As crude oil continues to feel the wrath of diminished demand and buoyant production, an increasing number of market pundits are now suggesting that $30.00 a barrel could be the new reality.

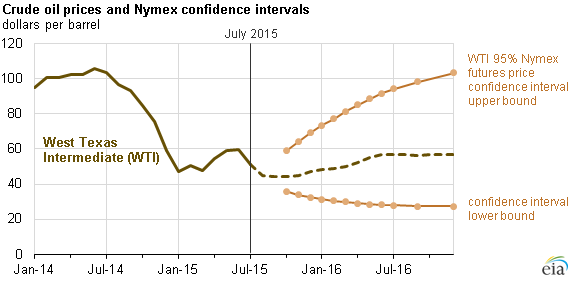

The latest release of the Energy Information Administration’s (EIA) short-term energy outlook has lowered the forward forecasting of WTI crude. Diminishing demand and concerns over a general slow-down in China have meant that global crude oil prices have been in relative free-fall since April.

Current modelling seems to indicate a mid-range price for WTI crude at around the $54.00 a barrel level throughout 2016. However, the confidence interval that the estimate resides within is impossibly wide, and provides a lower bound just under the $30.00 level. Considering the current global turmoil, as well as the seasonal slowdown under way, it would appear that the downside is realistically the probable target.

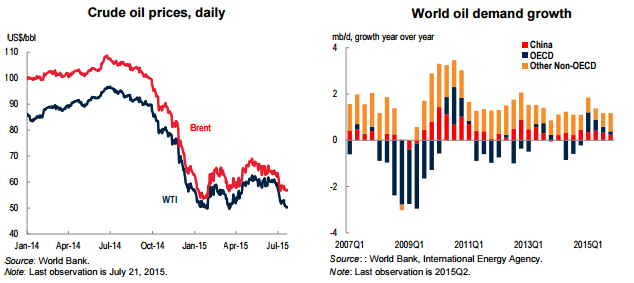

Given the current economic turmoil in China, and the fact that much of their petroleum reserve purchasing has ceased for the year, demand for crude oil is likely to remain relatively static for the remainder of 2015. To complicate matters, the market is moving to price in the impact of millions of barrels of oil starting to flow from Iran. This additional supply potentially adds to the already sizeable commodity glut on the global markets.

Although cheaper oil prices are likely to provide some short-term respite to motorists, its implications for both the industry and the global economy are stark. WTI prices are now close to levels not seen since the global financial crisis in 2009. Although there is a definite supply glut impacting prices, demand has also diminished, in line with a slowdown throughout Asia. In fact, OECD demand has reduced significantly throughout 2015 and mirrors the current absence of persistent inflation within the west.

The reality is that the powerhouse economies of Europe and the U.S.A are slowing and entering a period of diminishing growth. As the majority of economic indicators are backward looking, it is extremely difficult to pick a downturn until you are actually in one. In comparison, crude oil is a rough indicator of economic activity and demand in real time.

A review of global oil prices therefore tells us that something murky is afoot within the global economy. When you consider the risk of a slowing China, modelling seems to show oil prices moving down, not up. Subsequently, we see the medium term price range for WTI falling into the low $30.00s.

So prepare yourself for the new reality of crude oil…prices in the $30.00s and a whole barrel of trouble.