Surprise surprise! Central banks keep rates steady! Yesterday I mentioned that a rate hike by Norges Bank was as certain as the Swiss National Bank (SNB) floor for EUR/CHF. I meant it as a joke, but it turned out to be true. Norges Bank did not cut rates. It was a measure of the market’s expectations that USD/NOK, which had been rising into the announcement, immediately plunged 4% -- almost as big as its reaction to the FOMC statement. It's since stayed around those levels. Gov. Olsen sounded much like Bank of Canada’s Gov. Poloz when he said that the Bank had cut rates in December “as a hedge against much weaker development in the real economy” but that the weakness “has not come through so far. That gives us the opportunity to wait and see now.” Weaker oil prices haven’t hurt the economy as much as expected while house prices continue to rise, he explained. Although Olsen held out the promise of rate cuts in the future if the economy develops as they expect, nonetheless the market rapidly readjusted and NOK gained 2.4% vs USD. NOK could continue to be an outperformer if the economy holds up better than expected. With GDP growth at 3.2% yoy and CPI inflation at 1.9%, it’s certainly one of the healthier of the major economies. So long as it stays there, NOK should be able to outperform EUR.

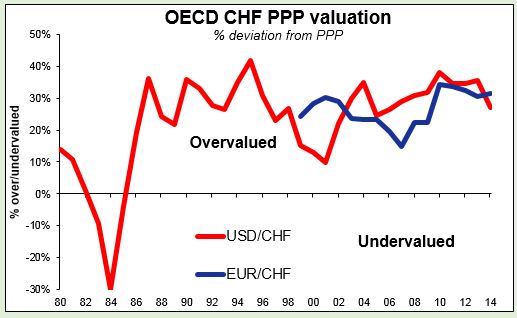

Meanwhile, the SNB sounded like the RBA and RBNZ as it complained that “the Swiss כranc is significantly overvalued and should continue to weaken over time.” They’re certainly right that it’s overvalued, but according to the OECD it’s been significantly overvalued since 1987 (36% overvalued vs USD then), so I wouldn’t hold my breath waiting for a big change. SNB said it would “remain active in the foreign exchange market, as necessary, in order to influence monetary conditions.” Nonetheless it “substantially” lowered its forecast for inflation, which it does not expect to go back to positive until 1Q 2017 (it’s been pretty steadily in deflation since 4Q 2011). Apparently even they aren’t willing to bet on their own success. I think USD/CHF remains a buy, but that’s only because of the strong dollar; EUR/CHF will struggle to stay steady and more likely will drift lower, in my view.

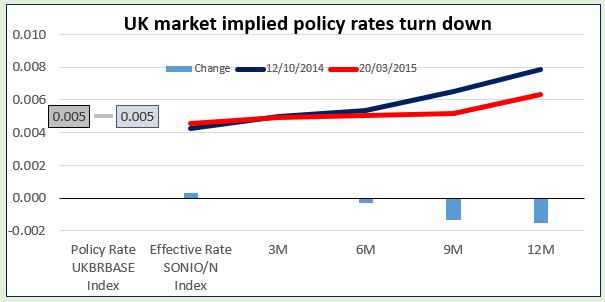

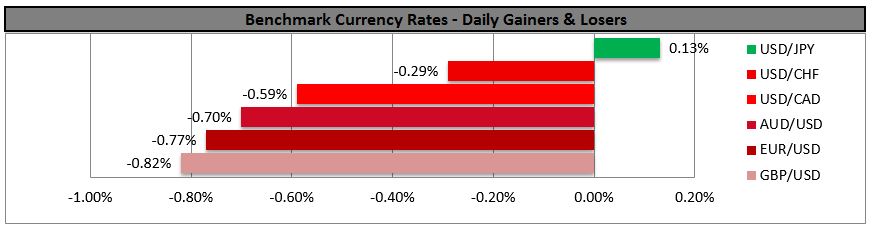

GBP was the big loser yesterday after a speech by Bank of England Chief Economist Andrew Haldane. He said that while he did not see an immediate reason to move interest rates either up or down, “I think the chances of a rate rise or cut are broadly evenly balanced.” This is in contrast to the assumed stance of the Bank’s Monetary Policy Committee (MPC), which is supposed to be considering the timing for a rate hike, much like the Fed. While markets have pushed back the assumed date of tightening by the Bank, it’s been assumed it was a question of “when,” not “whether.” Haldane is just one member of the MPC and his comments are in contradiction to those of Gov. Carney, who recently said it would be “extremely foolish” to cut rates or resume QE unless lower inflation was hurting wage growth, consumer spending and business investment. Nonetheless as Chief Economist, Haldane’s words do carry weight. Reopening this debate on top of the political uncertainty that the pound currently faces makes for a difficult background for GBP. I’m now bearish on the currency all around.

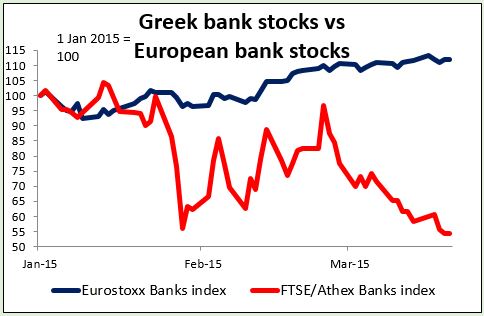

Today’s highlights: Back to worrying about Greece! During the European day, investors will probably shift their focus back to politics as Greece has to roll over EUR 1.6bn of short-term notes, repay EUR 350mn to the IMF and pay around EUR 110mn in interest to the ECB. Payments on a swap originally arranged by Goldman Sachs (NYSE:GS) in 2001 – one of the infamous swaps that disguised Greece’s fiscal position so it could qualify for euro membership -- are also due. Greece gathered EUR 1.3bn in a Treasury bill auction on Wednesday, but the remaining amount will simply drain the country’s available liquidity. The way things are going it will be a matter of weeks before Greece runs out of money. To make matters worse, comments by eurogroup president Jeroen Dijsselbloem about Greece possibly imposing capital controls have spurred withdrawals from the banks, which are estimated at some EUR 300mn a day – pretty much using up the EUR 400mn increase in the Emergency Liquidity Assistance (ELA) that the ECB recently granted. No surprise that Greek bank stocks are collapsing even while bank stocks elsewhere in Europe perform well. Tensions between Greece and its creditors escalated further last week with the former filing a complaint against German Finance Minister and the latter saying he couldn’t rule out Greece leaving the euro. Greek PM Tsipras meets with German Chancellor Merkel on Monday; we’ll see if they can kiss and make up or whether the exchange of views just makes things worse.

As for the indicators, eurozone’s current account for January is coming out.

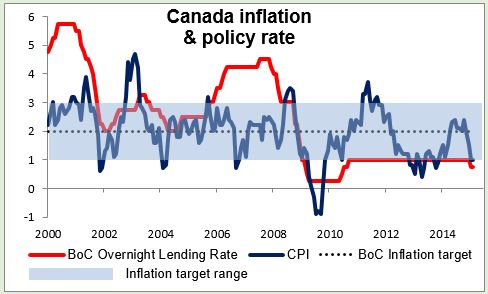

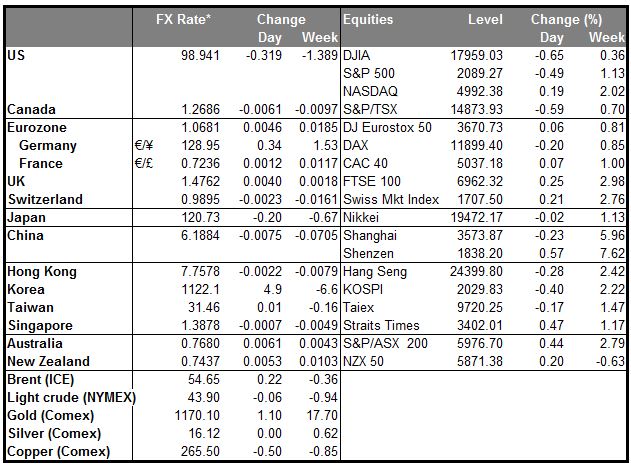

In Canada, CPI inflation for February is expected to decelerate from the previous month and fall below the Bank’s lower boundary of 1%-3% target range, adding to pressure on the Bank of Canada to loosen further. Along with the low oil prices this is likely to keep CAD under selling pressure.

As for the speakers, during the US session, Atlanta Fed President Dennis Lockhart and Chicago Fed President Charles Evans speak. It will be interesting to hear their takes on the FOMC decision.

Finally, don’t miss the eclipse today!

The Market

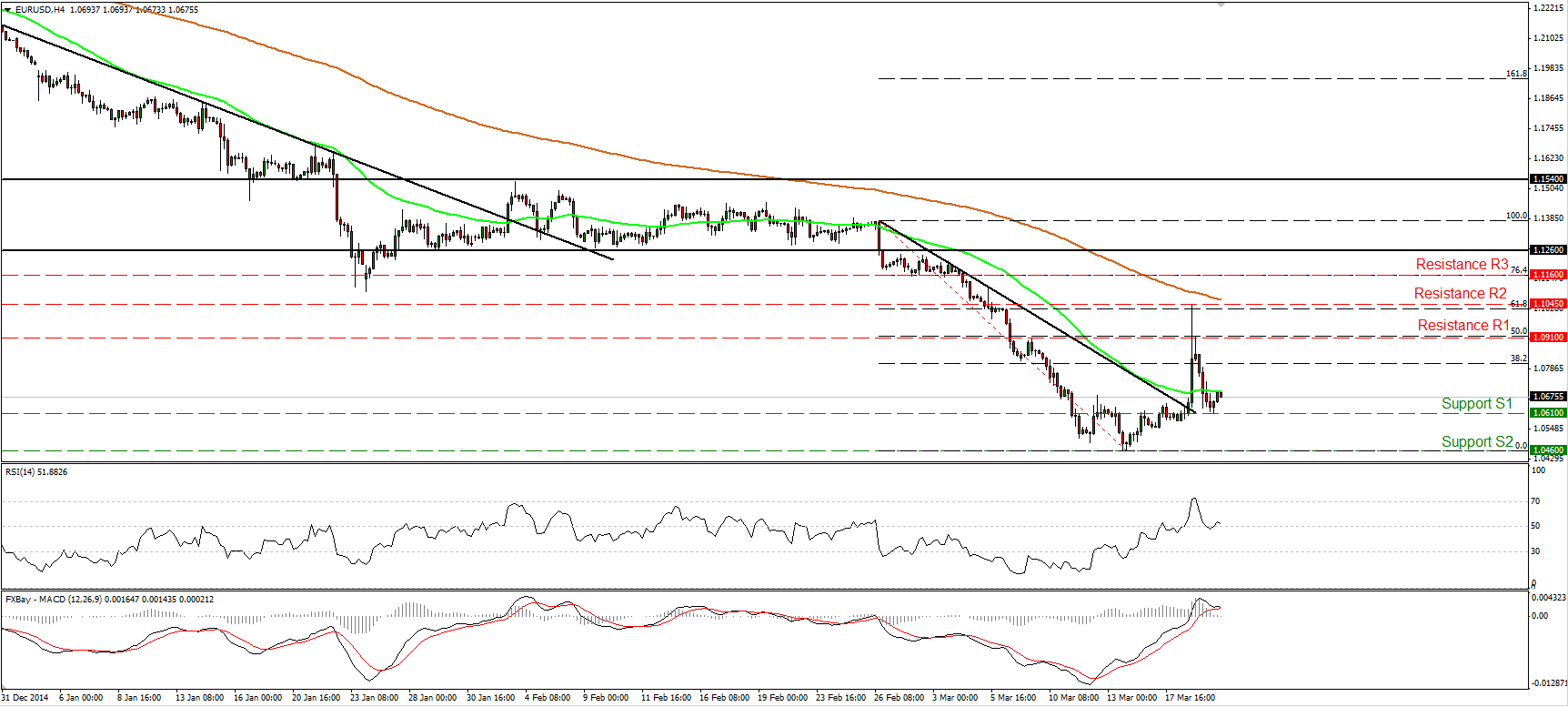

EUR/USD gives back all its FOMC gains

EUR/USD tumbled on Thursday and gave back all its gains achieved on Wednesday after the FOMC decision. The fall was halted at 1.0610 (S1) and subsequently EUR/USD rebounded somewhat. I still believe that Wednesday’s rally was a 61.8% retracement of the 26th of February – 13th of March decline, and that the bears will get into the game again, driving the rate below 1.0610 (S1). A move below that hurdle could aim for another test at 1.0460 (S2). Our momentum studies corroborate my view. The RSI, although above 50, points down and appears ready to move below its equilibrium barrier, while the MACD has topped and could fall below its trigger any time soon. As for the broader trend, the price structure still suggests a longer-term downtrend. EUR/USD is printing lower peaks and lower troughs below both the 50- and the 200-day moving averages.

• Support: 1.0610 (S1), 1.0460 (S2), 1.0360 (S3).

• Resistance: 1.0910 (R1), 1.1045 (R2), 1.1160 (R3).

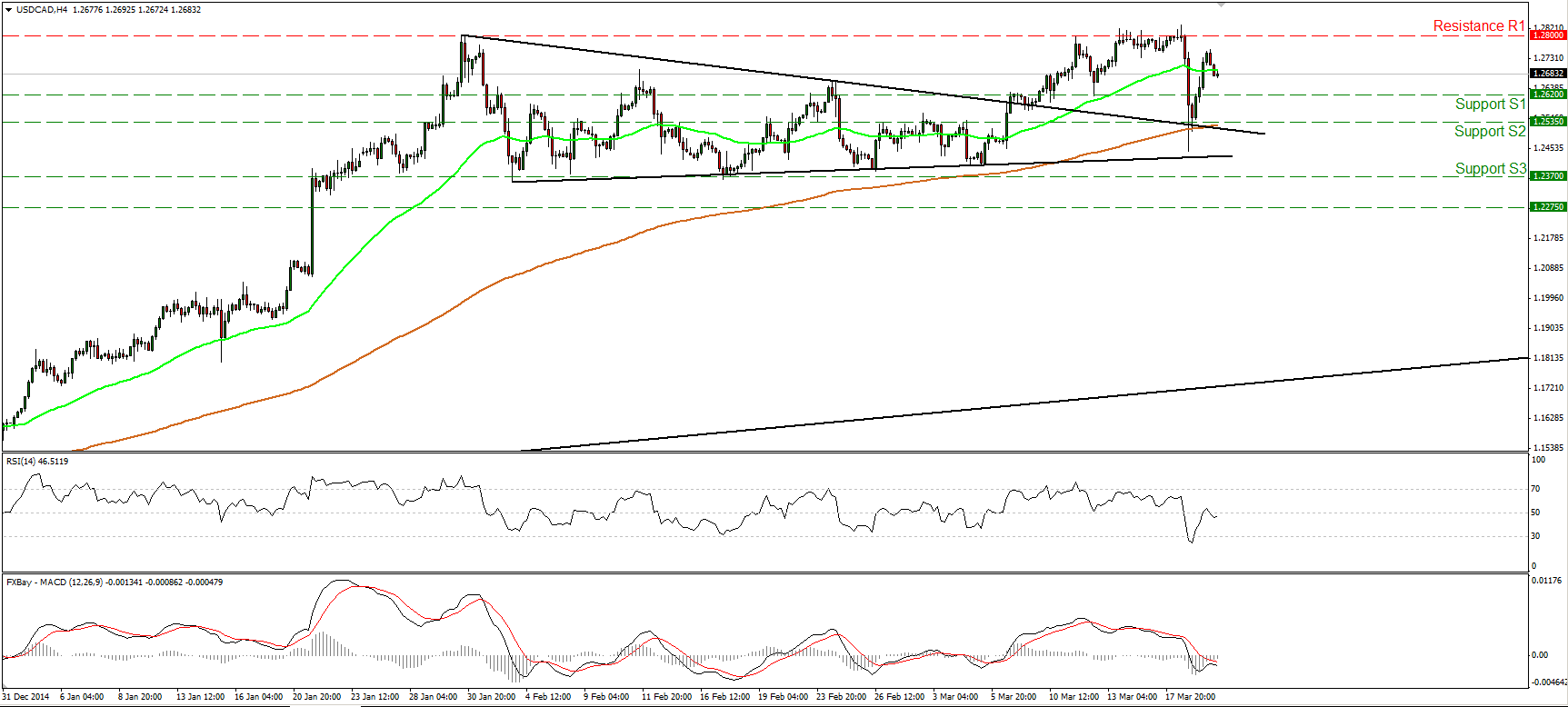

USD/CAD waits for Canada’s CPI

USD/CAD recovered a large portion of its FOMC plunge and during the early European morning Friday is trading between the support barrier of 1.2620 (S1) and the resistance of 1.2800 (R1). Today, Canada’s CPI for February is coming out and is expected to have slowed down. This could give buyers a reason to challenge again the key resistance territory of 1.2800 (R1). A clear close above 1.2800 (R1) is likely to see scope for extensions towards our next resistance at 1.2900 (R2). Switching to the daily chart, the rate is still trading above the 50- and 200-day moving average. Moreover the upside exit of the triangle that had been containing the price action since the beginnings of February signaled a trend continuation. Therefore, the overall trend of this pair stays to the upside.

• Support: 1.2620 (S1), 1.2535 (S2), 1.2370 (S3).

• Resistance: 1.2800 (R1), 1.2900 (R2), 1.3000 (R3).

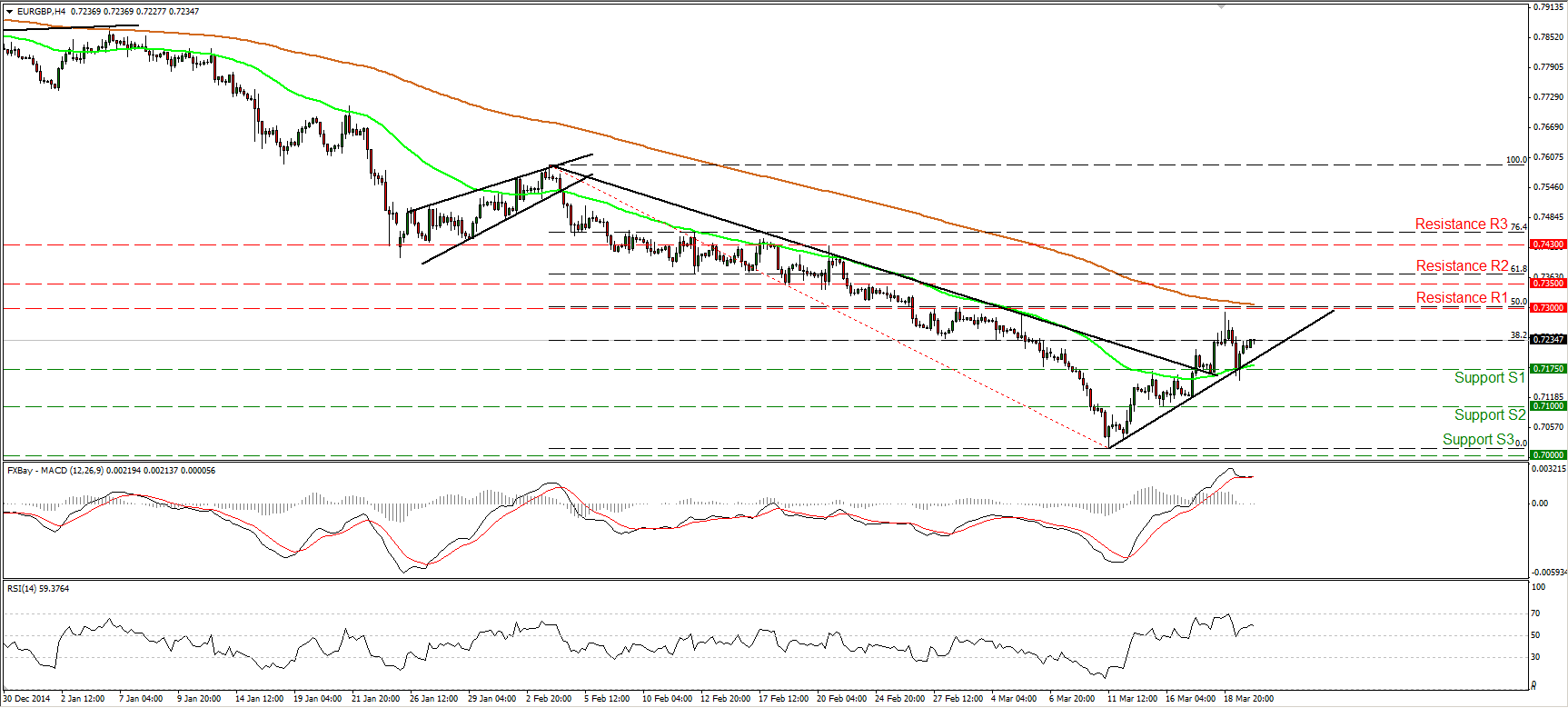

EUR/GBP rebounds from a short-term uptrend line

EUR/GBP raced higher on Thursday after finding support near the short-term uptrend line taken from the low of the 11th of March, and near the 50-period moving average. As long as the rate is trading above the aforementioned uptrend line and above the downtrend line drawn from the peak of the 3rd of February, the short-term bias is positive in my view. I would expect another test near the 0.7300 (R1) barrier, which happens to be the 50% retracement level of the 3rd of February – 11th of March down wave. As for the broader trend, after the downside exit of the triangle pattern on the 18th of December, the price structure has been lower peaks and lower troughs below both the 50- and the 200-day moving averages. This keeps the overall downtrend intact and therefore, I would see the short-term uptrend as a corrective move of the larger negative path.

• Support: 0.7175 (S1), 0.7100 (S2), 0.7000 (S3).

• Resistance: 0.7300 (R1), 0.7350 (R2), 0.7430 (R3).

Gold trades virtually unchanged

Gold moved lower yesterday but found support slightly below 1165 (S1) and rebounded to trade virtually unchanged. The precious metal remains below the downtrend line taken from back at the high of the 22nd of January, therefore I still consider the outlook to be negative. A clear close below 1165 (S1) would probably confirm that sellers took control again and perhaps set the stage for another test at the 1147 (S2) line. As for the broader trend, the decline from 1307 seem to be in force from a technical standpoint, but only a move below 1140 (S3) would signal a forthcoming lower low on the daily chart and probably the continuation of that down path.

• Support: 1165 (S1), 1147 (S2), 1140 (S3).

• Resistance: 1175 (R1), 1190 (R2), 1200 (R3).

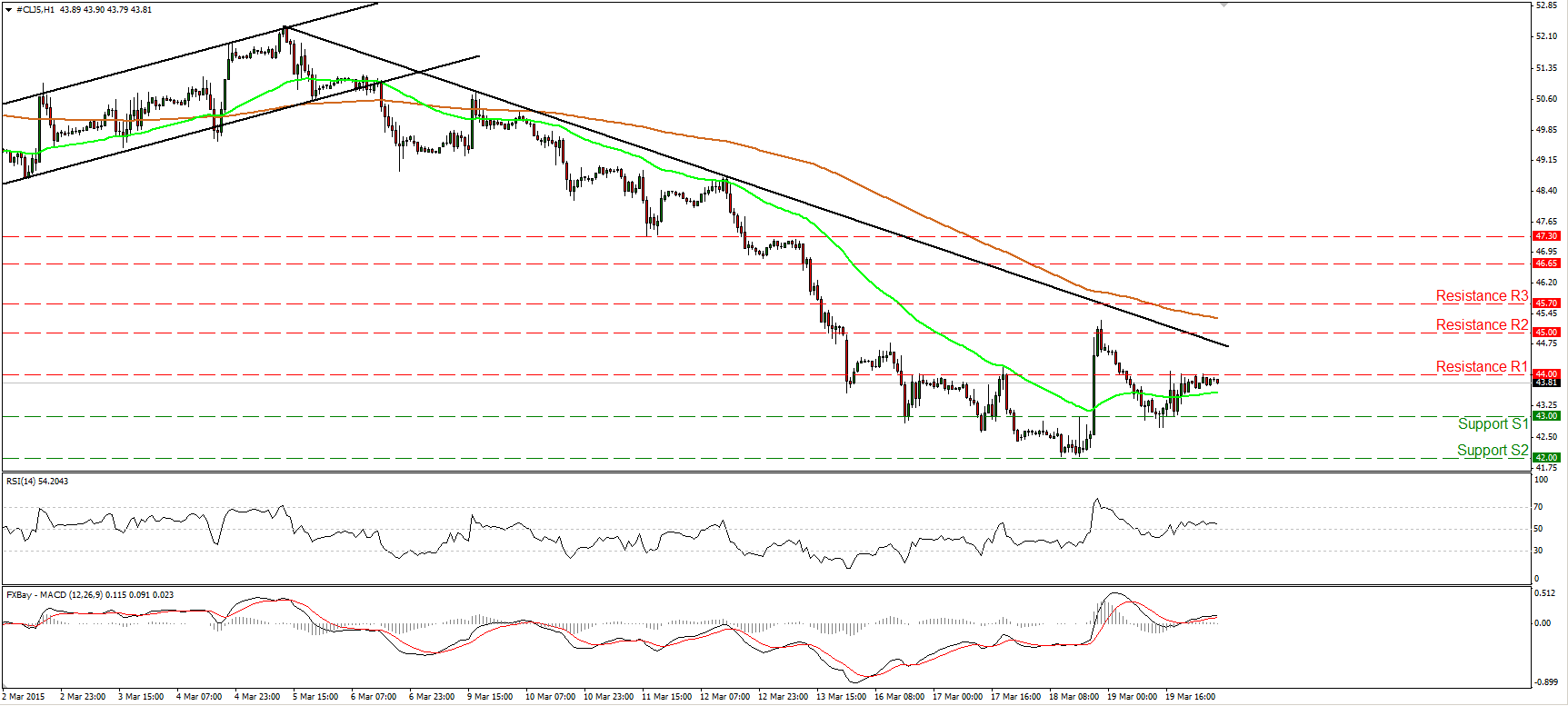

WTI hit support around 43.00 and rebounds

WTI slid on Thursday, found support at our 43.00 (S1) barrier, and rebounded to challenge our 44.00 (R1) line as resistance this time. As long as WTI is trading below the downtrend line drawn from the peak of the 5th of March, I would consider the near-term outlook to be negative. Therefore, I would expect the forthcoming wave to be negative. I expect another test near the 43.00 (S1) hurdle, where a clear dip could pull the trigger for the key zone of 42.00 (S2), defined by the low of Tuesday and the trough of the 11th of March 2009. On the daily chart, WTI is printing lower peaks and lower troughs below both the 50- and the 200-day moving averages. This keeps the longer-term downtrend intact in my view.

• Support: 43.00 (S1), 42.00 (S2), 40.00 (S3).

• Resistance: 44.00 (R1) 45.00 (R2), 45.70 (R3).