Italian voters send the same message to the authorities Sunday’s local elections in Italy sent the same message as recent elections in places as varied as Spain, Finland, and Poland: we don’t like what you’re doing to us. Voters abandoned Italian PM Renzi’s center-left Democratic Party (PD), while there was a marked rise in support for the right-wing Northern League and the anti-establishment 5-Star Movement.

The snub to the Italian ruling party follows the Spanish municipal elections just a week ago, which saw a huge swing against the ruling party and in favor of anti-austerity parties. At the same time, in Poland, the President was defeated by a little-known right-wing member of the European Parliament who focused on jobs and the economy. Meanwhile, in Finland, the new PM named the leader of the eurosceptic Finns Party as the country's new foreign and European affairs minister.

These results are probably EUR-negative in the short run in that they increase the political uncertainty. However, I believe that they are actually EUR-positive in the long run. That is, they will increase pressure on the EU to let up on austerity programs and focus on growth for now. They also make it more likely that the EU will compromise with Greece, out of fear that the voters will vote everyone out of office next time around. The Spanish newspaper Mundo reported last week that German Chancellor Merkel had intervened in the talks with Greece and told the finance ministers to work out some agreement. I suspect that she is getting worried about the electoral implications of continued chaos in Greece. However, the Greek newspaper Kathemerini Monday reported that no progress was made over the weekend, so perhaps the Spanish report was overly optimistic. I expect the Greek issue to hang over the market – the Sword of Damocles naturally comes to mind – and for EUR to trade with a negative bias this week ahead of the payment to the IMF coming due on Friday.

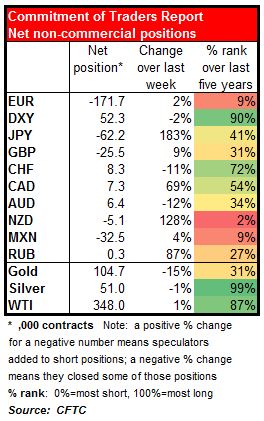

Speculators expand JPY and EUR shorts, oil longs The weekly Commitment of Traders (COT) report on positions in the US futures market showed that speculators such as hedge funds greatly increased their JPY shorts and modestly increased their EUR shorts, while adding to long positions in oil. The JPY shorts are still around the middle of the five-year range, however (41st percentile), so there is still room for investors to add to them. EUR shorts, however, are approaching the bottom of the historical range, meaning it may take a significant shock to get people to add to them.

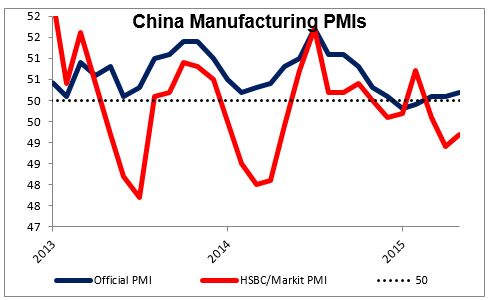

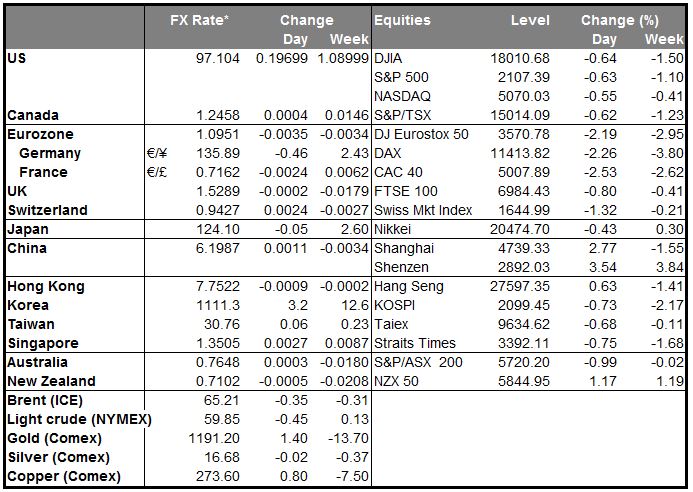

China’s manufacturing PMI stabilizes China’s official manufacturing PMI for May edged higher to 50.2 from 50.1, suggesting that the Chinese economy has at least stabilized. This compares with the final reading of the Markit (NASDAQ:MRKT) manufacturing PMI of 49.2, showing continued contraction. The official non-manufacturing PMI fell slightly to 53.2 from 53.4. The news had no effect on AUD or NZD. Shanghai stocks, however, were up 3% at the time of writing and Shenzhen up 3.9% -- apparently last week’s 6.5% plunge was seen as a buying opportunity, not an indication of what’s to come.

Today’s indicators: We also get the final Markit manufacturing PMI figures for May for several European countries and the Eurozone as a whole. As usual, the final forecasts are the same as the initial estimates, thus the market reaction on these news is usually limited, unless we have a huge revision from the preliminary figures. UK manufacturing PMI for May is forecast to increase a bit, which could prove GBP-positive.

In addition to the PMIs, German CPI for May is coming out after several regional states release their data in the course of the morning. As usual, we will look at the larger regions for a guidance on where the headline figure may come in, as an indication for the near-term direction of EUR. Nevertheless, following the introduction of the QE program by the ECB, the German CPI as well as the Eurozone’s CPI to be released on Tuesday, although important, are not big market movers anymore.

From Sweden, the Executive Board of the Riksbank will meet. Following the nation’s dip back into deflation, they could announce further easing measures to help boost prices. This could put SEK under increased selling pressure. Retail sales for April are also coming out.

From Canada, we get the RBC manufacturing PMI for May. However, the market usually pays more attention to the Ivey PMI, which will be released on Thursday.

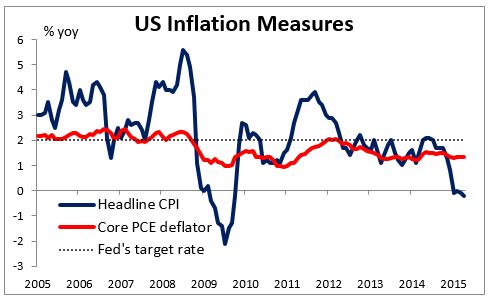

The US announces personal income and personal spending for April. Personal income is expected to accelerate, while personal spending is forecast to decelerate somewhat. The yoy rate of the PCE deflator and core PCE are also coming out. The PCE deflator is expected to decelerate, while the core PCE, the Fed’s favored inflation gauge, is forecast to accelerate. The latter could add to dollar’s strength. The Markit manufacturing PMI and the ISM manufacturing PMI both for May are also due out.

As for the speakers, Boston Fed President Eric Rosengren, Fed Vice Chairman Stanley Fischer and ECB Governing Council member Erkki Liikanen speak.

The rest of the week: RBA, ECB, US payrolls, OPEC and the peak of the Greek crisis? We have an action-packed week ahead of us with many events that are likely to impact the FX market.

On Tuesday, the spotlight will be on the Reserve Bank of Australia policy meeting. At their last meeting, the Bank cut rates by 25 bps. It also removed the easing bias from its statement and sounded a bit more optimistic over the country’s fundamentals. The forecast is for the Bank to remain on hold at this meeting and I would expect them to reintroduce the easing bias and leave open the possibility for another rate cut. This, along with the recent sharp decline in Australia’s capital expenditure in Q1 that shows the rebalance from the mining sector remains challenging for the nation, is likely to keep AUD under selling pressure.

On Wednesday, the most important event will be the ECB policy meeting. We would expect the ECB President Draghi to reiterate Governing Council’s view that the QE program will continue at least until the scheduled ending date of Sep. 2016, and maybe even longer if necessary. This again could put EUR under selling pressure. Another key point of interest will be any comments on the ECB’s Emergency Liquidity Assistance (ELA) to Greece.

As for the indicators, we get the US ADP employment report for May, two days ahead of the nonfarm payroll release. The ADP report is expected to show that the private sector gained more jobs in May than it did in the previous month. That’s likely to be USD-positive.

On Thursday, in the UK, the Bank of England meets to decide on its key policy rate. There’s little chance of a change, hence the impact on the market could be minimal, as usual.

Finally, Friday is nonfarm payrolls day! The market consensus for May is for an increase in payrolls of 220k, just below the 223k in April. Another reading above 200k could suggest that the US labor market is gathering steam again and is likely to boost USD across the board as this would leave the September rate hike scenario alive.

On Friday, we also have an OPEC meeting. A newspaper in Saudi Arabia said that OPEC is not expected to cut its oil production at its meeting in June. The organization is most likely to keep its production target at 30mn barrels per day, especially after the small rebound in prices from their January’s low levels. That would be a signal that the group is determined to continue with its policy of not giving away market share to non-OPEC producers even if prices fall. This could push oil prices down.

Perhaps the most important event on Friday, perhaps of the entire week (month? year?): Greece has to make a EUR 306mn payment to the IMF. Will they have the money to pay it? This will be a key pressure point for the Greek negotiations. It could be the start of the end for Greece’s euro drama. One temporary solution could be for the country to wrap all the payments due in June into one, which would be due later in the month. That would give them a bit more time to work out a resolution, if indeed one can be worked out.

Between the Greek payment to the IMF, the OPEC meeting and the NFP, Friday will be a volatile day.

The Market

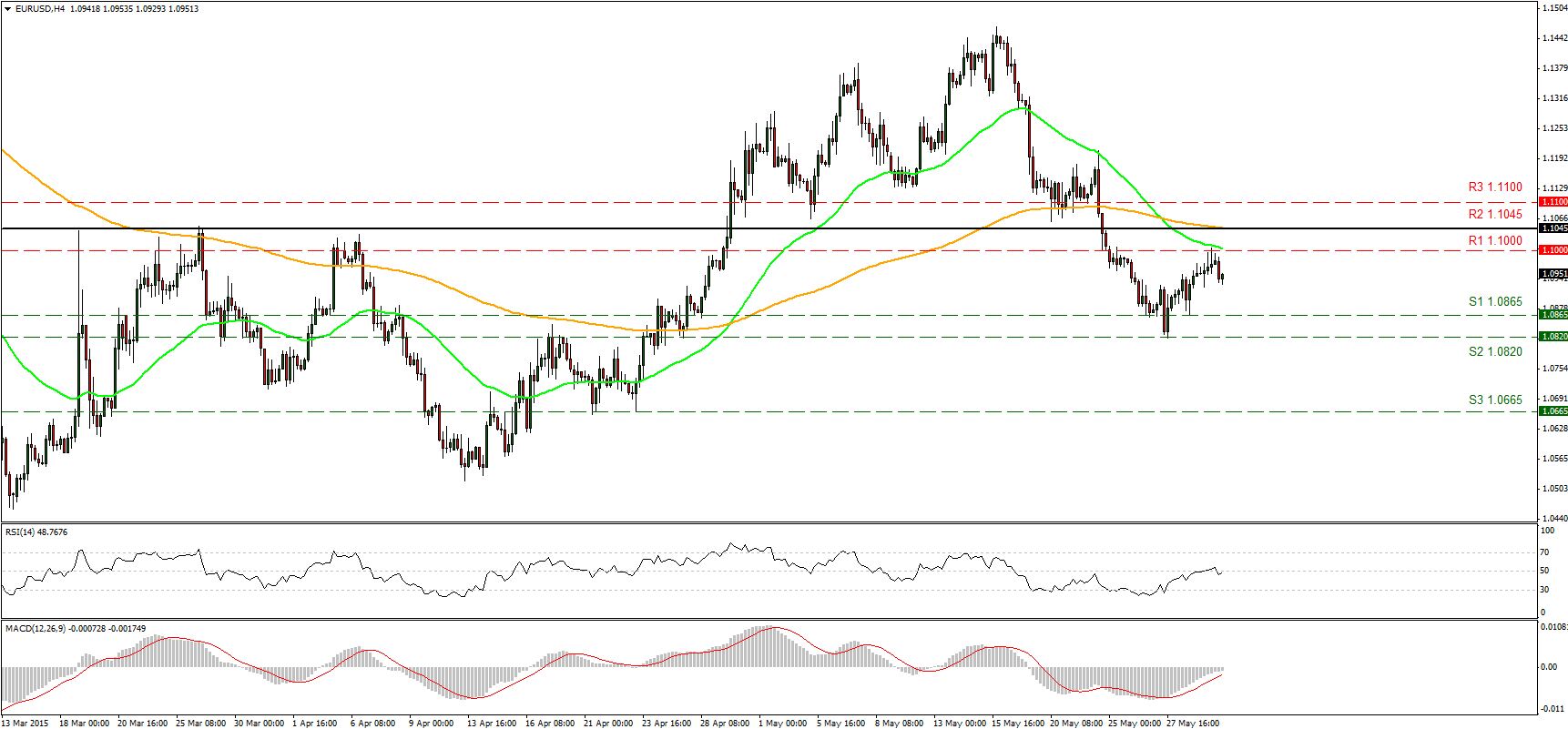

EUR/USD found resistance near 1.1000

EUR/USD fell on Monday after finding resistance near the 1.1000 (R1) barrier and the 50-period moving average. I would expect the decline to continue at least for another test of our 1.0865 (S1) support line. A clear break of that level could push the rate even lower, perhaps towards our next support of 1.0800 (S2). If the pair falls below that level, this could confirm a forthcoming lower low on the 4-hour chart and perhaps pave the way for the 1.0665 (S3) zone. Our momentum studies support this, as the RSI found resistance near the 50 line and declined, while the MACD, already negative, shows willingness to cross its trigger line and time soon. On the daily chart, the move below the 1.1045 (R2) barrier increases the likelihood that the 13th of April – 15th of May recovery was just a corrective move and that the prior downtrend could now be resuming.

• Support: 1.0865 (S1), 1.0820 (S2), 1.0665 (S3).

• Resistance: 1.1000 (R1), 1.1045 (R2), 1.1100 (R3).

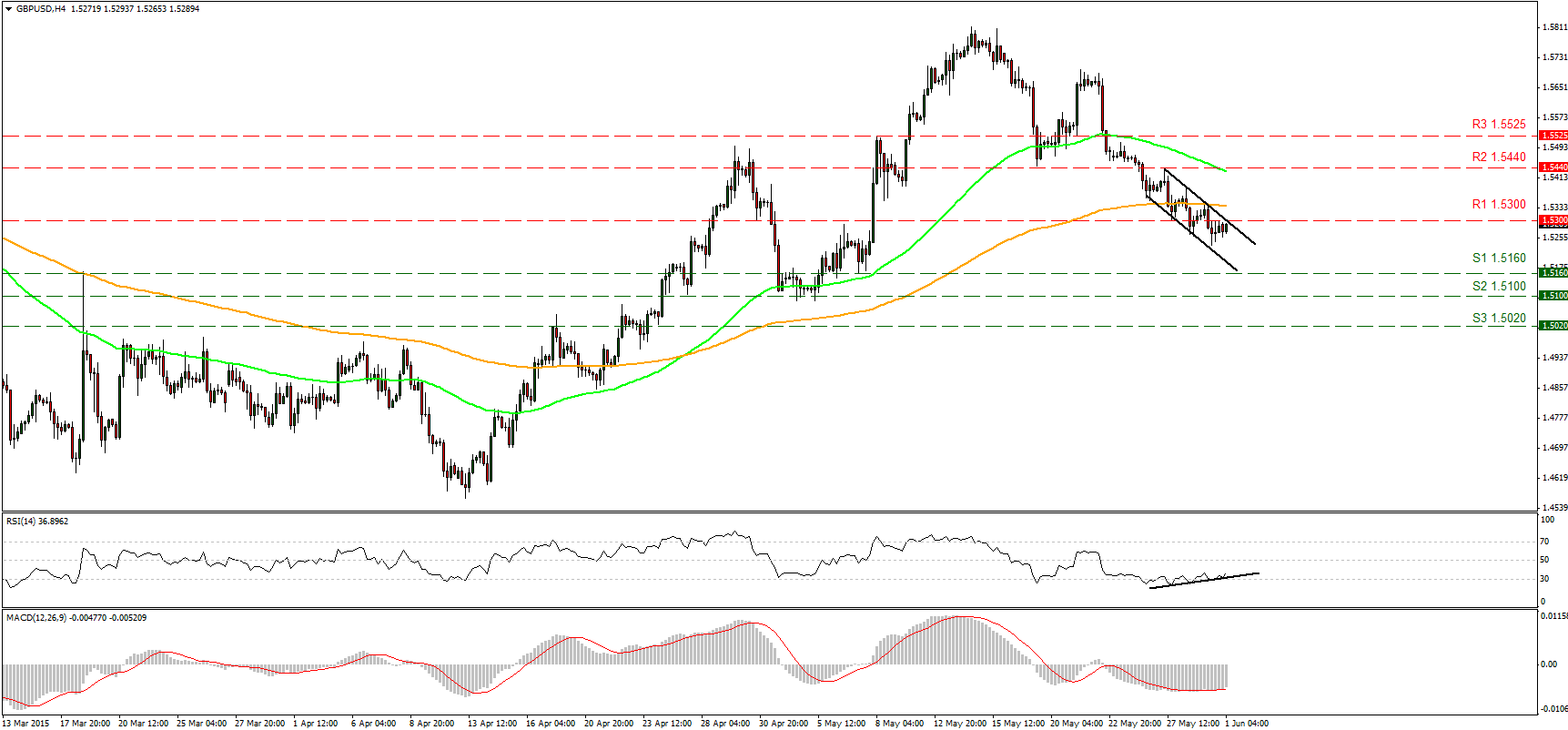

GBP/USD fell below 1.5300

GBP/USD traded lower on Monday, breaking below the support-turned-into-resistance level of 1.5300 (R1). The short-term outlook remains somewhat negative, and the pair could decline and test the 1.5160 (S1) support line. However, I would be careful for further declines as there is positive divergence between the price action and our momentum signs. The RSI gyrated around the 30 line and now points up, while the MACD, although negative, has bottomed and crossed above its trigger line. Even though we could see the rate lower, given our momentum signals, I would switch my stance to neutral for today. On the daily chart, the rate is trading just above the 80-day exponential moving average, which supports my stance to take the sidelines for today.

• Support: 1.5160 (S1), 1.5100 (S2), 1.5020 (S3) .

• Resistance: 1.5300 (R1), 1.5440 (R2), 1.5525 (R3).

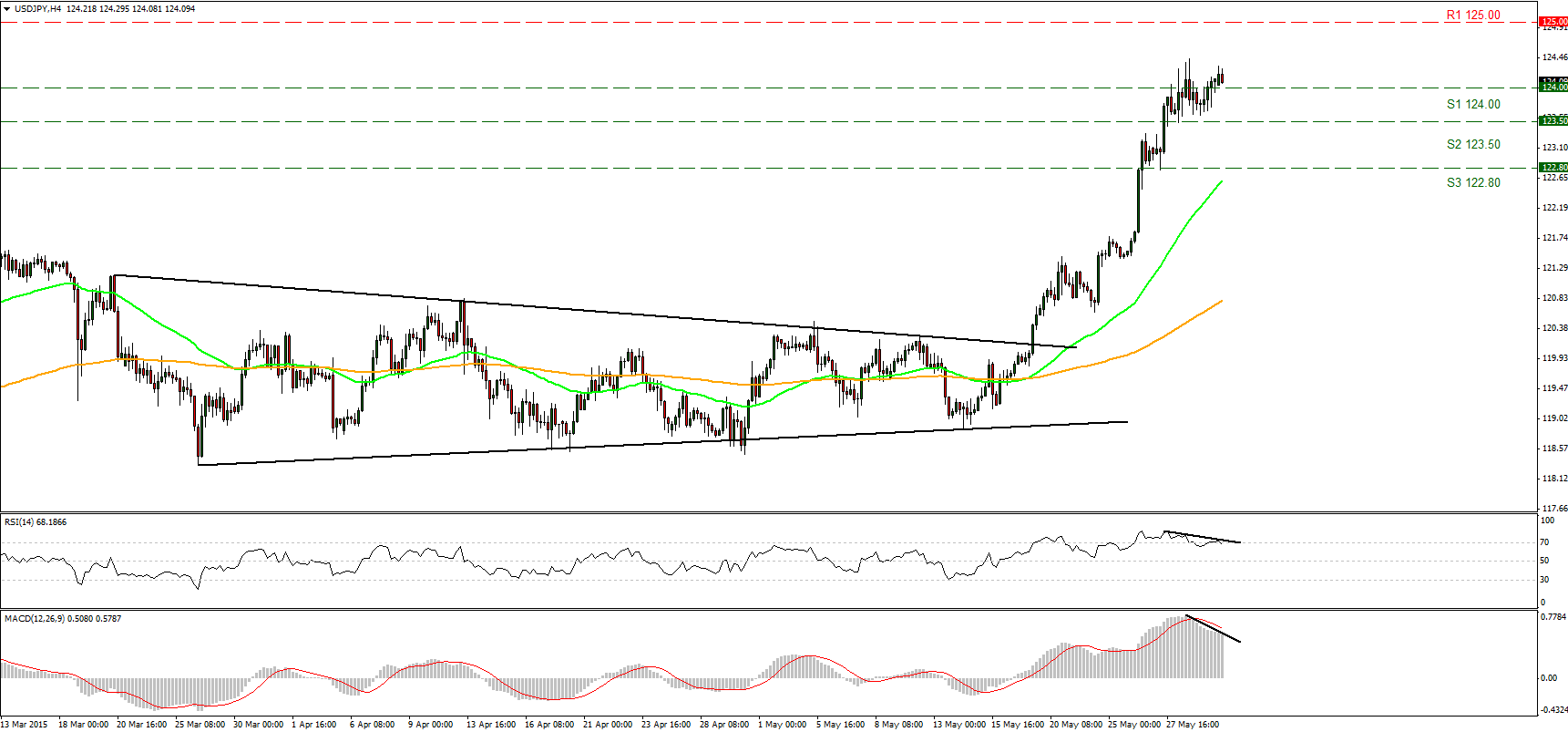

USD/JPY fractionally above 124.00

USD/JPY retreated somewhat on Friday, but remained above the 123.50 (S2) support barrier. During the early European morning Monday, the pair moved higher to trade again above 124.00 (S1). The short-term picture remains positive, and therefore, I would now expect the bulls to challenge the psychological barrier of 125.00 (R1). However, we could see a minor pullback before the next leg higher. This notion is supported by the negative divergence between our short-term momentum indicators and the price action that show a halt in the upside speed. The RSI fell below its 70 territory and points down, while the MACD crossed below its trigger line and points down. As for the broader trend, the break above 122.00 confirmed a forthcoming higher high on the daily chart and signaled the continuation of the longer-term bullish trend.

• Support: 124.00 (S1), 123.50 (S2), 122.80 (S3).

• Resistance: 125.00 (R1), 125.80 (R2), 126.60 (R3).

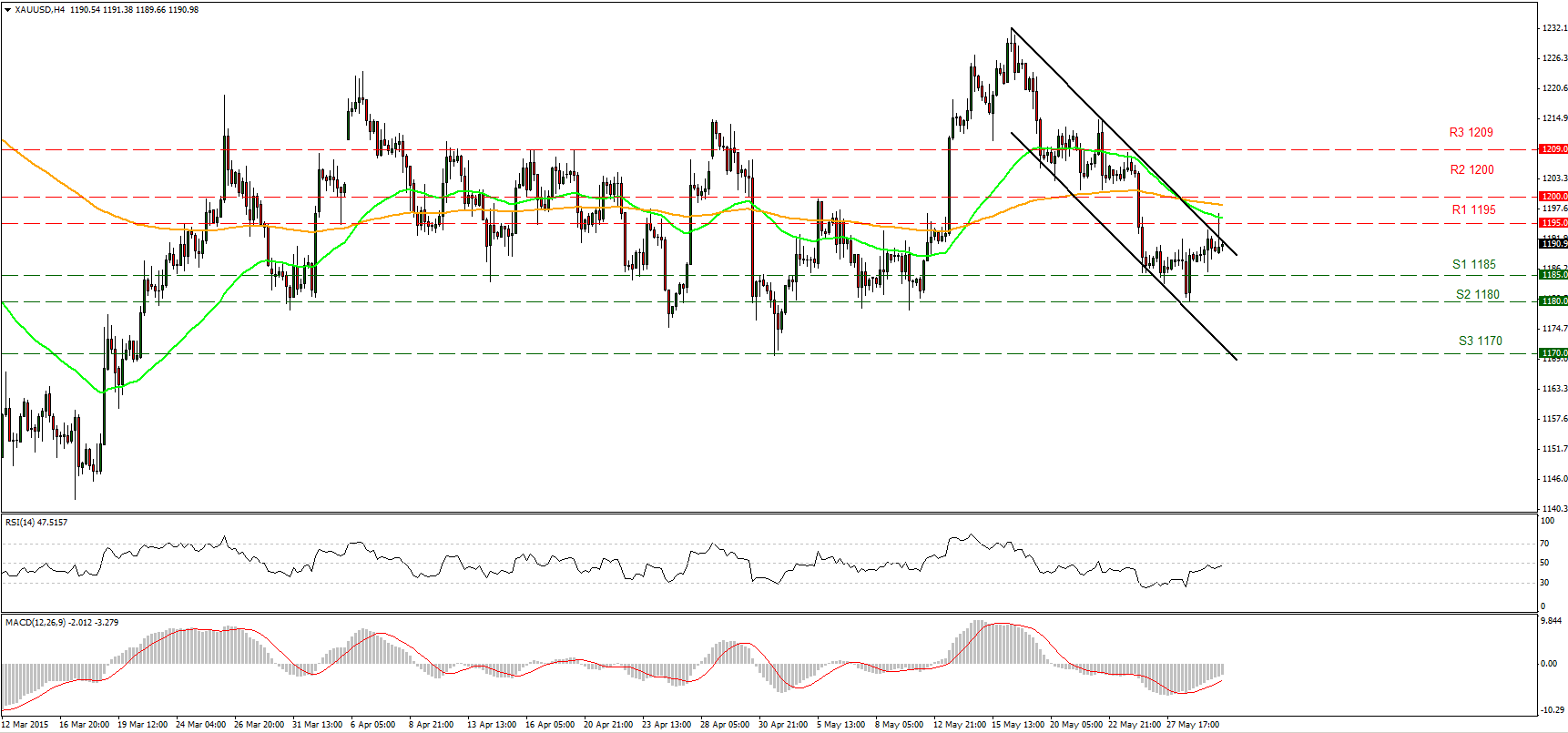

Gold near the upper boundary of the downside channel

Gold made a few attempts on Friday to break above the upper boundary of the black downside channel, but none of them had the needed strength and the precious metal continued to trade within the channel. Given that the price lies just below the upper boundary of the channel, I would like to take the sidelines for now, at least until a clear trending structure is formed. Our short-term momentum signals support my neutral stance, as the RSI stands just above its 50 line and points somewhat up, while the MACD, fractionally above its zero line points sideways. In the bigger picture, gold has been trading in a non-trending mode since the last days of March. Therefore, although I see a negative near-term picture, I would maintain my neutral stance as far as the overall picture is concerned.

• Support: 1185 (S1), 1180 (S2), 1170 (S3).

• Resistance: 1195 (R1), 1200 (R2), 1209 (R3).

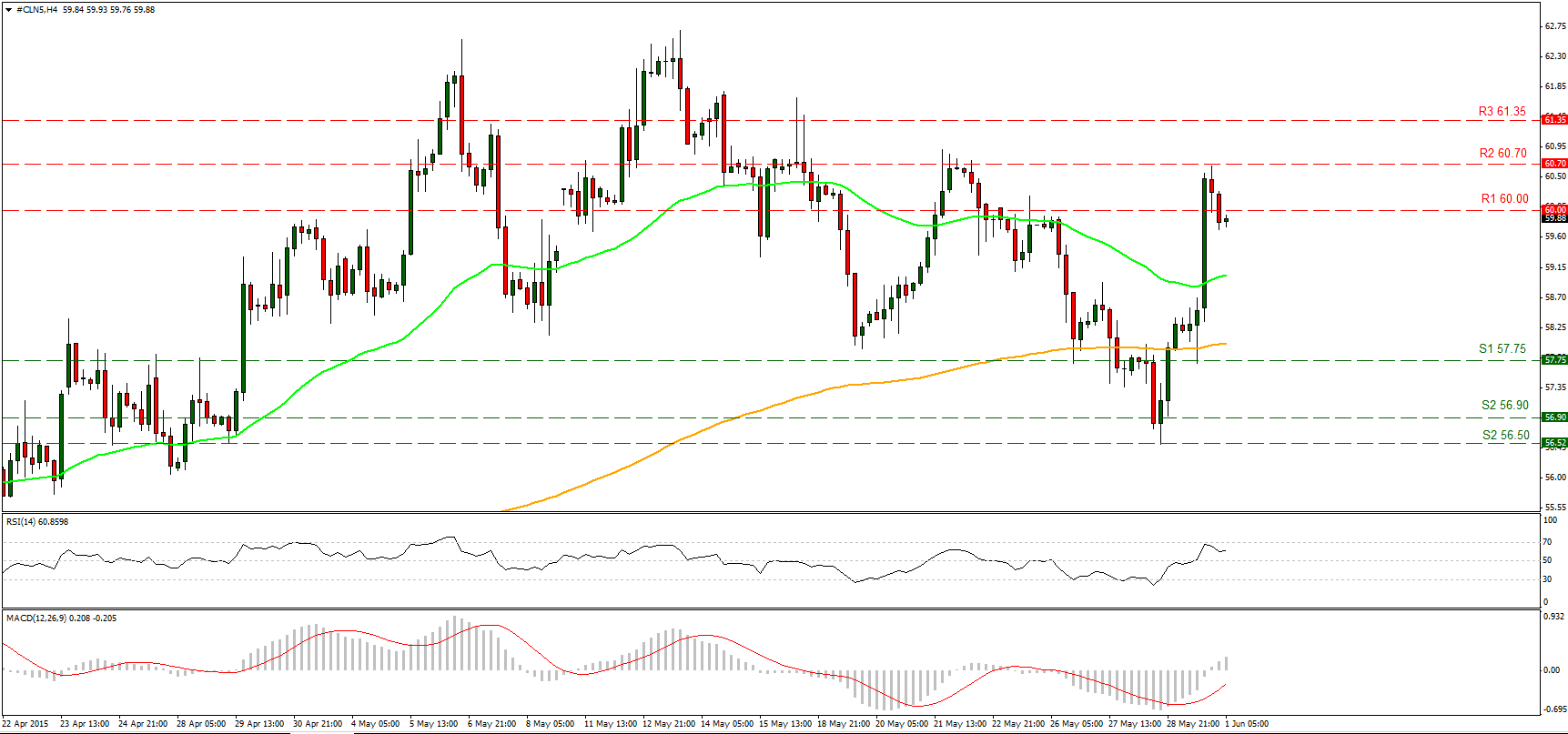

WTI finds support at 57.40 and rebounds

WTI found resistance near 60.70 (R2) on Friday and fell to trade a few cents below the 60.00 (R1) resistance hurdle. The short-term outlook is negative in my view; therefore, I would expect for a test of our 57.75 (S1) support line in the near future. The RSI found resistance at its 70 territory and declined, while the MACD shows signs of topping and could fall below its zero line anytime soon. As for the broader trend, the break above 55.00 on the 14th of April signaled the completion of a double bottom formation, something that could carry larger bullish implications in the not-too-distant future. Therefore, I would treat any declines that stay limited above 55.00 as a corrective phase for now.

• Support: 57.75 (S1), 56.90 (S2), 56.50 (S3).

• Resistance: 60.00 (R1) 60.70 (R2), 61.35 (R3) .