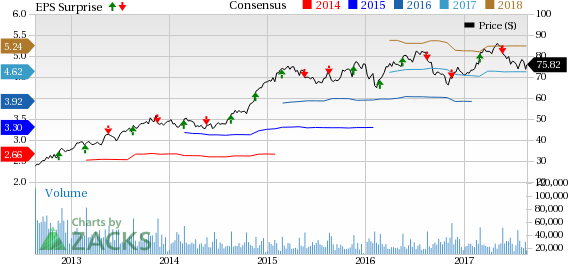

Lowe’s Companies, Inc. (NYSE:LOW) posted lower-than-expected second-quarter fiscal 2017 results. This was the second straight quarter wherein both the top and bottom lines fell short of the Zacks Consensus Estimate. As a result, shares of this North Carolina-based company tumbled roughly 6% during pre-market trading hours. In the past three months, the stock has declined 5% in line with the industry.

The home improvement retailer posted adjusted earnings of $1.57 per share that missed the Zacks Consensus Estimate of $1.62. However, bottom line improved 14.6% from $1.37 delivered in the year-ago quarter, following an increase of 18.4% registered in the preceding quarter.

Net sales of $19,495 million also came below the Zacks Consensus Estimate of $19,524 million. However, sales jumped 6.8% year over year after increasing 10.7% in the previous quarter. The company’s sales increase can be attributed to its efforts to provide a better omni-channel customer experience and an improvement in the housing market.

Comparable sales (comps) increased 4.5% during the quarter under review, up from 1.9% recorded in the first quarter. Comps for the U.S. business climbed 4.6%, following an increase of 2% in the preceding quarter. Comps were up 7.9% in the month of July.

Gross profit increased 6.1% year over year to $6,670 million, however, gross profit margin contracted roughly 23 basis points to 34.2%.

Other Financial Aspects

Lowe’s, which competes with The Home Depot, Inc. (NYSE:HD) , ended the quarter with cash and cash equivalents of $1,696 million, long-term debt (excluding current maturities) of $15,788 million and shareholders’ equity of $5,536 million.

During the quarter, the company kept its promise of returning surplus cash to stockholders as it repurchased shares worth $1.25 billion and distributed $299 million as dividends.

Outlook

Management continues to project total sales growth of approximately 5% with comps increase of about 3.5% during fiscal 2017. Lowe’s envisions operating margin to increase approximately 80 to 100 basis points in the fiscal year.

However, Lowe’s took a somewhat conservative stance when it comes to earnings. This Zacks Rank #3 (Hold) stock now envisions earnings to come in the band of $4.20–$4.30 per share compared with $4.30 projected earlier.

Moreover, the company intends to open 25 home improvement and hardware stores during fiscal 2017. As of Aug 4, 2017, the company operated 2,141 stores in the U.S., Canada and Mexico.

Like to Know Hot Stocks in the Retail Space, Check These

Investors interested in the retail space may consider some better-ranked stocks such as The Children's Place, Inc. (NASDAQ:PLCE) flaunting a Zacks Rank #1 (Strong Buy) and Lumber Liquidators Holdings, Inc. (NYSE:LL) carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Children's Place delivered an average positive earnings surprise of 16.3% in the trailing four quarters and has a long-term earnings growth rate of 9%.

Lumber Liquidators delivered an average positive earnings surprise of 24.2% in the trailing four quarters and has a long-term earnings growth rate of 27.5%.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

Home Depot, Inc. (The) (HD): Free Stock Analysis Report

Lowe's Companies, Inc. (LOW): Free Stock Analysis Report

Lumber Liquidators Holdings, Inc (LL): Free Stock Analysis Report

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

Original post

Zacks Investment Research