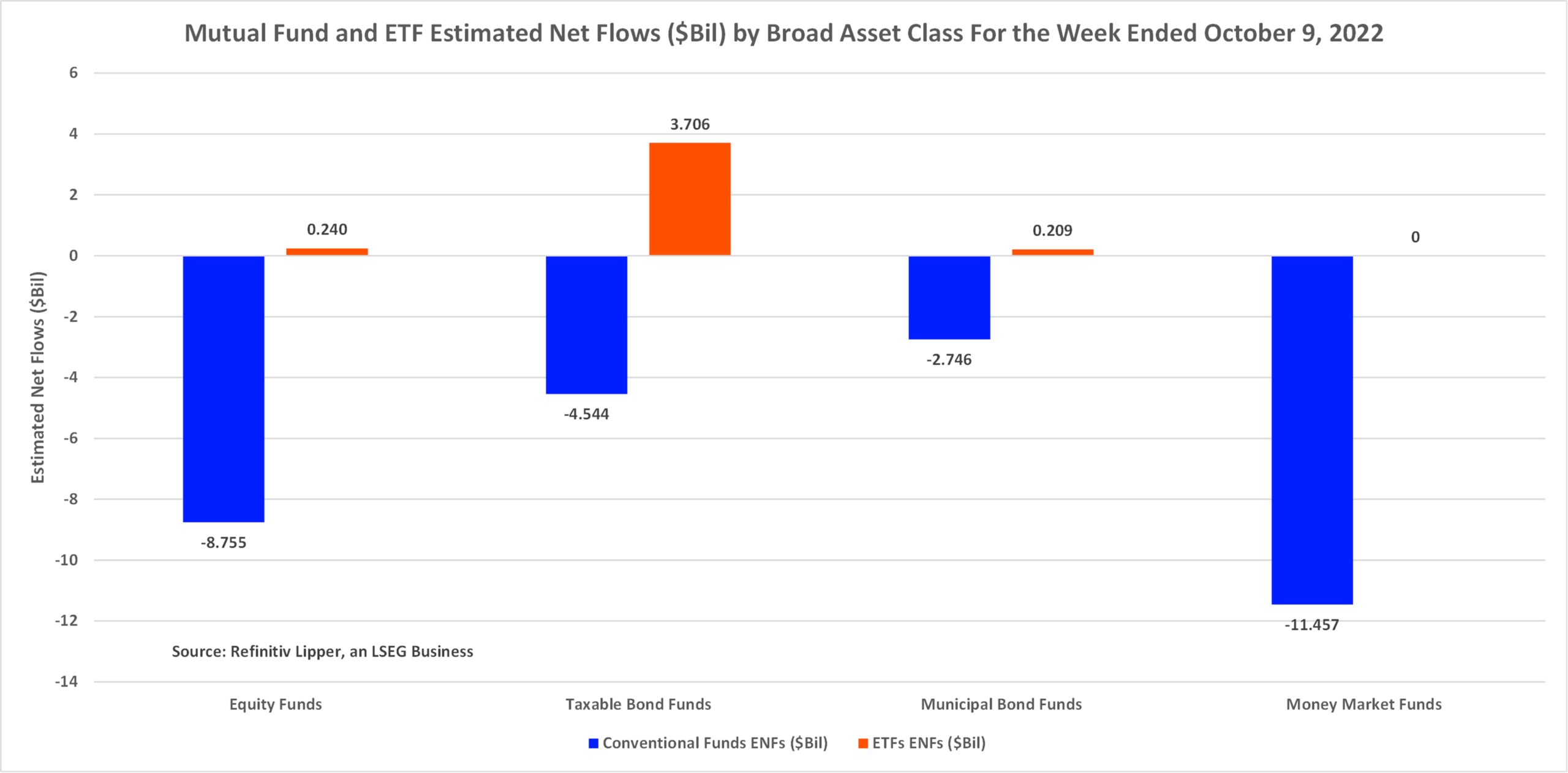

During the Refinitiv Lipper fund-flows week ended November 9, 2022, investors were net redeemers of fund and ETF assets, withdrawing a net $23.4 billion from fund coffers as investors awaited the October employment figures, midterm election results, and the October consumer price index (CPI) report due out later in the week.

Fund and ETF investors were net sellers of all four broad asset classes, pulling money out of money market funds (-$11.5 billion), equity funds (-$8.5 billion), tax-exempt fixed income funds (-$2.5 billion), and taxable bond funds (-$838 million).

However, as has been the case just about every week this year, there was a stark difference between ETFs and conventional mutual funds’ estimated net flows, with ETFs attracting some $4.2 billion, while their conventional fund cousins handed back a net $27.5 billion this week.

While already priced into the market, a fourth 75 basis-point (bps) rate hike on Wednesday, accompanied by a hawkish commitment by Federal Reserve Chair Jerome Powell to stay the course on fighting inflation still weighed on investors.

Nonetheless, U.S. markets rose three of the five trading days this week, as investors embraced a Goldilocks’ October nonfarm payrolls report, that while beating analysts’ expectations, still showed job creation slowed for the third straight month—coming in at its lowest value since December 2020—and the unemployment rate increased slightly from 3.5% in September to 3.7%, providing some relief to investors that the economy may be cooling and perhaps supporting a less aggressive Fed monetary policy.

U.S markets continued to move higher as investors welcomed the possibility of a potential gridlock in Washington, D.C., if Republicans win control of the House of Representatives. Investors also warmed to the news reported by The Wall Street Journal that Chinese leaders are considering steps to loosen their zero-COVID policy—which might help ease inflationary pressures caused by supply chain shortages.

At the end of the fund-flows week, U.S. stocks snapped their three-day winning streak, as control of Congress remained in a state of limbo after a tighter-than-expected midterm race left control of the U.S. House and Senate unsettled.

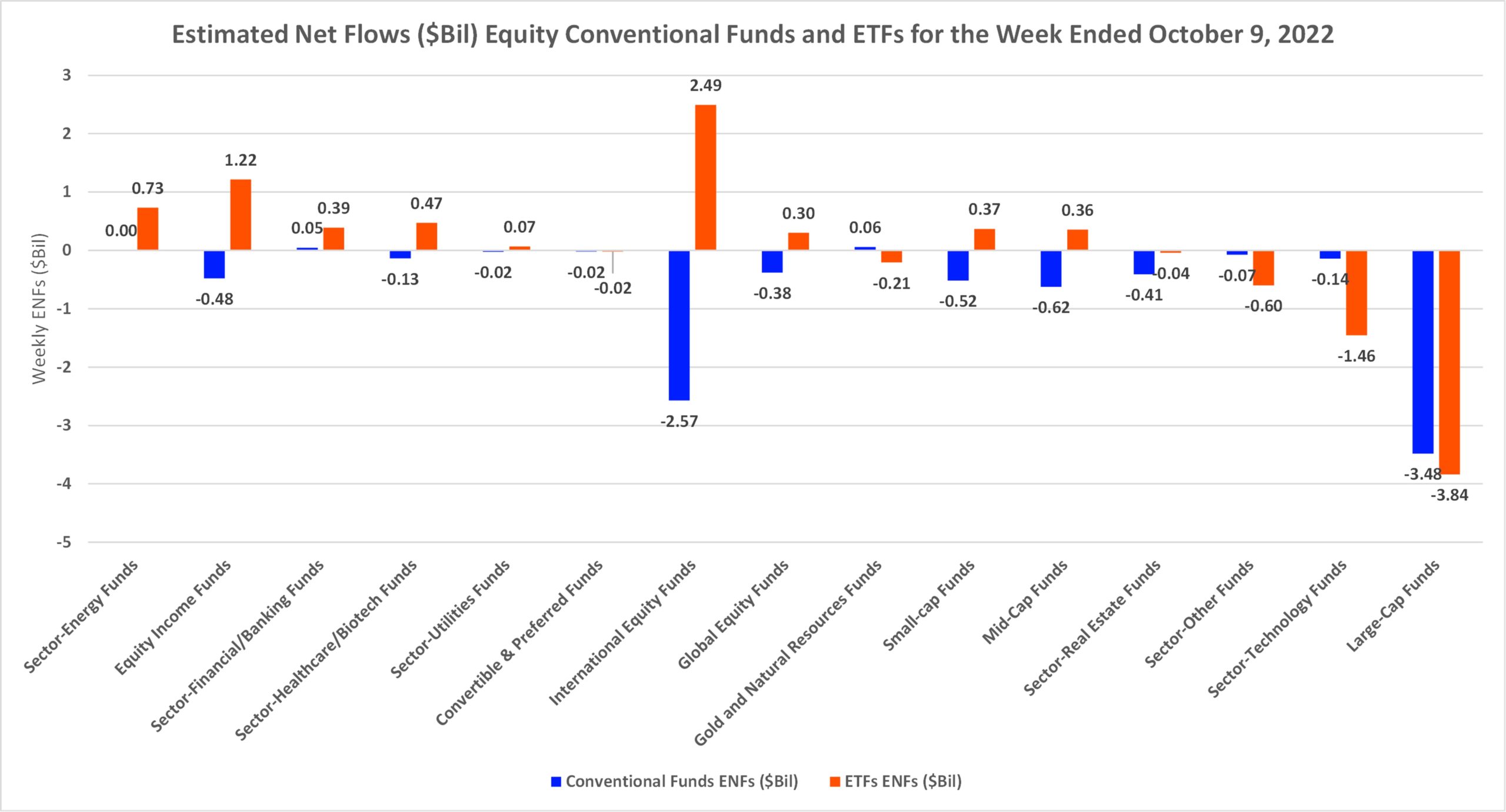

While equity funds and ETFs collectively suffered net redemptions (-$8.5 billion), investors continued to put money back to work in selective sectors, primarily utilizing ETFs. Sector-energy funds (including ETFs) (+$736 million) and equity income funds (+$735 million) were the primary attractors of investors’ assets, followed by sector-finance/banking funds (+$434 million) and sector-healthcare/biotech funds (+$336 million). At the bottom of the equity pile were large-cap funds (-$7.3 billion, impacted significantly by large outflows witnessed by SPDR S&P 500 ETF (SPY), -$9.7 billion).

While hidden in the headline figures, international equity ETFs attracted $2.5 billion last week, benefitting from investors’ growing interest in commodities and on news that China might be softening its zero-COVID policy stance. Emerging markets equity ETFs took in $1.8 billion for the fund-flows week, attracting net new money for the sixth consecutive week. On the ETF side, Invesco QQQ Trust 1 (QQQ, +$2.5 billion) and iShares Core MSCI Emerging Markets ETF (IEMG, +$877 million) attracted the largest amounts of net new money of all individual equity ETFs.

During the press conference following the Fed’s interest rate hike on Wednesday, November 2, Jerome Powell indicated the Fed is nowhere near pausing its fight against inflation, stating, “We have a way to go.” According to the CME’s FedWatch tool, investors were pricing in a 33% chance that the benchmark rate could climb to a range of 5.25% and 5.5%. As of Wednesday, the federal funds rate stood at a target range of 3.75% to 4%.

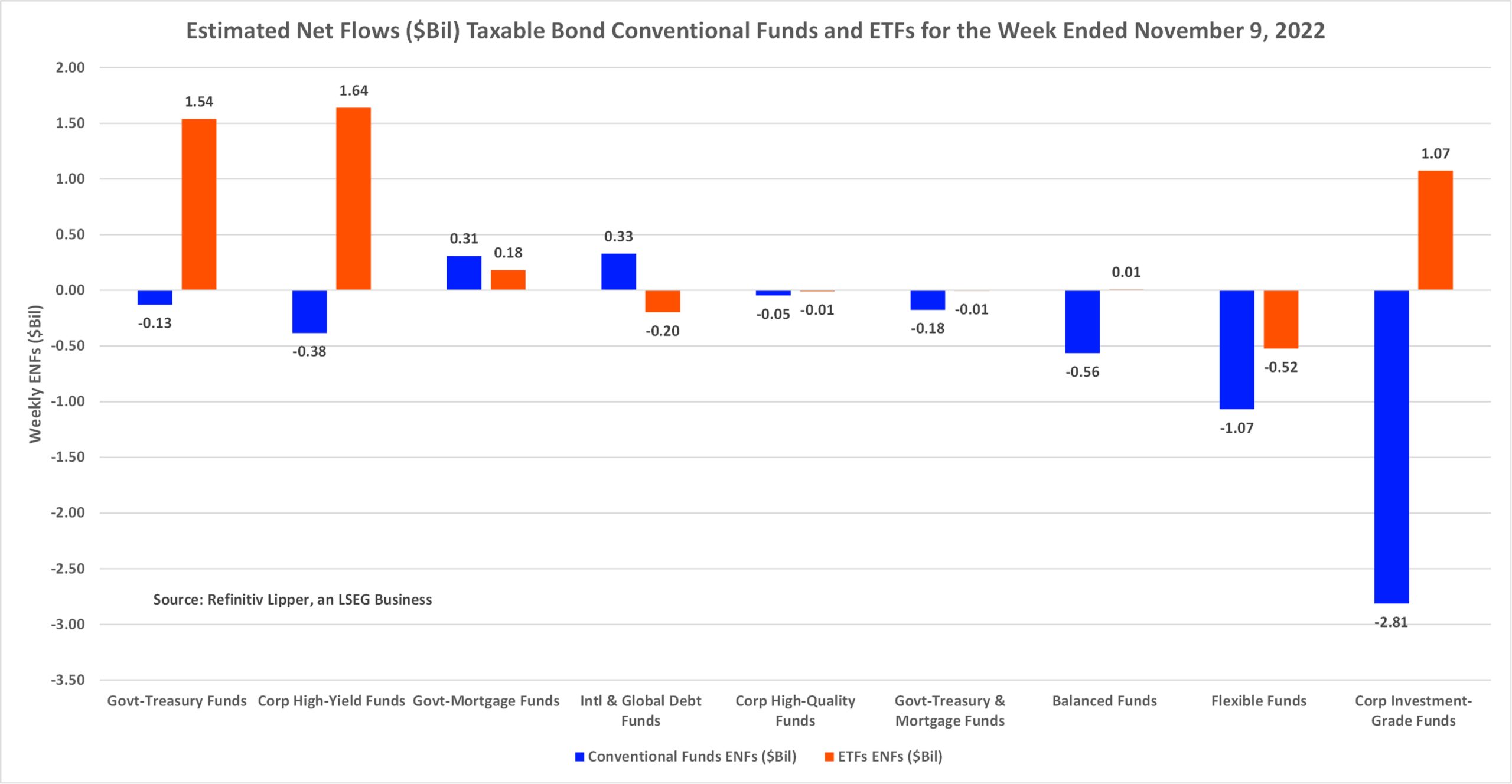

Regardless, investors, while being net redeemers of taxable bond funds (-$838 million, including ETFs) this week, were still net purchasers of a disparate group of offerings, padding the coffers of government-Treasury funds (+$1.4 billion), corporate high-yield funds (+$1.3 billion), and government-mortgage funds (+$488 million), while corporate investment-grade debt funds (and ETFs) experienced the largest outflows (-$1.7 billion), bettered slightly by flexible funds (-$1.6 billion).

It appears that investors preferred to use ETF offerings to gain exposure to what looks like very dissimilar bets, injecting the largest amount of net new money into corporate high-yield ETFs (+$1.6 billion), government-Treasury ETFs (+$1.5 billion), and corporate investment-grade ETFs (+$1.1 billion). Focusing on ETFs, iShares iBoxx $ High Yield Corporate Bond ETF (HYG, +$1.3 billion), iShares 1-5 Year Investment Grade Corporate Bond ETF (IGSB), +$840 million), and SPDR Portfolio Long Term Treasury ETF (SPTL, +$519 million) attracted the largest amounts of net new money of all individual taxable fixed income ETFs. Meanwhile, iShares 20+ Year Treasury Bond ETF (TLT, -$1.0 billion) and iShares Floating Rate Bond ETF (FLOT, -$311 million) handed back the largest individual net redemptions for the week.

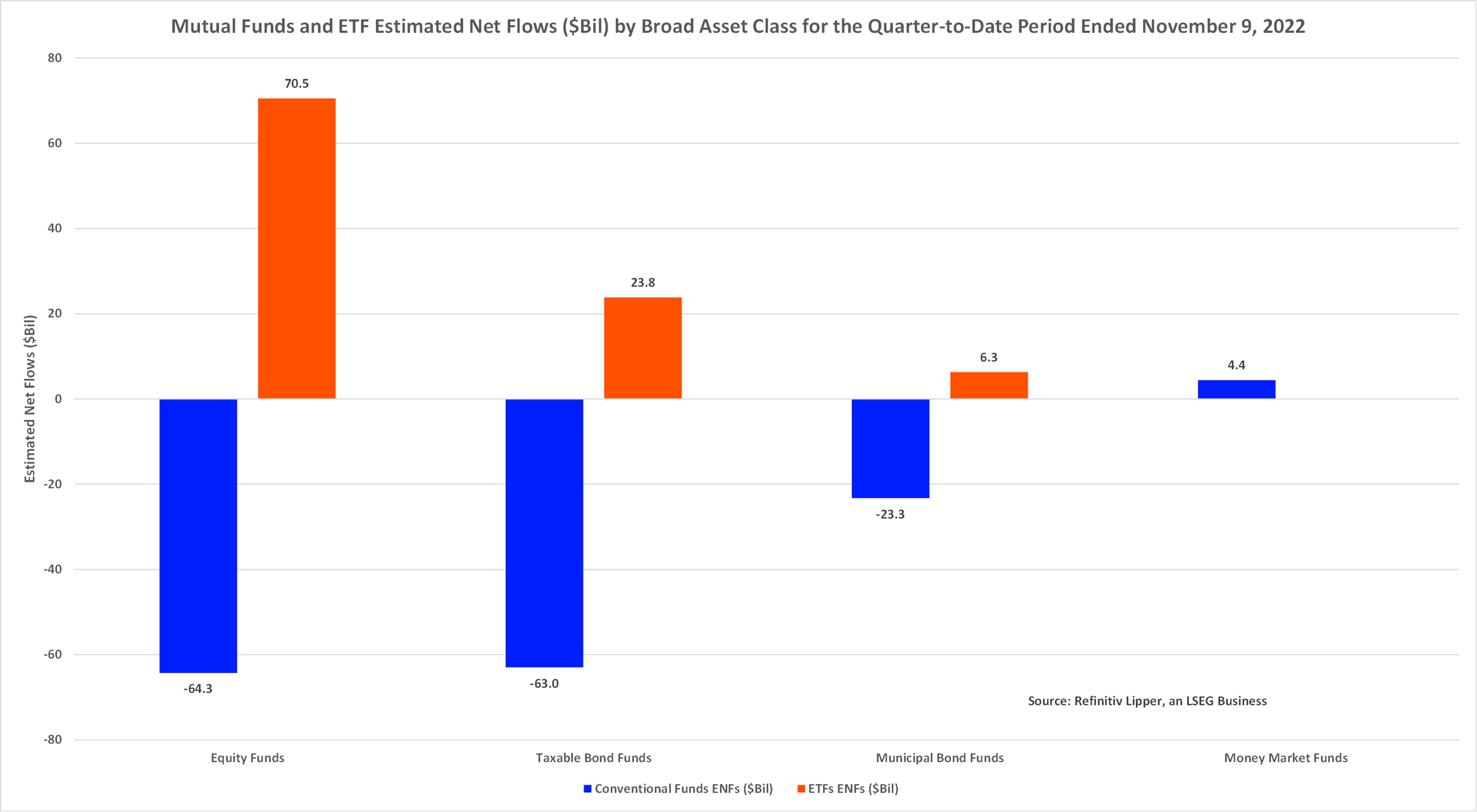

Quarter to date, fund and ETF investors have injected a net $6.2 billion into equity funds and $4.4 billion into money market funds while being net redeemers of taxable bond funds (-$39.2 billion) and municipal debt funds (-$17.0 billion). However, the summary numbers don’t paint a clear picture. The dichotomy highlighted above is clearly in play quarter to date, with ETFs attracting a net $100.6 billion when looking at the major asset classes while conventional funds suffered net redemptions of $146.2 billion.