Greek talks end with no agreement The talks between the EU and Greece ended abruptly last night with accusations of bad will between the two sides. In fact, the disagreement seems to be between Greece and the European Commission on one side and the finance ministers on the other. Greece said that the Commission had offered an acceptable path forward, but that the finance ministers changed the proposal to one that would tie Greece to its current agreement. Syriza was elected on a promise to renegotiate the current agreement, so of course that was unacceptable to them and Greek Finance Minister Varoufakis rejected the offer. End of talks. Dutch Finance Minister Dijsselbloem said that ministers could reconvene on Friday if there’s a breakthrough. Without a deal, Greece’s current aid agreement expires at the end of February and the country could run out of money by the end of March, and almost definitely will by the end of July.

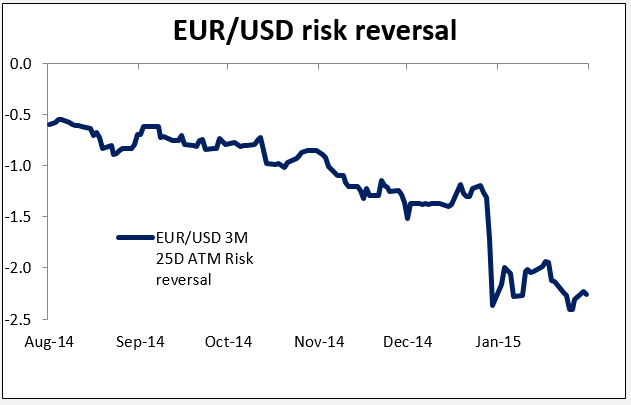

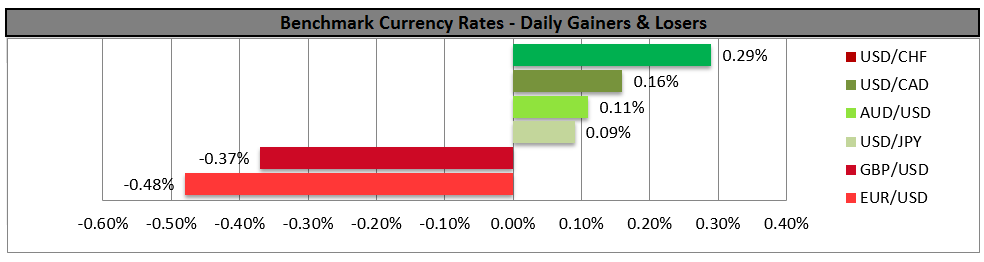

FX market remains remarkably calm. EUR was the worst-performing G10 currency as USD gained against most, but still it was nothing extraordinary – the day’s range was 0.78%, almost exactly in line with the average of the last six months of 0.82%. The 3m ATM 25 delta risk reversal has actually moved a bit higher in the last few days, indicating that EUR/USD puts are becoming a little bit less expensive relative to calls – in other words, demand for insurance against a falling EUR is weakening. Apparently FX investors still believe a solution will be found (as do I), although investors in the Greek stock market are not so confident. I would still expect more fireworks and volatility – and another leg down in EUR/USD – before a solution is found.

What options does Greece have? The easiest one would be to accept an extension of its current program. That would mean continuing the reform measures that are already promised, such as privatization, tax collection, cuts of pensions, reduction in the number of government employees, etc. As mentioned above however, Syriza won the election promising not to do this.

Greece has also threatened to turn to Moscow or China for the money. Moscow has indicated that it’s ready to help, but this is not a move to be taken lightly. Russia might demand a naval base in Greece in return, which could threaten Greece’s membership in NATO. This would not be the preferred solution for Greece, I assume.

Another possibility that academics are suggesting is for the government to issue a parallel currency to fund its operations while they continue the negotiations. This would be an IOU redeemable in euros at some point in the future when the money starts flowing again. There is some precedent for this even in the US, where some states – which are not allowed to run budget deficits – have done this to fund themselves temporarily. However, people might take this as the first step to creating a new currency and leaving the eurozone. It could precipitate a bank run and financial chaos.

There are other technical matters that Greece can bring up as well to get the finance ministers to agree to allow the country greater access to funding, but these are not long-term solutions.

Looking at these possible solutions, #2 and #3 seem politically difficult and #4 is only a way of delaying the inevitable, so I think it comes down to #1. They will have to find some face-saving way to make Greece accept the current program without it appearing that they are accepting the current program. Officials have said they are already 70% down this road, but there are still 30% of the items that they can’t agree on. One way to square this circle might be just to rename a lot of the things that upset the Greeks, such as changing “program” to “contract” or something like that. The main sticking point seems to be political, and not just from Germany: the governments of the other peripheral countries, which have also endured wrenching adjustment programs, don’t want their voters to think that they went through all that austerity only because their representatives weren’t good negotiators. As European Commission President Jean-Claude Juncker said once, “We all know what to do, we just don’t know how to get re-elected after we’ve done it.” That applies to both sides in this case.

RBA minutes show doubts on domestic demand, China The Reserve Bank Australia (RBA) released the minutes of its February meeting. This was the meeting where it cut its benchmark interest rate by 25 bps. The minutes showed that doubts about a pickup in domestic spending and China’s demand for raw materials were behind the decision. The RBA still feels AUD is too strong, which it may well be, looking at various PPP valuations. I remain bearish on AUD based on my view that China is serious about refocusing its economy and will be buying less iron ore and coal from Australia in the future.

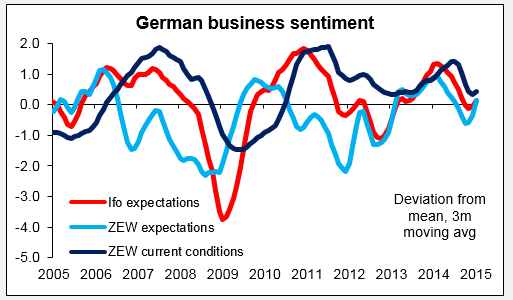

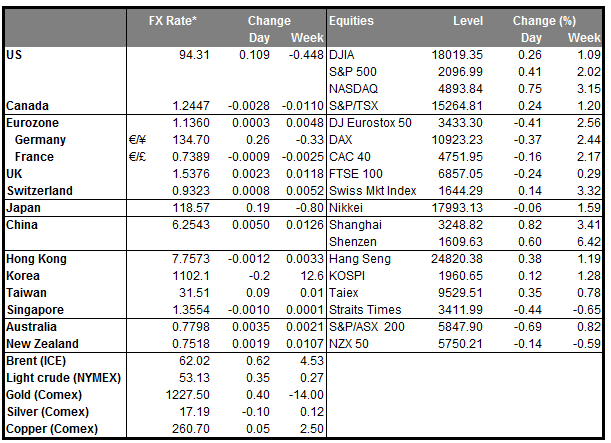

Today’s highlights: During the European day, the highlight will be the German ZEW survey for February. Both indices are forecast to have risen and this could be the 4th consecutive rise in the indices. Following the surprisingly strong Q4 GDP growth rate, this will add to the evidence that the German economy is gaining momentum.

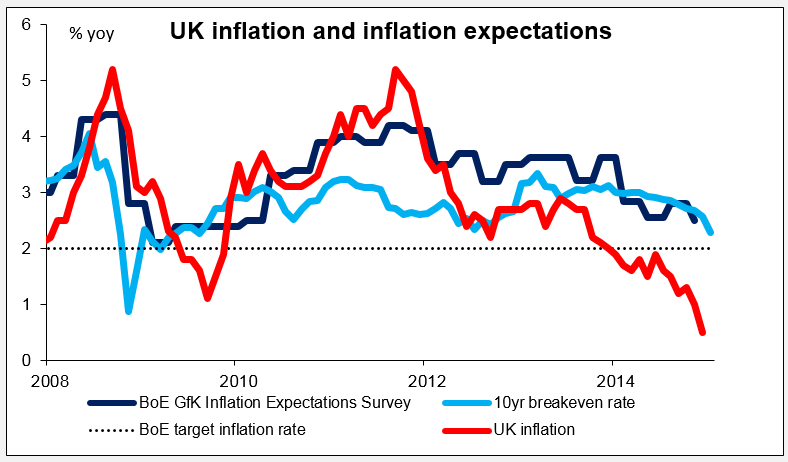

In the UK, the CPI for January is expected to have eased further. This is likely to confirm the comments in last Thursday’s inflation report that inflation may drop below zero in the coming months and remain close to zero for much of 2015. Therefore, the market reaction could be limited as a decline is already priced in somewhat following the inflation report.

In Sweden, we get the CPI for January. Last week, the Riksbank cut rates and introduced a mini QE despite the board’s belief that the underlying inflation has bottomed out. They also expressed readiness to do more to ensure that inflation rises towards the target. The CPI rate is expected to remain unchanged at -0.3% yoy, while the CPIF – the Bank’s favorite inflation measure - is expected to stay at +0.5% yoy. If the actual figure falls below expectations, this will prompt further action from the Riksbank and could weaken SEK further. Otherwise, we could see a short-lived strengthening of the currency.

In the US, the Empire State manufacturing PMI for February is expected to show that business conditions for NY manufactures is expected to increase a bit, while he NAHB housing market index also for February is expected to show a small improvement. These could boost USD.

We have one speaker on Tuesday’s agenda: Philadelphia Fed President Charles Plosser.

The Market

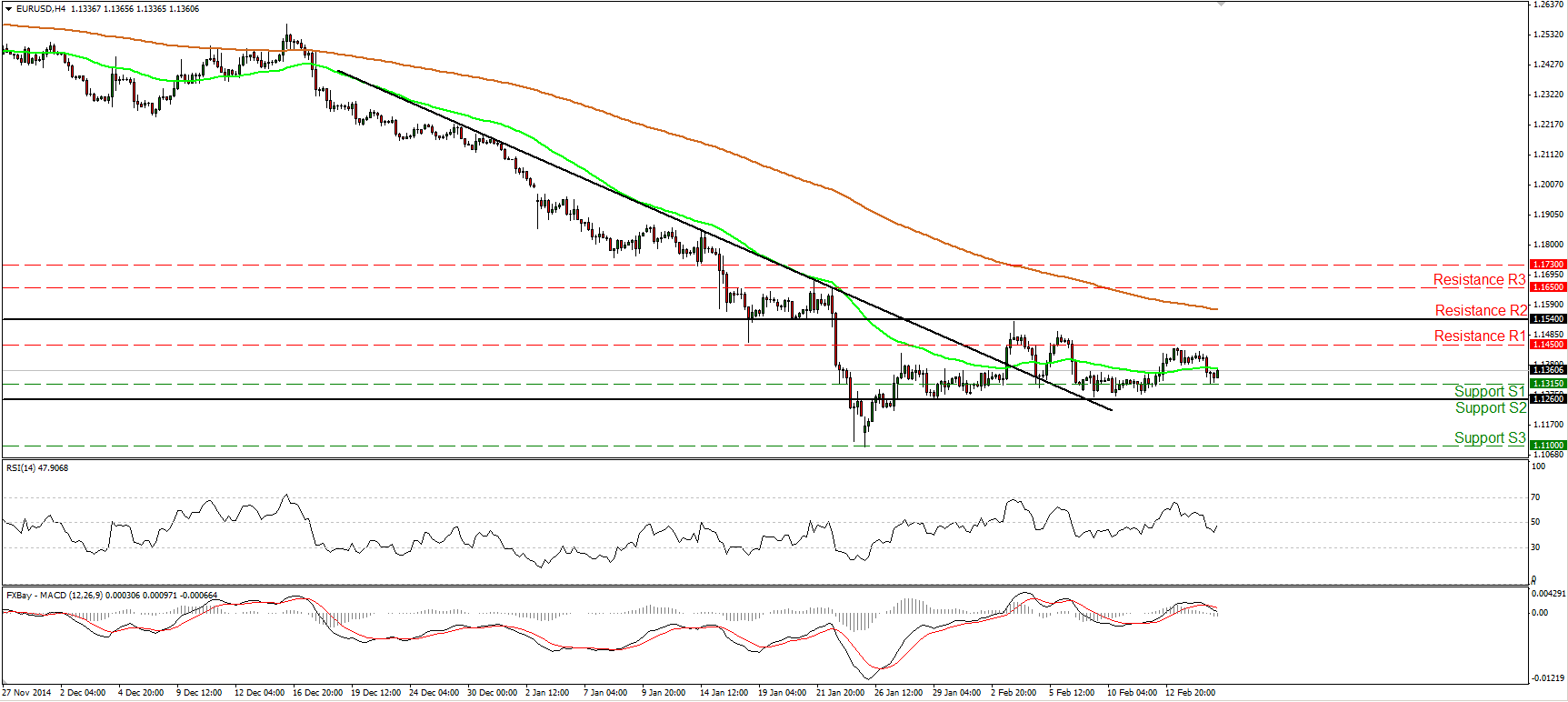

EUR/USD slides as Greek debt talks fail

EUR/USD retreated on Monday after talks between Greece and eurozone finance ministers over a new financing arrangement for Greece broke down abruptly. Nevertheless the rate hit support at 1.1315 (S1) and rebounded somewhat. As long as EUR/USD is trading in a sideways mode between the key support of 1.1260 (S2) and the resistance of 1.1540 (R2), I would consider the near-term bias to be neutral. As far as the broader trend is concerned, I believe that the pair is still in a downtrend. EUR/USD is printing lower peaks and lower troughs below both the 50- and the 200-day moving averages. A clear dip below 1.1260 (S2) is the move that would shift the bias back to the downside and perhaps pull the trigger for another test at 1.1100 (S3).

• Support: 1.1315 (S1), 1.1260 (S2), 1.1100 (S3).

• Resistance: 1.1450 (R1), 1.1540 (R2), 1.1650 (R3).

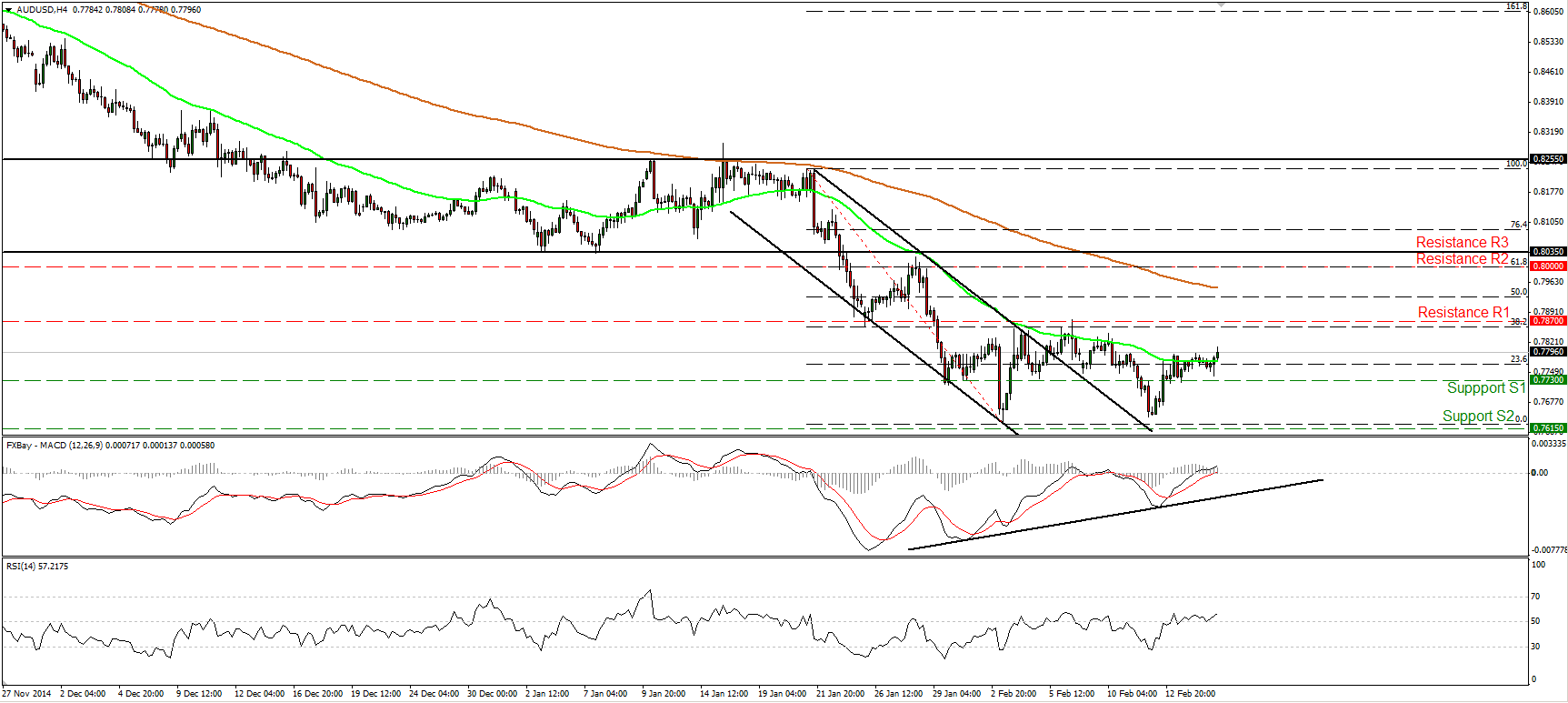

AUD/USD continues racing higher

AUD/USD continued its upside ride after finding support slightly above the 0.7730 (S1) barrier. Bearing in mind that the rate failed to move below the key obstacle of 0.7615 (S2) last Thursday, and that there is new positive divergence between the MACD and the price action, I would expect the up move to continue and challenge once again the 0.7870 (R1) area, which stands close to the 38.2% retracement level of the 21st of January – 3rd of February decline. A decisive break above that zone would signal the completion of a minor-term double bottom pattern and perhaps target the psychological zone of 0.8000 (R2). Nevertheless, on the daily chart I still see a longer-term downtrend. As a result, I would treat any near-term advances as corrective waves before sellers pull the trigger again. I still believe that we are going to see AUD/USD challenging the 0.7500 (S3) territory in the future.

• Support: 0.7730 (S1), 0.7615 (S2), 0.7500 (S3).

• Resistance: 0.7870 (R1), 0.8000 (R2), 0.8035 (R3).

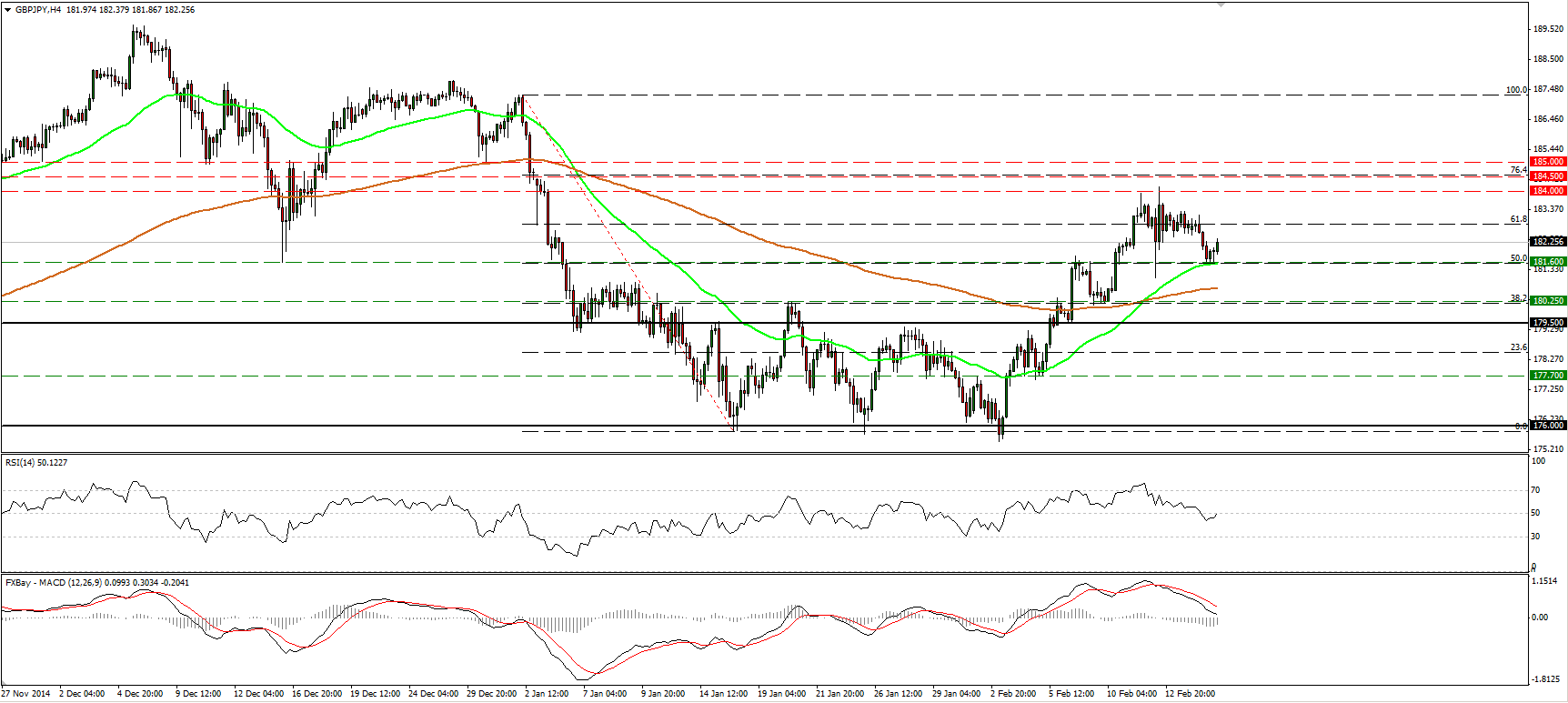

GBP/JPY pulls back and finds support at 181.60

GBP/JPY tumbled on Monday but hit support at the 181.60 (S1) barrier, near the 50-period moving average, and rebounded somewhat. The price structure on the 4-hour chart still suggests a short-term uptrend, and as a result I would expect another leg up and perhaps another test at the resistance hurdle of 184.00 (R1). However, today we get the UK CPI for January which is expected to have continue its disinflationary course. This could trigger a further pullback and probably delay any bullish move. On the daily chart, 14-day the RSI is still in a rising mode, while the MACD stays above both its zero and signal lines. These momentum signs reveal bullish momentum and magnify the case that we are likely to see a higher rate in the not-too-distant future.

• Support: 181.60 (S1), 180.25 (S2), 179.50 (S3).

• Resistance: 184.00 (R1), 184.50 (R2), 185.00 (R3).

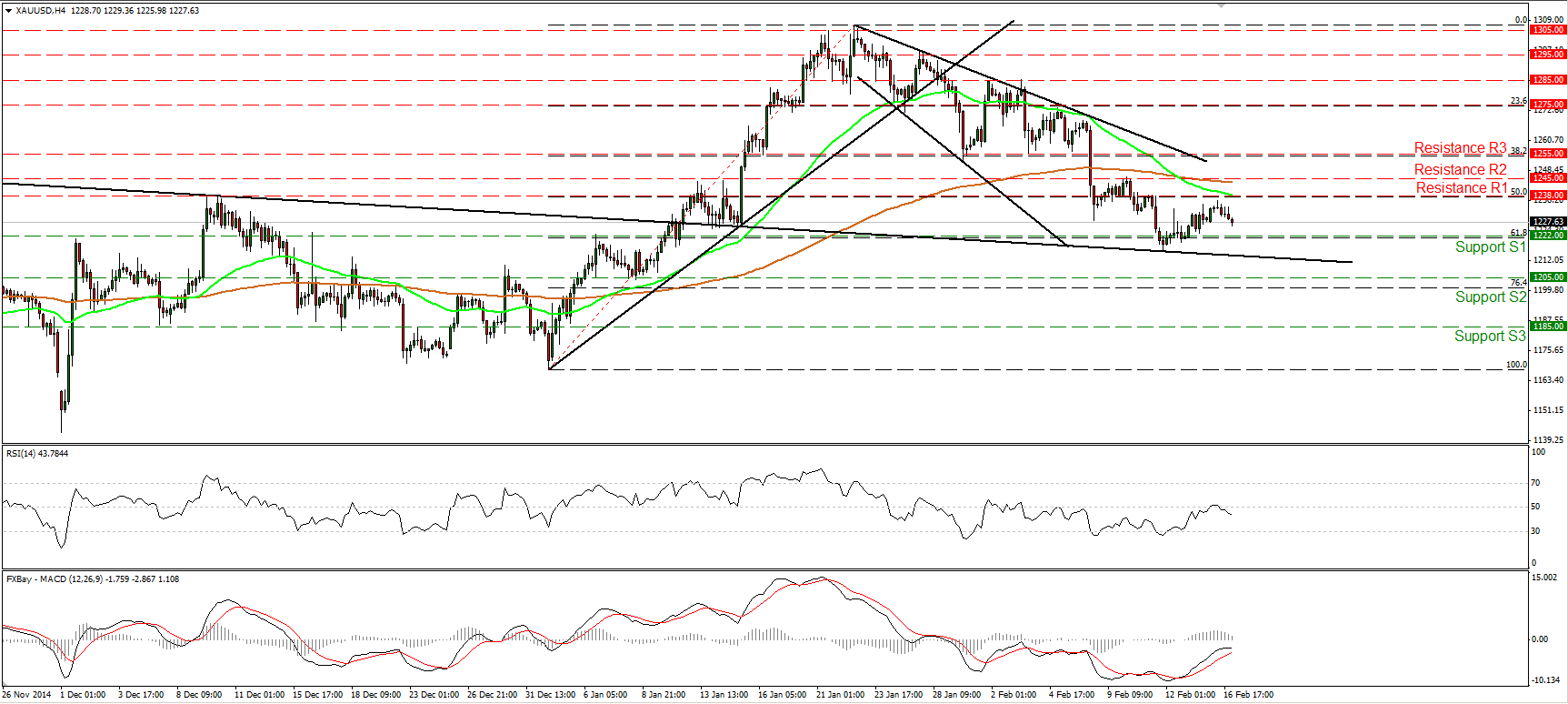

Gold hits resistance near 1238

Gold moved somewhat lower on Monday after finding resistance close to the 1238 (R1) level, but remained above the 1222 (S1) barrier, which lies fractionally close to the 61.8% retracement level of the 2nd – 22nd of January advance and above the neckline of the inverted head and shoulders formation seen on the daily chart and completed on the 12th of January. Although the price structure on the 4-hour chart still suggests a short-term downtrend, in the bigger picture, there is still the possibility for a higher low near the neckline of the pattern. Thus, I would still treat the decline from 1305 as a corrective phase, for now.

• Support: 1222 (S1), 1205(S2), 1185 (S3).

• Resistance: 1238 (R1), 1245 (R2), 1255 (R3).

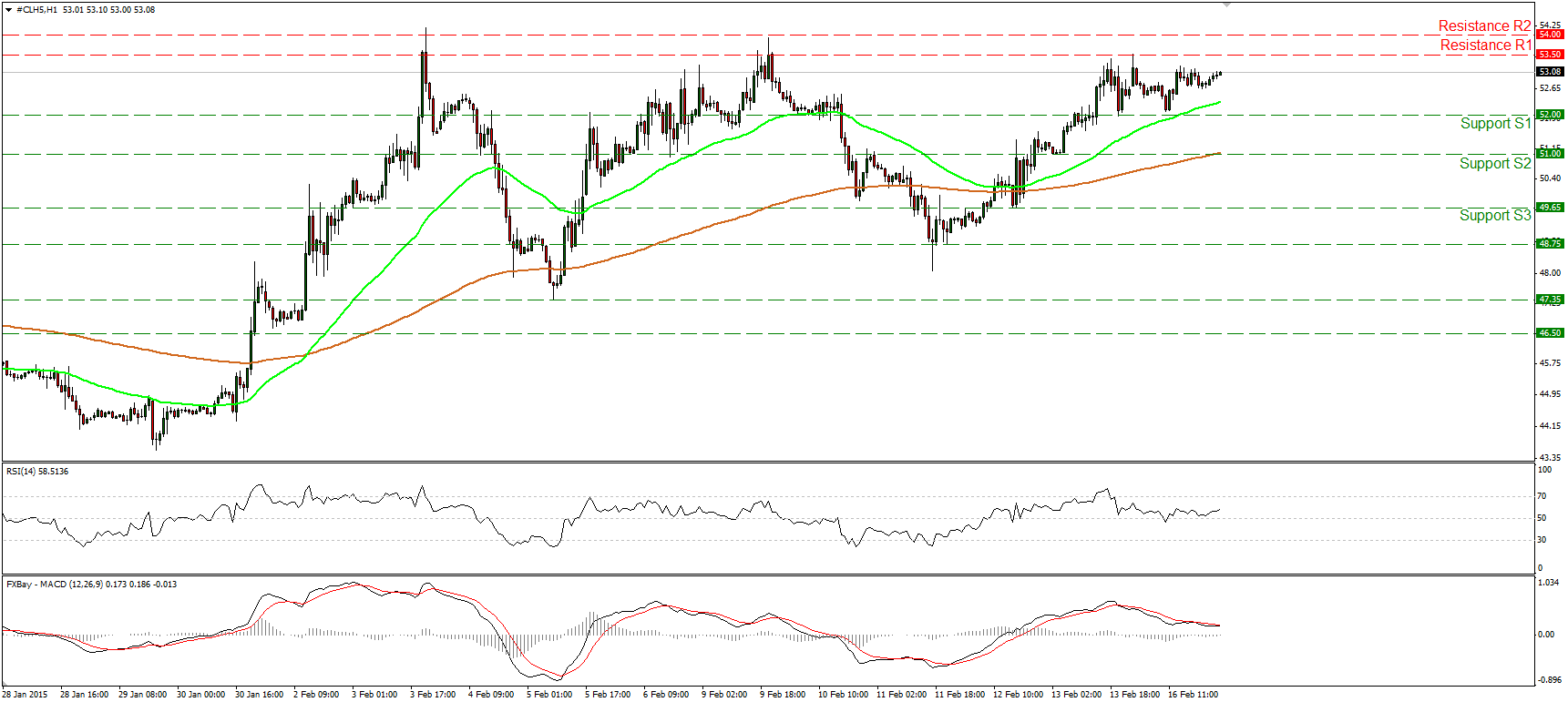

WTI in a consolidative mode

WTI traded in a sideways manner yesterday, oscillating between the support line of 52.00 (S1) and the resistance of 53.50 (R1). This keeps the short-term bias flat in my view. On the daily chart, WTI is still trading below both the 50- and the 200-day moving averages. Nevertheless, bearing in mind that the 14-day RSI moved higher after rebounding from near its 50 line, while the daily MACD stands above both its zero and signal lines, I would prefer stay flat as far as the overall picture is concerned as well.

• Support: 52.00 (S1), 51.00 (S2), 49.65 (S3).

• Resistance: 53.50 (R1) 54.00 (R2), 55.00 (R3).