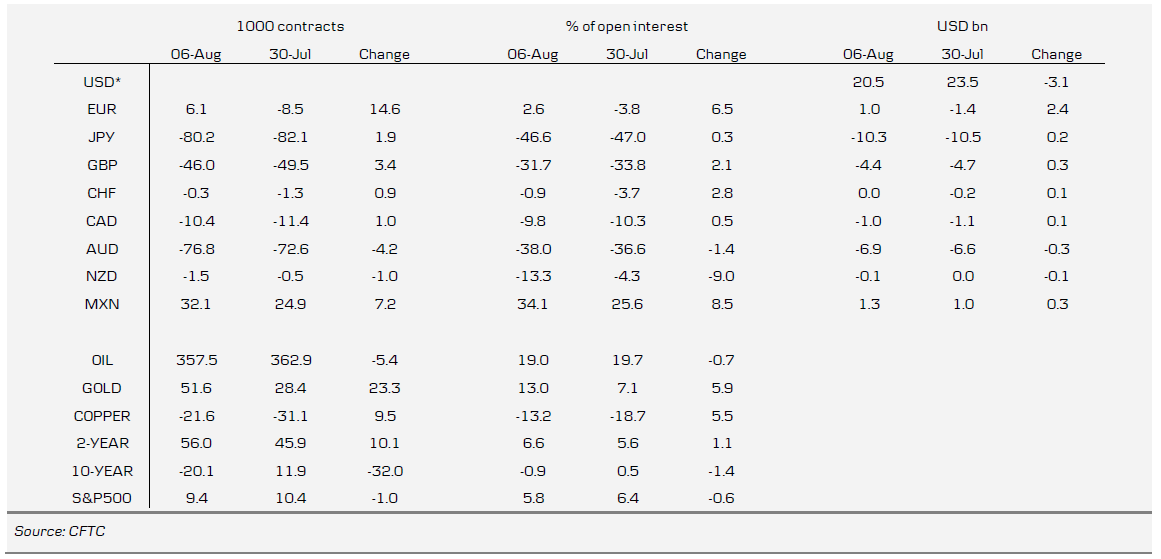

The latest IMM data show that investors scaled back slightly on aggregated net long USD positions in the week that ended 6 August.

Aggregated net long USD positions are now equivalent to USD20.5bn (down USD3.1bn over the week). Most of this correction is once again seen against the euro with speculators going from being net short EUR 3.8% of open interest to being net long 2.6% of open interest. Hence, the support to EUR/USD from short-covering has now come to an end. A first indication that a peak in EUR/USD might be closer, not least if we are correct in forecasting that Fed tapering will begin at the September FOMC.

The IMM data also show that the FX market was very short GBP going into the ‘forward guidance’ announcement” on Wednesday. It might explain a part of the GBP performance seen lately. Next focal point here is the MPC minutes on Wednesday. If they show that one or more MPC members do not support Carney, there is probably room for more short-covering in GBP.

To Read the Entire Report Please Click on the pdf File Below.