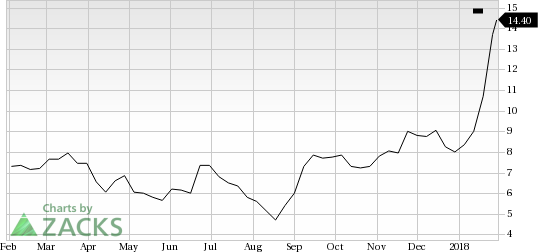

Iovance Biotherapeutics, Inc. (NASDAQ:IOVA) was a big mover last session, as the company saw its shares rise more than 5% on the day. The move came on solid volume too with far more shares changing hands than in a normal session. This continues the recent uptrend for the company as the stock is now up 77.8% in the past one-month time frame.

The stock gained after the company’s phase 2 studies of its LN-145 tumor-infiltrating lymphocyte technology, which is used for cancer treatment, showed confirmed partial responses. The company also announced the closing of a public offering of 15,000,000 shares of its common stock on Jan 29, 2018.

The company has seen one positive estimate revision in the past few weeks, while its Zacks Consensus Estimate for the current quarter has also moved higher over the past few weeks, suggesting that more solid trading could be ahead for Iovance Biotherapeutics. So make sure to keep an eye on this stock going forward to see if this recent jump can turn into more strength down the road.

Iovance Biotherapeutics currently has a Zacks Rank #3 (Hold) while its Earnings ESP is negative.

A better-ranked stock in the Medical - Biomedical and Genetics industry is Bioverativ Inc. (NASDAQ:BIVV) , which currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Is IOVA going up? Or down? Predict to see what others think: Up or Down

Don’t Even Think About Buying Bitcoin Until You Read This

The most popular cryptocurrency skyrocketed last year, giving some investors the chance to bank 20X returns or even more. Those gains, however, came with serious volatility and risk. Bitcoin sank 25% or more 3 times in 2017.

Zacks’ has just released a new Special Report to help readers capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 4 crypto-related stocks now >>

Lion Biotechnologies, Inc. (IOVA): Free Stock Analysis Report

BIOVERATIV INC (BIVV): Free Stock Analysis Report

Original post

Zacks Investment Research