•Oil gains further The remarkable rebound in oil continued yesterday, with WTI trading this morning an astonishing 7.6% higher than yesterday’s early European price, and even that was down substantially from its peak during the US day (note though that our table below shows the change from the end of one European day to the next and so has a different figure). According to Bloomberg, this has been the biggest three-day rally in oil in 25 years. The reason for the rise yesterday seems to have been the expressed willingness of OPEC producers to hold talks with non-OPEC producers to get fair prices, although with the caveat that it has to be on a level playing field. The US Energy Information Administration (EIA) also revised down its estimate of recent domestic oil production, while there were unsubstantiated reports of a decline in Saudi output.

• Personally I can’t see Russia, Mexico or any other non-OPEC producer agreeing to limit production, so I think this is all talk and no action. I suspect that positioning had a lot to do with the surge: with prices below $40, investors who were short, and there were a lot of them, rushed for the door at the same time to lock in profits and sent it soaring. That surge isn’t likely to last indefinitely.

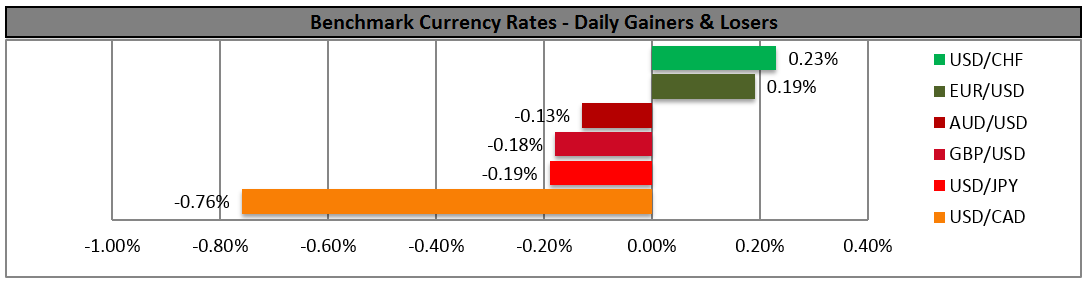

• Oil prices could come off further following the news of a further contraction in Chinese manufacturing (see below) and ahead of Wednesday’s weekly EIA report, which is expected to show a rise in US oil inventories. Until there is concrete news of production cutbacks, the glut is likely to continue and prices are likely to fall further, in my view. That prospect bodes ill for CAD, NOK, RUB and MXN. CAD was especially strong overnight and so it may show a particularly notable reaction to the reversal in oil prices during today’s trading.

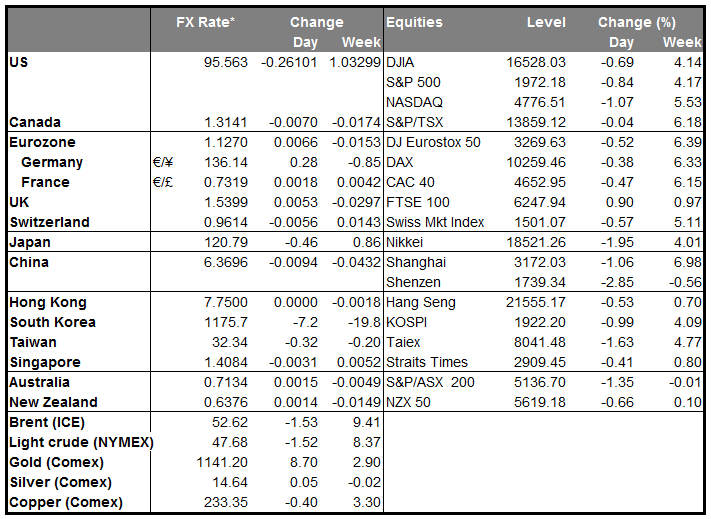

• China manufacturing PMI falls to three-year low China’s official manufacturing PMI fell into contractionary territory in August, hitting a three-year low. Although the final Caixin/Markit manufacturing PMI was revised up slightly, it remains deeply in contractionary territory and so failed to offset the impact of the official figure. Virtually all Asian stock markets fell (Malaysia being the sole exception). S&P 500 stock futures were down a sharp 1.8% at the time of writing. Further risk reduction today could prove positive for EUR and JPY, two major funding currencies.

• RBA keeps rates unchanged, as expected The RBA kept its benchmark rate unchanged at 2% at its meeting Tuesday, as the market has predicted. Moreover, Gov. Stevens’ comments following the meeting were almost unchanged from last month. He maintained his neutral bias and as for AUD, he simply repeated last month’s statement that the Australian dollar is adjusting to the significant declines in key commodity prices. The fact that they are not more concerned than they were last month, despite the increased weakness in the Chinese economy and the turmoil in global stock markets, is slightly bullish AUD and the currency rallied somewhat, although whether it continues to do so today may depend more on the performance of stock markets – so far very weak – than carry-over momentum from the RBA.

• Today’s highlights: During the European day, we get the final manufacturing PMI figures for August for several European countries and the Eurozone as a whole. As usual, the final forecasts are the same as the initial estimates. Market reaction on these news is usually limited unless there is a huge revision from the preliminary figures. The UK manufacturing PMI for August is forecast to increase a bit, which could prove GBP-positive. Eurozone’s unemployment rate for July is also due to be released.

• From Canada, the monthly GDP for June and the Q2 GDP figure are due out. The monthly figure is expected to accelerate, but not enough for Q2 GDP as a whole to improve, as it is expected to fall further and put the country in a technical recession. It looks like the effects of falling commodities prices on the Canadian economy are not going to fade out anytime soon. The renewed slump in oil prices is likely to put further downside pressure on CAD, and BoC could act again to underpin the fragile economy. A weak quarterly growth rate could push CAD lower. The RBC manufacturing PMI for August is also coming out. Market pays more attention to the Ivey PMI to be released on Friday. Thus, the reaction is usually limited at the release.

• In the US, the final Markit manufacturing PMI and the ISM manufacturing PMI both for June are also due out. The ISM index is expected to decline slightly, but not enough to change anyone’s view on the economy. The ISM prices paid index, however, is expected to drop further to a low 39.0, which may call into question whether inflation is likely to pick up any time soon and therefore whether the Fed can hike rates in September. That could be negative for the dollar.

• Speakers include Boston Fed President Eric Rosengren, a non-voting member of the FOMC.

The Market

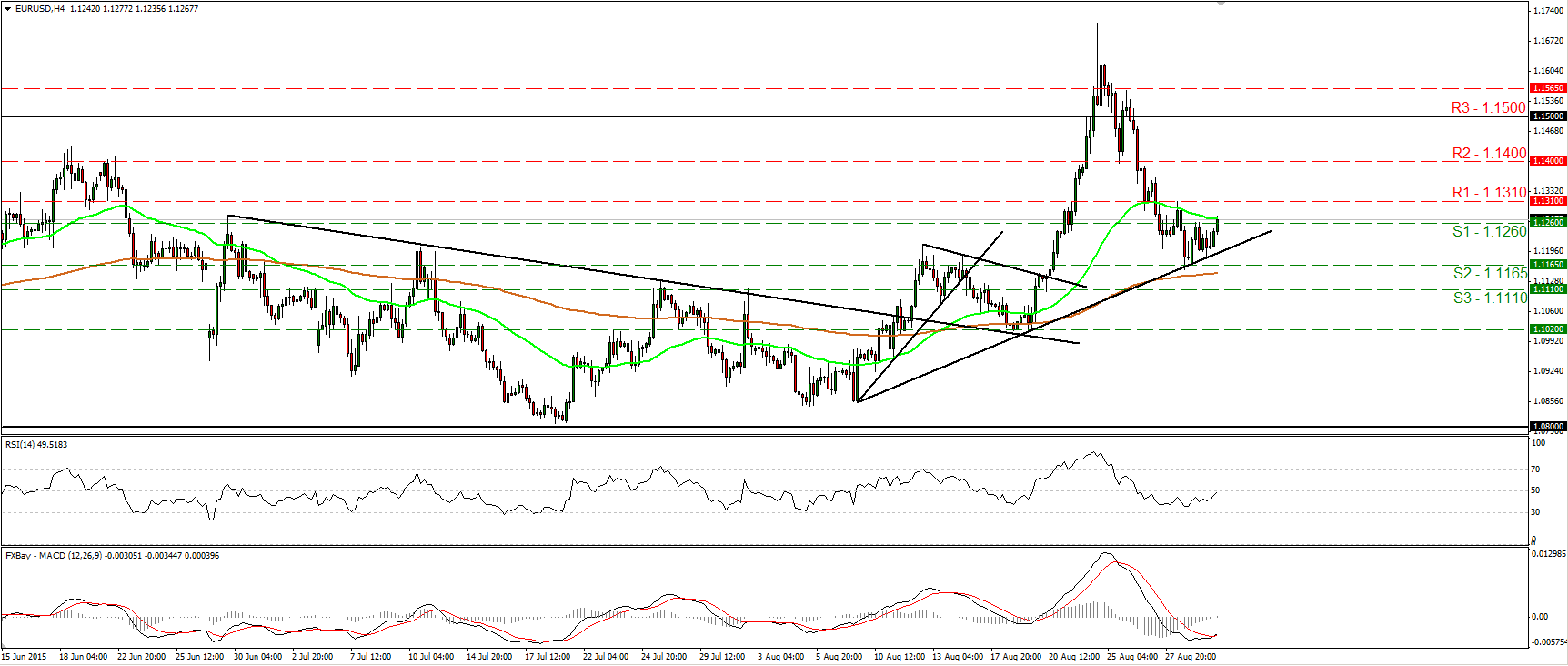

EUR/USD headed towards 1.1310

• EUR/USD hit the upside support line taken from the low of the 7th of August and rebounded. On Tuesday, during the Asian morning, the rate moved above 1.1260 (S1), yesterday’s high, and is now probably headed towards the 1.1310 (R1) resistance hurdle. A break above that barrier is likely to signal a short-term trend reversal and perhaps set the stage for extensions towards the 1.1400 (R2) area. Our momentum studies support that EUR/USD could trade higher in the near term. The RSI has turned up and now looks ready to cross above its 50 line, while the MACD, although negative, has bottomed and crossed above its trigger line. As for the broader trend, given that on the 26th of August, EUR/USD fell back below 1.1500 (R3), I would hold my neutral stance. The move below that psychological hurdle confirmed that the surge on the 24th of the month was a false break out. Therefore, I would like to see another move above 1.1500 (R3) before assuming that the overall outlook is back positive.

• Support: 1.1260 (S1), 1.1165 (S2), 1.1110 (S3)

• Resistance: 1.1310 (R1), 1.1400 (R2), 1.1500 (R3)

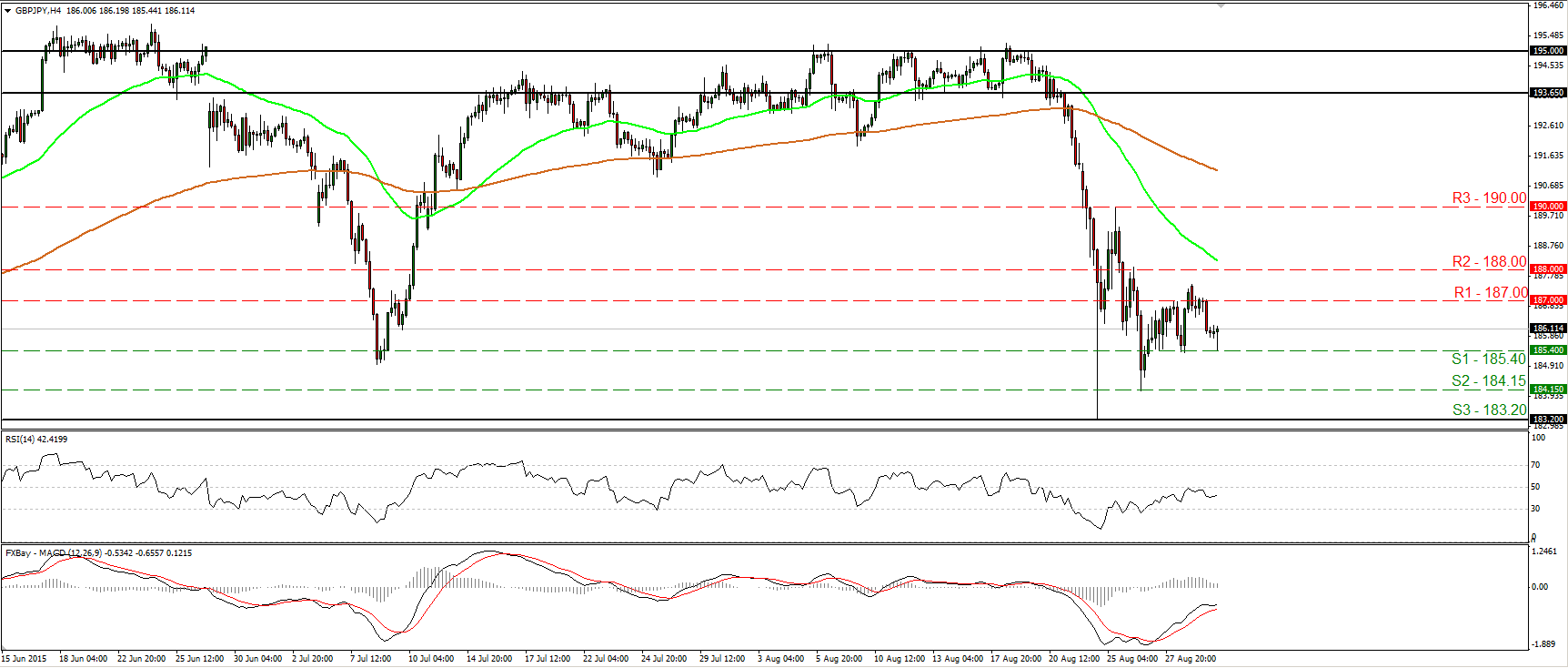

GBP/JPY hits support at 185.40

• GBP/JPY traded lower on Monday after it found resistance near 187.00 (R1). However, the decline was halted by the 185.40 (S1) barrier, marked by the low of the 28th of August. As long as the rate is trading between these two barriers, I would hold a flat stance as far as the near-term picture is concerned. A break below 185.40 (S1) is needed to extend Monday’s decline and perhaps aim for the 184.15 (S2) line, the low of the 26th of August. On the other hand, another attempt above 187.00 (R1) could trigger bullish extensions towards the 188.00 (R2) obstacle. In the bigger picture, I see that on the 24th of August, GBP/JPY found support at 183.20 (S3), which stands slightly above the 61.8% retracement level of the 14th of April – 18th of June advance. I prefer to see a clear close below that barrier before I assume further medium-term declines. For now, I would adopt a neutral stance as far as the overall outlook is concerned as well. • Support: 185.40 (S1), 184.15 (S2), 183.20 (S3) • Resistance: 187.00 (R1), 188.00 (R2), 190.00 (R3)

AUD/USD trades slightly higher following the RBA rate decision

• AUD/USD traded slightly higher during the early European morning Tuesday, after the RBA left its key policy rate unchanged and reiterated that the Aussie is adjusting to lower commodity prices. I believe that the positive leg is likely to continue for a while and perhaps give another test at the 0.7200 (R1) resistance zone. Our short-term momentum studies corroborate that view. The RSI turned up and looks ready to cross above its 50 line, while the MACD, rebounded from near its trigger line and is pointing north as well. What is more, there is positive divergence between both these indicators and the price action.

• Nevertheless, although we may see the rate trading higher for a while, I would treat any possible near-term advances as providing renewed selling opportunities. On the daily chart, the completion of a head and shoulders formation and the move below the psychological zone of 0.7500 signaled the continuation of the prevailing long-term downtrend, in my opinion. The break below 0.7250 (R2) confirmed a forthcoming lower low on the daily chart, and this supports the case that AUD/USD will eventually trade lower and perhaps aim for the psychological zone of 0.7000 (S3).

• Support: 0.7080 (S1), 0.7040 (S2), 0.7000 (S3)

• Resistance: 0.7200 (R1), 0.7250 (R2), 0.7285 (R3)

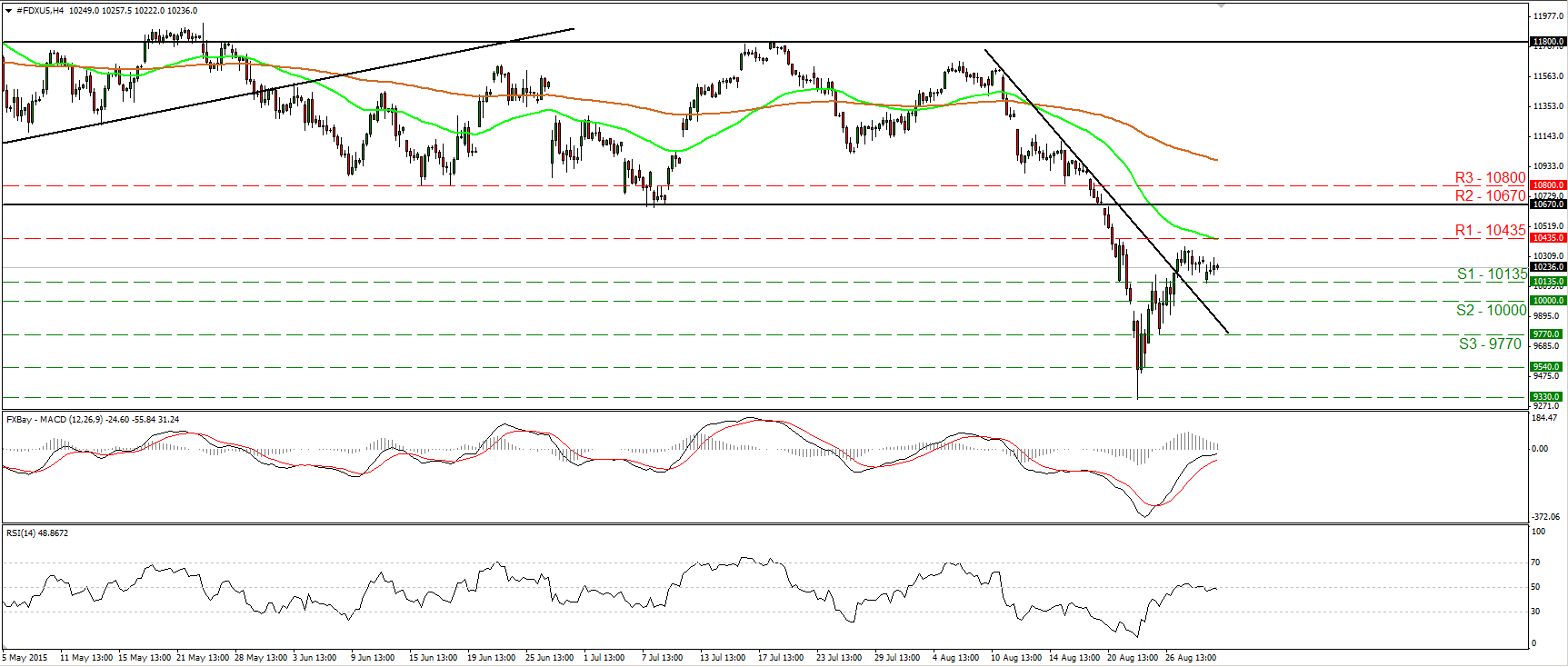

DAX futures rebound from 10135

• DAX futures hit support at 10135 (S1) on Monday and then rebounded somewhat. The index is still trading above the short-term downtrend line drawn from the peak of the 10th of August, but remained stuck below the 10435 (R1) resistance hurdle. A break above that resistance could challenge the 10670 (R2) key obstacle as a resistance this time. The RSI is back below its 50 line and is pointing somewhat down, while the MACD, already above its trigger line, looks to be headed towards its zero line. Having in mind these mixed momentum signs, I would prefer to see a break above 10435 (R1) before getting confident on the upside. On the downside, I think that a move below the psychological zone of 10000 (S2) could change the short-term outlook. On the daily chart, the break below 10670 (R2) on the 20th of August has shifted the medium-term outlook to the downside, in my view. Therefore, I would treat any future near-term advances that stay limited below the 10670 (R2) zone as a corrective phase.

• Support: 10135 (S1), 10000 (S2), 9770 (S3)

• Resistance: 10435 (R1) 10670 (R2), 10800 (R3)

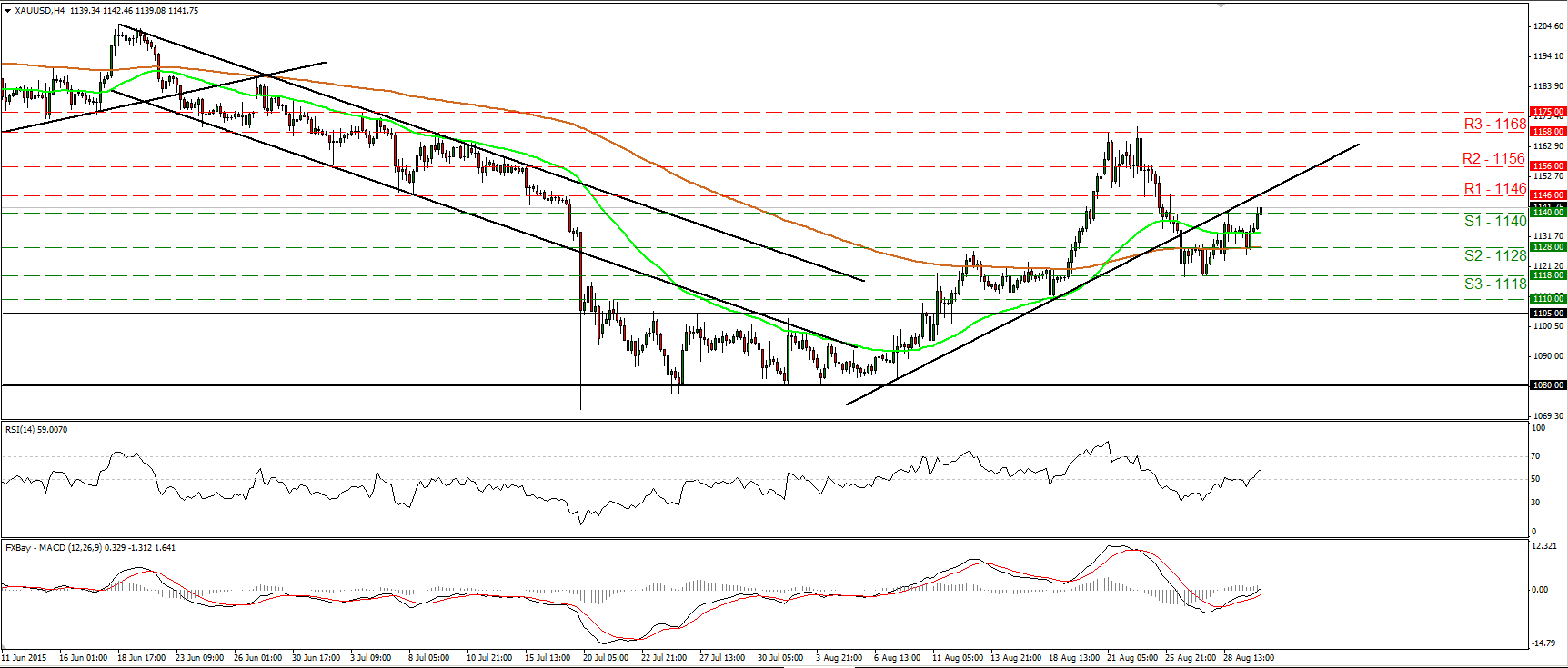

Gold rebounds from near 1128

• Gold traded higher on Monday, after it hit support near the 1128 (S2) barrier. The metal is now headed towards the 1146 (R1) obstacle and the uptrend line taken from the low of the 7th of August. I believe that a move above that trend line, could shift the short-term bias somewhat positive again and could target the 1156 (R2) zone. Our short-term oscillators detect positive momentum and magnify the case that the yellow metal could continue trading higher in the short run. The RSI emerged above its 50 line, while the MACD, already above its trigger line, has just obtained a positive sign. As for the bigger picture, with no clear trending structure on the daily chart, I would hold my neutral stance as far as the overall outlook is concerned.

• Support: 1140 (S1), 1128 (S2), 1118 (S3)

• Resistance: 1146 (R1), 1156 (R2), 1168 (R3)