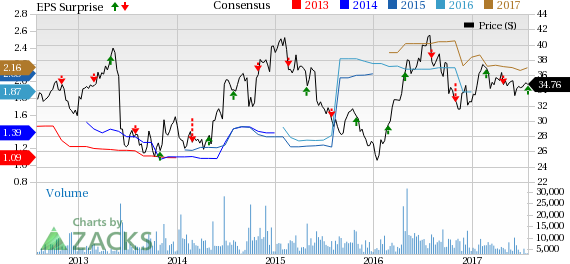

Iron Mountain Inc. (NYSE:IRM) reported second-quarter 2017 normalized funds from operations (FFO) of 55 cents per share that surpassed the Zacks Consensus Estimate of 52 cents and increased 14.6% year over year.

However, revenues of $949.8 million missed the Zacks Consensus Estimate of $955.2 million but improved 7.5% year over year. At constant currency (cc), storage revenues were up 10.6% to $590.2 million while service revenues grew 5.1% to $359.6 million. The company achieved internal storage rental growth of 4.8% in the quarter.

Iron Mountain reported adjusted EBITDA of $318.1 million compared with $261.4 million in the year-ago quarter. Moreover, adjusted EBITDA margin improved 390 basis points (bps) to 33.5% from 29.6% in the year-ago quarter.

Per the company, year–over-year improvement in top-line and bottom-line result were mainly driven by synergies from Recall Holdings acquisition, transformation initiatives and continued strong performance of its storage rental business.

We note that on a year-to-date basis, the stock has gained 7%, outperforming the industry’s growth of 3.2%.

Quarter Details

Operating expenses decreased 1% year over year to $779.6 million. Selling, general & administrative (SG&A) expense decreased 14.3% from the year-ago quarter to $237.4 million. Depreciation & Amortization advanced 11.4% year over year to $128.1 million.

Operating income increased 76.1% from the year-ago quarter to $170.2 million. However, operating margin expanded 700 bps to 17.9%.

Iron Mountain exited the quarter with cash and cash equivalents of $291 million compared with $295.6 million as of Mar 31, 2017. Long-term debt was $6.03 billion compared with $5.92 billion as of Mar 31, 2017.

Outlook

The company has reiterated outlook for the full year. Iron Mountain still expects revenues to be in the range of $3.750–$3.840 billion, reflecting 8–10% growth year over year.

Similarly, adjusted EBITDA guidance range of $1.250–$1.280 billion, representing growth of 16–19%, is still maintained. Adjusted FFO is expected to be in the range of $715–$760 million.

Internal storage rental growth rate is expected to be 2.5–3% in 2017. Capital expenditures along with non-real estate investment are projected to be in a bracket of $150–$170 million.

Our Take

Iron Mountain’s diversified revenue base is a positive. It is noteworthy that 95% of the Fortune 1000 companies are on Iron Mountain’s client list. Additionally, its strong product portfolio, increasing market share, and promising international business are the primary growth catalysts. Moreover, the company’s entry into the data center market is likely to be a growth driver.

Furthermore, the company has an aggressive acquisition strategy to supplement organic growth in storage revenues. The acquisition of Recall Holdings has been positive for the company. Apart from generating synergies worth $105 million, the buyout also expanded its footprint in international markets.

However, the costs of such initiatives are expected to weigh on financials, especially as the company already has a highly leveraged balance sheet. Also, volatile currency environment and intensifying competition remain overhangs.

Zacks Rank & Stocks to Consider

Currently, Iron Mountain carries a Zacks Rank #4 (Sell). Better-ranked stocks in the tech sector include Alibaba Group Holding Ltd. (NYSE:BABA) , Applied Optoelectronics, Inc. (NASDAQ:AAOI) and Symantec Corp. (NASDAQ:SYMC) . Alibaba Group Holding and Applied Optoelectronics both sport a Zacks Rank #1 (Strong Buy) while Symantec carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank Stocks here.

Long-term growth of Alibaba Group, Applied Optoelectronics and Symantec is projected to be 30.4%, 18.75% and 10.25%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Iron Mountain Incorporated (IRM): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Symantec Corporation (SYMC): Free Stock Analysis Report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

Original post

Zacks Investment Research