Clear vision on SaaS potential

InVision offers a rare investment opportunity as a listed European software as a service (SaaS) company. It has seen the pain of making the move across to a SaaS platform and is well positioned to gain from the growth in the use of its injixo workforce management (WFM) software and online training offerings in call centres. Although valued at a premium to more traditional, smaller listed European software companies, it stands at a significant discount to other SaaS plays.

European SaaS opportunity

InVision offers a rare investment opportunity as a listed European software company that has made the transition to a SaaS business model and has leading positions in undeveloped markets. The majority of target users still use in-house solutions for WFM and traditional classroom training, but management sees a combined €600m market opportunity in the shift to cloud-based application-specific software and online training. The transition to SaaS has been painful but well executed and the recent results show gains in earnings terms are being seen.

Clear logic for increasing product adoption

The business case for InVision’s WFM product is based on its low price per agent call centre WFM SaaS offer. Management estimates that the €9 cost per agent per month is more than made up for by the typical €30 per agent per month savings. It is far from clear exactly how fast the transition to professional WFM software will be in small- and medium-sized call centres but in many ways this is a situation analogous to the historical moves of SMEs to using customer relationship management (CRM) or accounting packages. With its eLearning pricing set at a fraction of the level of traditional teaching methods, this business area also has a compelling story, albeit a less developed one.

Valuation: Premium rating but not a SaaS rating

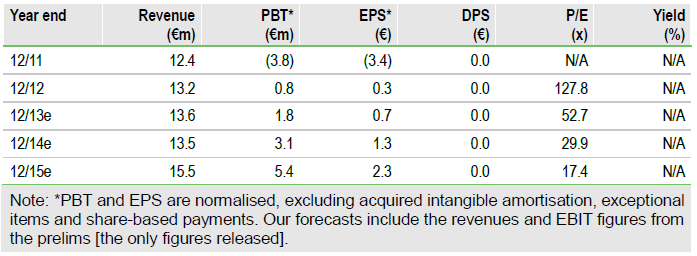

InVision is forecast to see strong underlying growth and to generate cash over the coming years. This is, to an extent, reflected in its premium valuation multiples compared to the more traditional smaller European software companies and the larger call centre software vendors, but the discount to the big names of the SaaS world is considerable. This discount could narrow as further evidence of the growth in SaaS revenues comes through. Furthermore, our simple DCF model also suggests that a higher share price is deserved.

To Read the Entire Report Please Click on the pdf File Below