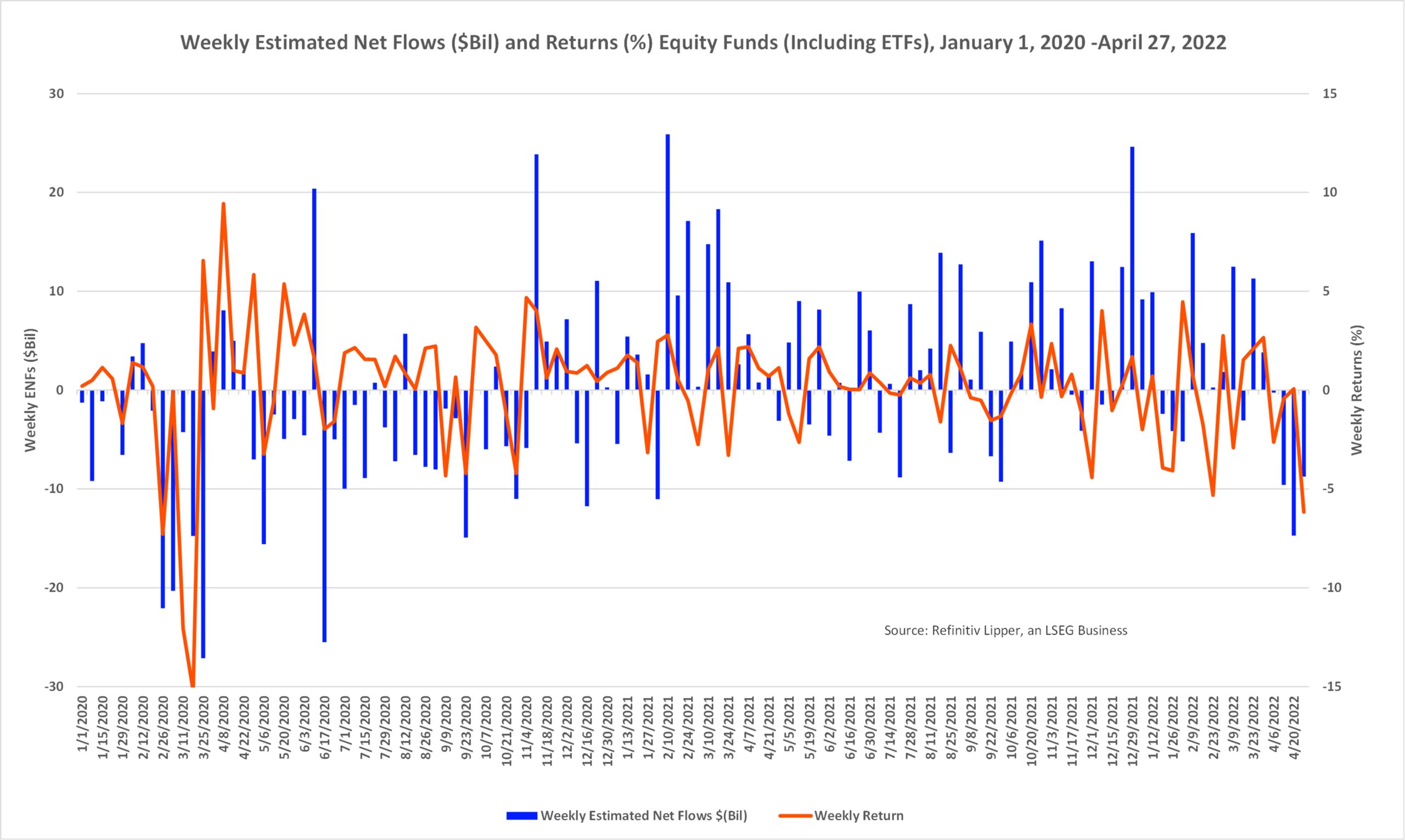

For the Refinitiv Lipper fund-flows week ended Wednesday, Apr. 27, investors turned a cold shoulder to equity mutual funds and ETFs, redeeming $7.6 billion and $1.2 billion, respectively.

The average equity fund (including ETFs) suffered a 6.17% decline for the week, its largest one-week decline since the fund-flows week ended Mar. 25, 2020—just after California became the first state to issue stay-at-home orders to fight against the spread of the novel coronavirus.

Equities tanked during the fund-flows week as investors weighed the implications of aggressive interest hikes by the Federal Reserve, Russia continuing to wage war on Ukraine, prolonged supply chain disruptions, and another COVID-related shutdown in China.

Investors generally fled long-term assets, padding the coffers of money market funds (+$40 billion) after Federal Reserve Board Chair Jerome Powell gave his support to moving faster on raising interest rates to stave off rising inflation.

Powell said, “It is appropriate in my view to be moving a little more quickly,” hinting at a potential 50-basis-point (bps) hike in May.

During the week, the Dow Jones Industrial Average suffered its largest one-day percentage decline since Oct. 28, 2020, falling 981.36 points (or 2.8%), after a fresh batch of Q1 corporate earnings generally disappointed.

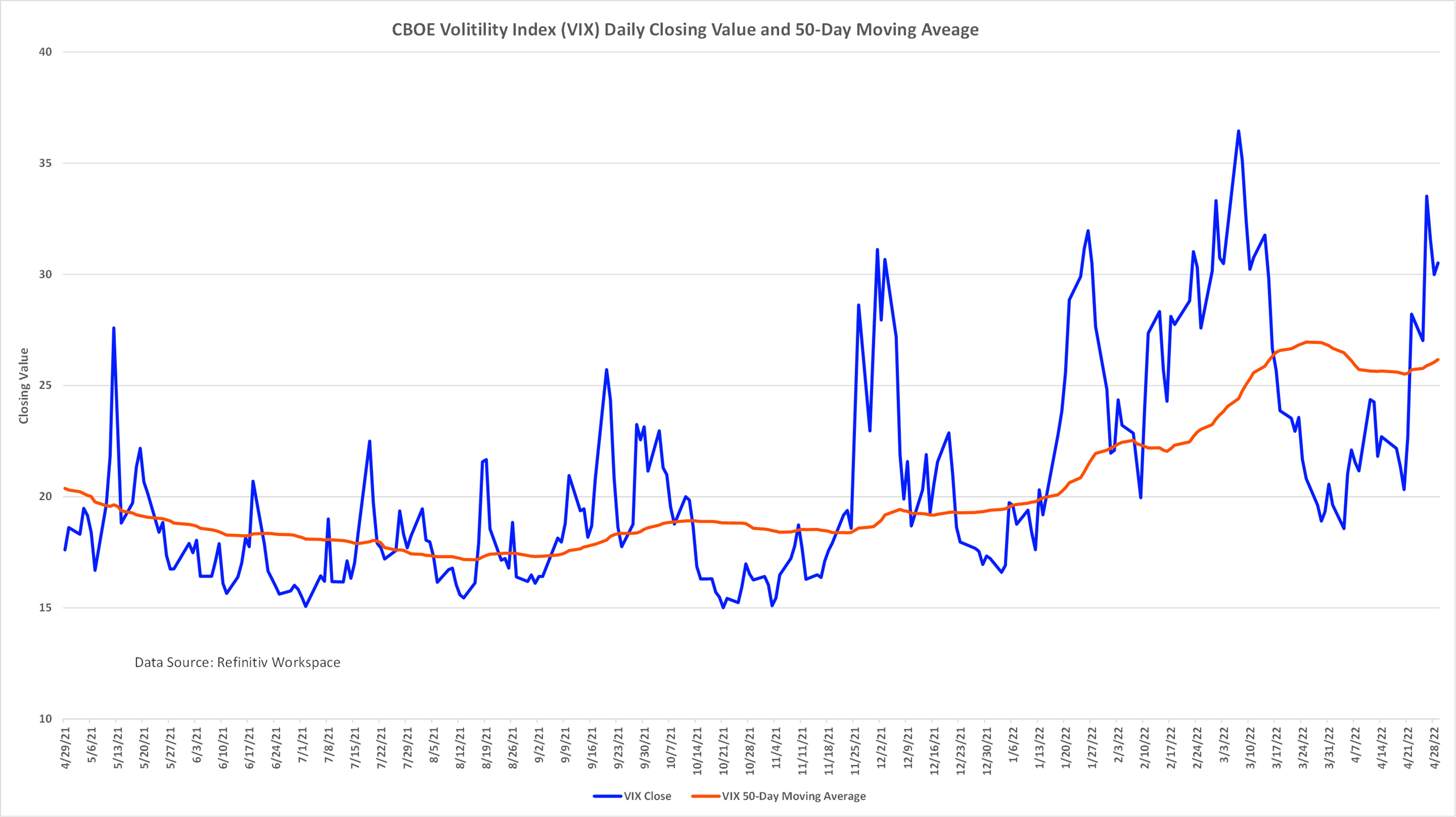

The CBOE Volatility Index (VIX) closed out the fund-flows week at 31.6, moving above its long-run average of just below 20. Year to date, the average equity fund is down 11.74%.

Nonetheless, during the week, investors—while being net redeemers of equity funds and ETFs—were net purchasers of select classifications, with Equity Leverage Funds attracting the largest amount of net new money, taking in $1.4 billion for the fund-flows week.

ProShares UltraPro QQQ (TQQQ) attracted the largest net inflows of the classification, drawing in $939 million. Equity Income Funds (+$1.3 billion) and Consumer Goods Funds (+$1.2 billion) attracted the next largest sums of net new money, while Financial Services Funds (-$2.2 billion) was the equity universe classification laggard.

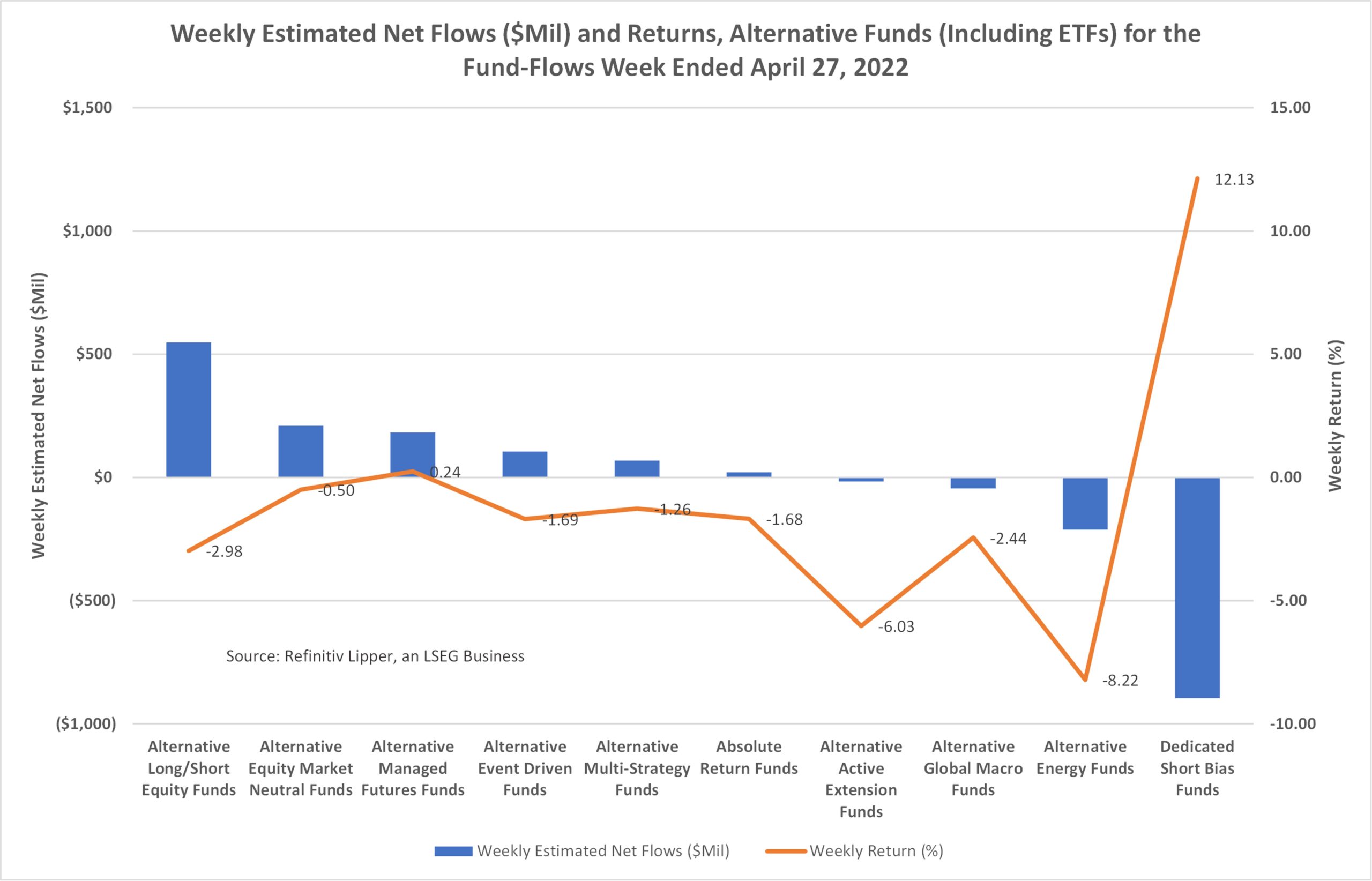

Interestingly, while—as might be expected during a market meltdown—Dedicated Short Bias Funds (+12.13%, including ETFs) posted the strongest returns of the 82 Lipper equity classifications for the fund-flows week.

They actually experienced net outflows to the tune of $896 million, as investors appeared to get out of the way of increased volatility—in both directions.

In the midst of the carnage for the week, the DJIA witnessed its biggest intraday turnaround since February on Monday, Apr. 25, as investors appeared to brush off weakness related to China’s renewed COVID lockdowns and focused on oversold issues.

With investors looking for places to duck for cover in this whipsaw market—other than money market funds—interest in alternatives funds has been on the rise, with Alternative Long/Short Equity Funds (including ETFs) attracting the largest sum of net inflows in the macro-group.

The classification took in $548 million this week and experienced its 71st consecutive week of net inflows, followed by Alternative Equity Market Neutral Funds (+$209 million), Alternative Managed Futures Funds (+$182 million), and Alternative Event Driven Funds (+$104 million).

The top attractors of investors’ assets in the Alternative Long/Short Equity Funds classification this past week were JPMorgan Hedged Equity Fund Class R6 (JHDRX), taking in $194 million, Global X NASDAQ 100 Covered Call ETF (NASDAQ:QYLD) (QYLD, +$124 million), Global X S&P 500® Covered Call ETF (NYSE:XYLD) (XYLD, +$114 million), and Global X Russell 2000 Covered Call (NYSE:RYLD) (RYLD, +$37 million).

Despite the prospect of imminent increases in the Federal Reserve’s key lending rate, investors continued to pad the coffers of longer-dated Treasuries and investment-grade debt funds, with General U.S. Treasury Funds (+$2.0 billion) attracting the largest net sum of money for the flows week, followed by Short U.S. Treasury Funds (+$1.5 billion), Corporate Debt BBB-Rated Funds (+$1.1 billion), and Loan Participation Funds (+$667 million).

Meanwhile, Core Plus Bond Funds witnessed the largest net redemptions (-$1.9 billion). The average bond fund (including ETFs) posted a 1.13% loss during the fund-flows week.

Whether focused on equity or fixed income securities—and with both asset classes suffering year-to-date declines of 11.74% and 6.69%, respectively—all eyes will be on next week’s Federal Open Market Committee meeting.

Scheduled to start on Tuesday, May 3, most analysts are expecting the Fed to enact at least a 50-bps hike in the federal funds rate and maybe even announce the beginning of unwinding its balance sheet.