 2017. Therefore, we expect investors to focus on updates from ALXN1210 as the successful development and commercialization of the drug will boost growth prospects.

However, with Soliris accounting for majority of revenues at Alexion, the company relies heavily on the drug for growth. Going forward, Soliris’ below-par performance might hurt the stock severly as it is considered to be Alexion’s key growth driver. It is to be noted that the drug is already witnessing challenges in Latin America. Also, Soliris’ quarter-to-quarter revenue growth will be impacted by the enrollment ramp-up of trials on ALXN1210 (by $70 million–$110 million), particularly in the second half of 2017. Soliris revenues are expected to be down in the second quarter of 2017.

What Does the Zacks Model Unveil?

Our proven model shows that Alexion is likely to beat earnings in the to-be-reported quarter because it has the right combination of two key ingredients – a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) – which have a significantly higher chance of beating earnings.

Zacks ESP: Alexion has an Earnings ESP of +6.48% as the Most Accurate estimate is $1.15 and the Zacks Consensus Estimate is pegged at $1.08. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Alexion carries a Zacks Rank #3, which when combined with a positive ESP of +6.48% makes us reasonably confident of an earnings beat.

Note that we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks That Warrant a Look

Here are some pharma stocks that you may want to consider, as our model shows that right combination of elements to post an earnings beat:

Agenus Inc. (NASDAQ:AGEN) has an Earnings ESP of +5.56% and a Zacks Rank #1. The company is expected to release results on Jul 27. You can see the complete list of today’s Zacks #1 Rank stocks here.

Gilead Sciences, Inc. (NASDAQ:GILD) has an Earnings ESP of +3.31% and a Zacks Rank #3. The company is scheduled to release results on Jul 26.

Intercept Pharmaceuticals, Inc. (NASDAQ:ICPT) has an Earnings ESP of +9.39% and a Zacks Rank #3. The company is expected to release results on Aug 3.

3 Top Picks to Ride the Hottest Tech Trend Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy... Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

Alexion Pharmaceuticals, Inc. (ALXN): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Agenus Inc. (AGEN): Free Stock Analysis Report

Intercept Pharmaceuticals, Inc. (ICPT): Free Stock Analysis Report

Original post

Zacks Investment Research