Morningstar offers its paid subscribers a premium service called, “ETF Valuation Quickrank.” The company offers price-to-fair value estimates for several hundred ETFs that are based upon a proprietary analysis of the underlying stock holdings. At present, each investment is being labeled as fairly valued or overvalued; you will not a find a single fund — broad-based, sector, foreign — that is being described as undervalued.

Assume for a moment that the fundamentals-based ratings provider serves up reasonable valuations. With 2nd quarter earnings (excluding financial companies) expected to show declines for the recent quarter, can anyone really tie the stock market’s epic July rise to corporate profits? How about sales growth. With year-over-year revenue increases virtually non-existent, can anyone genuinely believe that success for U.S. equity investing relates to strong company fundamentals? In truth, the main things that move share prices in today’s environment reside outside of the balance sheets.

Federal Reserve policy and perceptions of policy are primarily responsible for the durability of U.S. equities. The S&P 500 might have hit an exorbitantly priced 1800 already had Chairman Bernanke not floated the notion that his institution could begin slowing down bond purchases. Yet there is very little chance the Fed will rock the apple cart. Incoming economic data will not support de facto tightening in 2013.

Nevertheless, speculation of the timing of the central bank’s exit plan may keep stocks range-bound in the months ahead. Moreover, range-bound treasury bonds should also keep a lid on stock gains. That leaves open the probability that yield-seeking pursuits may dominate the landscape once more. Master limited partnerships, real estate investment trusts, dividend payers from telecom to utilities — money managers looking for cash flow are revisiting the possibilities.

In June, Fed officials began reassuring investors that interest rates would stay low for several years and income-generating stock ETFs recovered in dramatic fashion. Indeed, SPDR S&P Dividend (SDY) which tracks the S&P High Yield Dividend Aristocrats Index is back at a record peak.

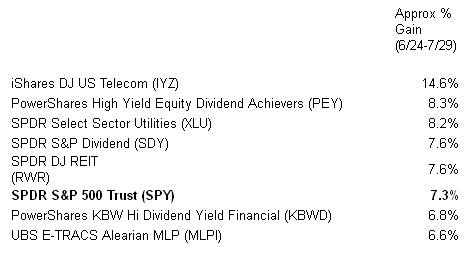

Here’s a breakdown of performance across a number of yield-oriented stock ETFs since the June 24 low:

Has The Hunt For Yield Returned?

One additional way to look at the “second chance” that high-yielding equity is receiving is through a price ratio. For example, the PEY:SPY price ratio soared in the first 4 months of the year, demonstrating the enormous hunger for yield-oriented assets like PowerShares High Yield Equity Dividend Achievers (PEY). In May, the PEY:SPY price ratio tanked. However, there has been a steady build-up of momentum as investors began taking an additional look at stock ETFs with above-average yields.

The current Administration desperately needs consumer lending rates to stay low (and perhaps move lower). Since jobs data and GDP growth are exceptionally unlikely to warrant changing the course of monetary policy prior to the selection of the next Fed chairman, and due to the fact that fiscal policy is likely to remain neutral or tight, it is reasonable to give some rate-sensitive assets another shot. I favor UBS E-TRACS Alerian MLP (MLPI) as well as SPDR Dow Jones REIT (RWR).

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Taking Another Look At Stock ETFs With Above-Average Yields

Published 07/30/2013, 03:33 AM

Updated 03/09/2019, 08:30 AM

Taking Another Look At Stock ETFs With Above-Average Yields

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.