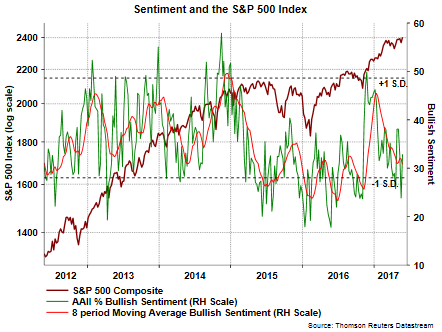

Much of the sentiment data seems to indicate investors are a bit nervous about stock ownership. The recent sentiment survey report by the American Association of Individual Investors did show a nine percentage point improvement in the weekly bullish sentiment reading, increasing to 32.9% from last week's 23.9% reading. However, the less volatile 8-period moving average of the bullishness reading remains at a low 31.1%, improving only .4% on the week.

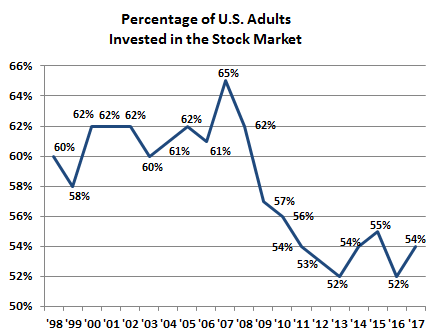

Further, in a Gallup poll released yesterday, the average percentage of Americans who own stock was reported at 54%. This level of ownership is down from the 65% reported prior to the financial crisis in 2007 and one of the lowest levels recorded in the last twenty years.

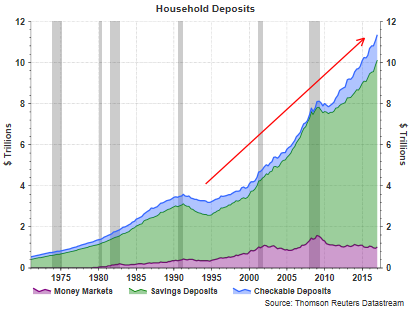

And lastly, the lower level of equity ownership by Americans seems to be showing up in cash holdings in money market and cash accounts. As can be seen below, household and not for profit deposits total $11 trillion. This figure is calculated from data obtained in the Federal Reserve's Flow of Funds Z.1 report. If investors were able to earn just 1% more on these near zero earning cash assets, the $110 billion in additional interest income would certainly be a positive stimulus for the economy.

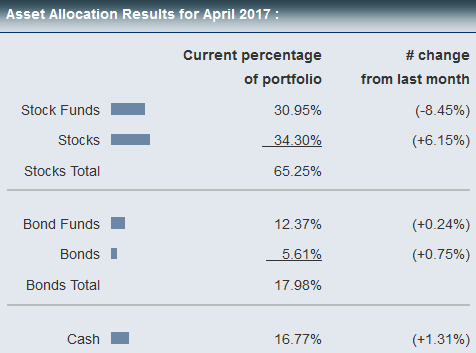

In spite of the apparent skepticism by investors to owning stocks, the equity market continues its move higher. Certainly, some of the growth in cash may be a result of the low level of interest one can earn on bonds. AAII also reports the results of a monthly asset allocation survey of investors and as seen in the graphic below, a typical balanced portfolio weighted 65% stocks and 35% bonds now has half the bond allocation in cash.

At the moment the level of cash on the sidelines along with the lower percentage of individuals owning stocks, could be a tailwind for equities. Maybe it takes a deeper correction to pull the cash off the sidelines; however, small market dips currently result in buyers coming into the market.